Building a Decarbonized Electric Energy Future

Building a Decarbonized Electric Energy Future

THE PAST – “An industrial ecosystem of unprecedented size and complexity, that took more than a century to build with the support of the highest calorifically dense source of cheap energy the world has ever known (oil) in abundant quantities, with easily available credit, and unlimited mineral resources.”

Simon Michaux, PhD, Geological Survey of Finland

THE PRESENT – “We now seek to build an even more complex system with very expensive energy, a fragile finance system saturated in debt, not enough minerals, with an unprecedented number of the human population, embedded in a deteriorating environment.”

Simon Michaux, PhD, Geological Survey of Finland

As the world looks to electrification to deal with climate change the rush to make this electrification by 2030 or 2035 has many obstacles. These obstacles include many issues from mineral shortages, the current lack of critical mass of recyclable materials to make a business case for recycling in the next ten years, permitting issues, and recently the realization by some of the environmental groups opposed to fossil fuels development realizing that electrification requires mining for minerals that enables transmission and storage, flooding of land for hydro, water usage in the mining of lithium, and the use of potentially sensitive lands and disruption of wildlife corridors for wind and solar farms. There are also additional issues with mining that involve the use of child labour in mining in the Democratic Republic of the Congo and considerable associated health and safety issues. Also, there is the issue of space where renewables require up to 100 times the space.

Additionally some facts about electrification and minerals

·The average smartphone contains at least 40 elements from the periodic table including cobalt and six rare earth minerals.

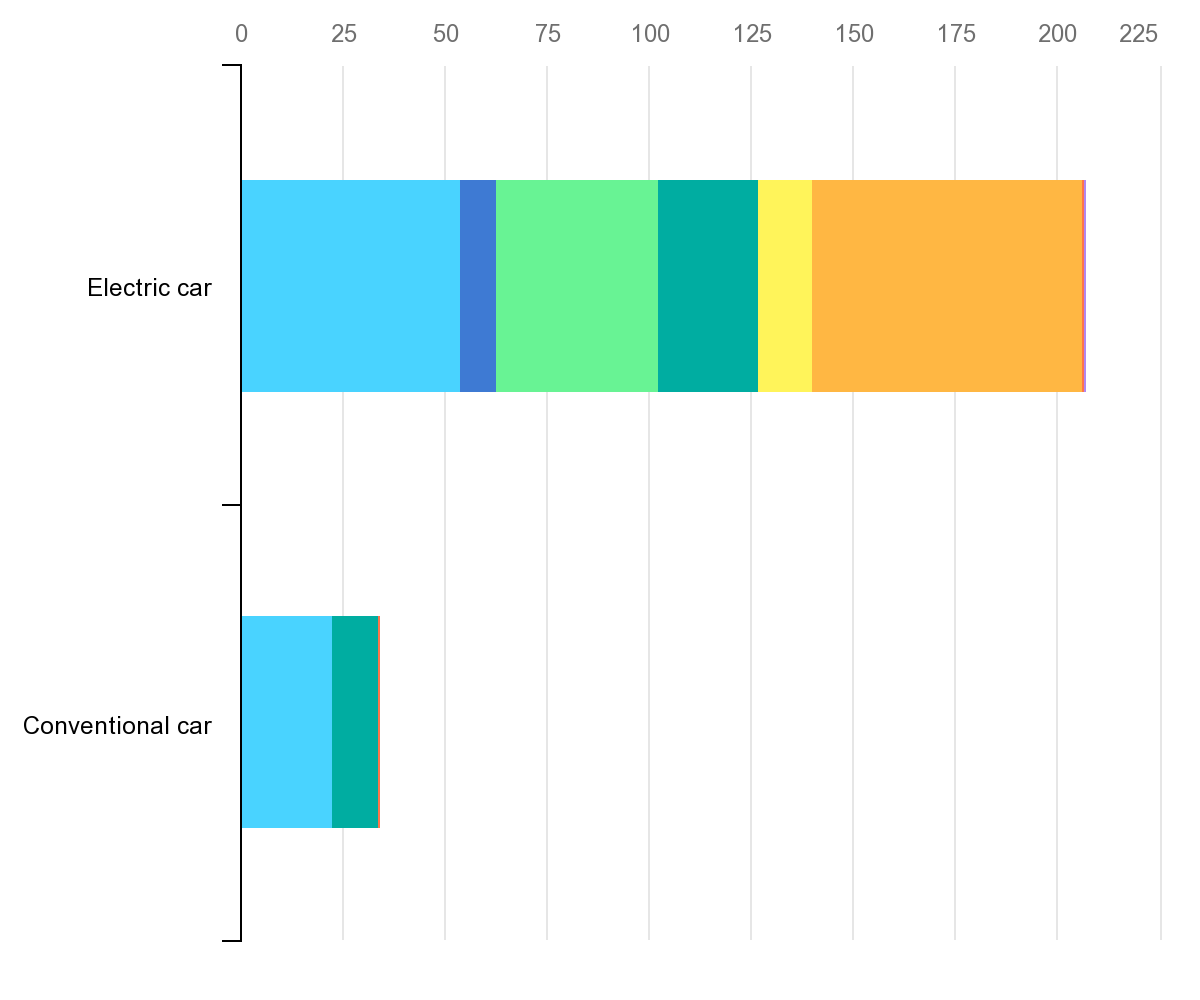

·The average electric vehicle uses six times more critical minerals than an ICE vehicle.

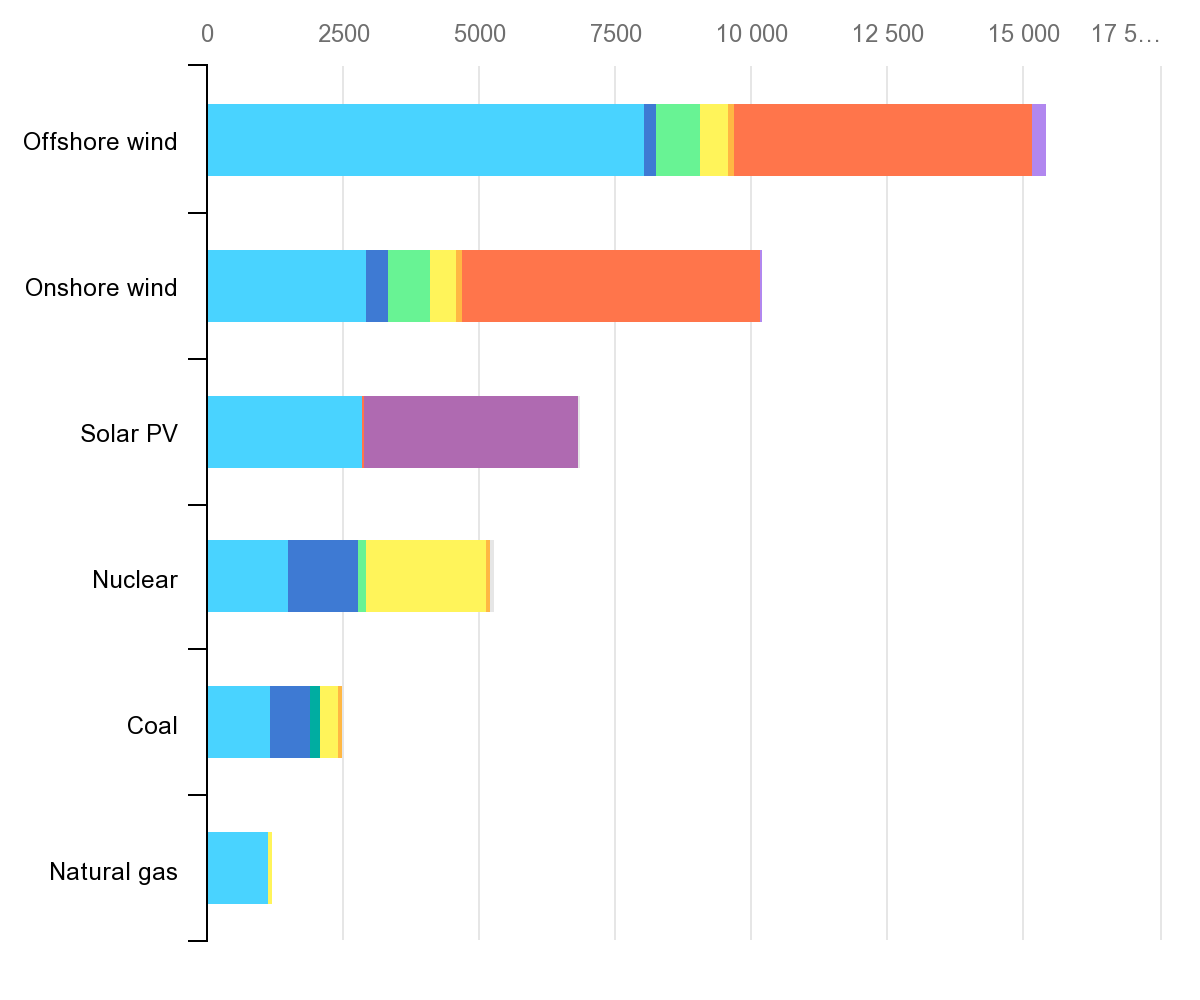

·An onshore wind plant needs nine times more mineral resources than an equivalent gas-fired power station,

·An e-bike is more mineral intensive than an ordinary bike.

More information on mineral usage can be found in the IEA,s report on The Role of Critical Minerals in the Clean Energy Transition. A few examples can be seen in Figures 1 and 2.

Figure 1: Comparison of Mineral Usage in an EV and an ICE

Figure 2: Comparison of Minerals Used in Energy Sources

Minerals and Mining

According to researcher Simon Michaux of the Geological Survey of Finland current mineral reserves are inadequate to support a renewable energy future. He presented his research in August 2022. His seminar can be viewed in its entirety on YouTube.

Video 1

His conclusion is the world’s current reserves to produce the metals required to manufacture one generation of renewable energy technologies are not even close to meeting the expected demand. A summary of current reserves and estimated requirements are summarized in Table 1 based on an IEA report.

Table 1: Known Reserves versus Required Volumes of Critical Electrification Minerals

|

Mineral |

Known Reserves (Tons) |

Required Volume (Tons) |

Is There Enough? |

|

Copper |

880,000,000 |

4,575,523,674 |

No (only 20%) |

|

Zinc |

250,000,000 |

35,704,918 |

Yes |

|

Manganese |

1,500,000,000 |

227,889,504 |

Yes |

|

Nickel |

95,000,000 |

940,578,114 |

No (only 10%) |

|

Lithium |

95,000,000 |

944,150,293 |

No (only 10%) |

|

Cobalt |

7,600,000 |

218,396,990 |

No (only 3.38%) |

|

Graphite |

320,000,000 |

8,973,640,257 |

No (only 3.57%) |

|

Silicon (metallurgical) |

|

49,571,460 |

Yes |

|

Silver |

530,000 |

145,579 |

Yes |

|

Vanadium |

24,000,000 |

681,865,986 |

No (only 3.52%) |

|

Zirconium |

70, 000,000 |

2,614,126 |

Yes |

In an article recently written for The TYEE by Andrew Nikiforuk an awarding winning and respected journalist with a focus on the energy industry and nature added to some of the key issues on the mines needed to bring the required minerals into the supply chain.

- In Canada, mining companies have more than 50 rare earth mining projects now on the books.

- In Canada, each of these projects takes 12 to 15 years from discovery to commissioning.

- The Mining Association of Canada has declared that “there is a natural synergy between mining” and “clean technology.”

- In Australia, geologists now gush that, “we will need more mines to save the planet.” More mines will have the opposite effect destroying landscapes, debasing watersheds and displacing rural communities. All to sustain our technological dependence on minerals.

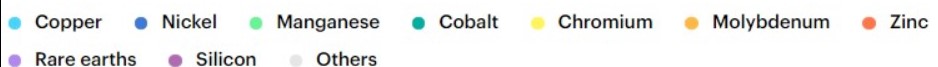

Figure 3 illustrates a conceptual model of the environmental issues associated with Rare Earth Extraction (REE) as presented by Yin et al in 2021. These are the same issues that are often raised by environmental groups when we discuss conventional fuel mining and extraction.

Figure 3: Conceptual Model of Environmental Issues Associated with Mineral and Rare Earth Extraction

Power Stations

Additional research by Michaux indicates that currently, the world has 46,423 power stations powered by oil, gas, coal, and nuclear energy. These would have to be replaced by 586,000 power stations powered by solar, wind, and hydrogen. The more than 10-fold increase in numbers is due to the low energy density of these renewable energy sources. These figures are based on using EVs for local and city transportation and hydrogen for long-range transportation. The 36,000 terawatts these plants produce support transportation electrification with no mention of other uses of electrification. Also needed to support the required capacity is a 115% increase in hydropower, a doubling of nuclear power, and a tripling of geothermal by 2050. Biomass would remain the same. This is just one scenario as the world's largest automobile manufacturer, Toyota, is betting on hydrogen as a larger segment for local transportation which could change some of the power station needs. But as Stephen Beatty, VP and Corporate Secretary, Toyota Canada mentions there is also an infrastructure problem with a lack of hydrogen filling stations.

Video 2

To add to the issues power stations and other projects need to be built in a regulatory regime that is not set up to as developer friendly. There are many areas of regulatory delays happening across Europe and the USA due to the increase in projects. This is discussed in the next section.

The other aspect of power stations is the intermittent nature of wind and solar so power reserves are also needed to store energy so there is a buffer. Based on Elon Musk's Hornsdale Power Reserve in Australia there would need to be more than 15 million of these 100 Megawatt reserves built across the globe and connected to the electrical grid to harness a 4-week buffer. In terms of power storage, this is 30 times the storage needed to support the global vehicle fleet and creates a battery market that is substantially larger than is currently being planned. It should also be noted that many of the current transition models rely on gas as the buffer for the intermittency issue of wind and solar.

Regulatory Environment

For the summer of 2022 power operators in the Central US, in their summer readiness report, predicted “insufficient resources to cover summer peak forecasts.”

In most countries Permitting across the EU and in the USA is one of the biggest bottlenecks for deploying wind power at scale. In the EU, approximately 80 GW of wind power capacity is currently stuck in permitting procedures. It is taking too long for developers to receive permits. In some countries permitting takes up to nine years. For the EU this is incompatible with its climate and energy ambitions. Last year the EU only installed 16 GW of new wind. The EU needs 31 GW every year on average to 2030 to meet its targets. In the US the entire electric grid has an installed capacity of about 1,250 gigawatts. Currently, 2,020 gigawatts of energy capacity are waiting in line to be connected due to regulatory delays.[xvi] AWS, Accenture and Wind Europe have been working to develop a permitting solution as seen in the video below.

Video 3

Additional concerns are the costs of connecting to the grid, particularly in the USA. One example is illustrated below with the Oceti Sakowin Power Authority and the Southwest Power Pool.

·In late 2017, the Oceti Sakowin Power Authority paid a $US 2.5 million deposit to secure a place in line for its application for its wind power project to be reviewed by the Southwest Power Pool, a regional grid operator. Five years later, the Southwest Power Pool came back and told it that the fee to connect to the grid would be $48 million. The cost was due to connecting all that new power to the grid would require major updates to the transmission infrastructure. The power authority was then given 15 business days to come up with $US 45.5 million.

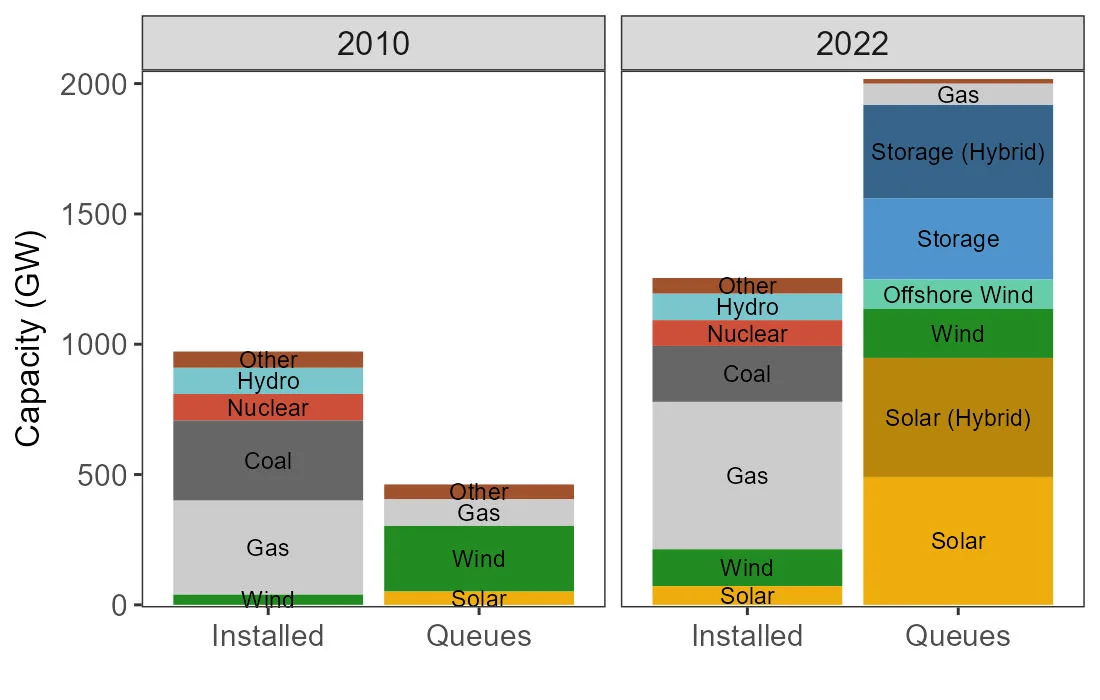

There are many other examples where the first estimates of connecting to the grid will cost many times the original estimates. Along with permitting, interconnection fees are increasing the queues in the USA. Figure 4 illustrates the existing versus queue size changes between 2010 and 2022.

Figure 4: Installed versus Queued Electricity Capacity in the USA

Additional problems with the interconnection are also complicated by the number of requests. A single natural gas power station typically adds 1,200 megawatts in a single request but with renewables due to lower energy densities that same 1,200-megawatt request is six, seven, eight, nine, or 10 different requests. Instead of a single request in the queue, there are many more requests in the queue as seen in Figure 4. Also, according to the Lawrence Berkley National Laboratory in 2022 the average new power generation project in the USA takes 35 months to go from the interconnection request being filed to an interconnection agreement being reached. The interconnection request is only one of the many permitting and regulatory hurdles each project needs to overcome.

At the residential level, there are additional complications with individual residents not being able to get permits for 200 amps services which are required for fast-charging outlets for EVs in the home. In Edmonton, Alberta the city is about to no longer issue permits for these electrical services as the electrical grid can only support a few of these types of services in each neighbourhood. There are also technical issues when the neighbourhood is supplied by underground versus overhead powerlines. A level 3 (fast-charger) charger will charge an EV to 80% in approximately 20 to 60 minutes whereas a level 2 will take 4 to 12 hours and a level 1 40 to 50+ hours. A 200 amp service is required for a level 3 charger and most likely required for a level 2 charger if you want to run your other electrical appliances at the same time especially as decarbonizing home heating adds heat pumps to the equation of electrical appliances.

Your Task

The issues facing the world with creating a sustainable electricity grid that will support the climate change goals that governments are calling for are daunting and maybe significantly more difficult to achieve than governments are communicating to their citizens. With goals of achieving 40% to 45% cuts in the next 6 and a half years when projects are taking up to nine years to get permitted, it does not seem like these cuts will be achievable. This is not only a big "messy" problem but needs to be looked at from the perspective that climate progress is lagging particularly in Canada. What needs to happen to achieve decarbonization of the electrical grid by 2050?

The quantity of metals required to manufacture just one generation of decarbonized energy

Hydrogen car support very limited in Canada

WindEurope Annual 2023 - AWS Permitting Tool