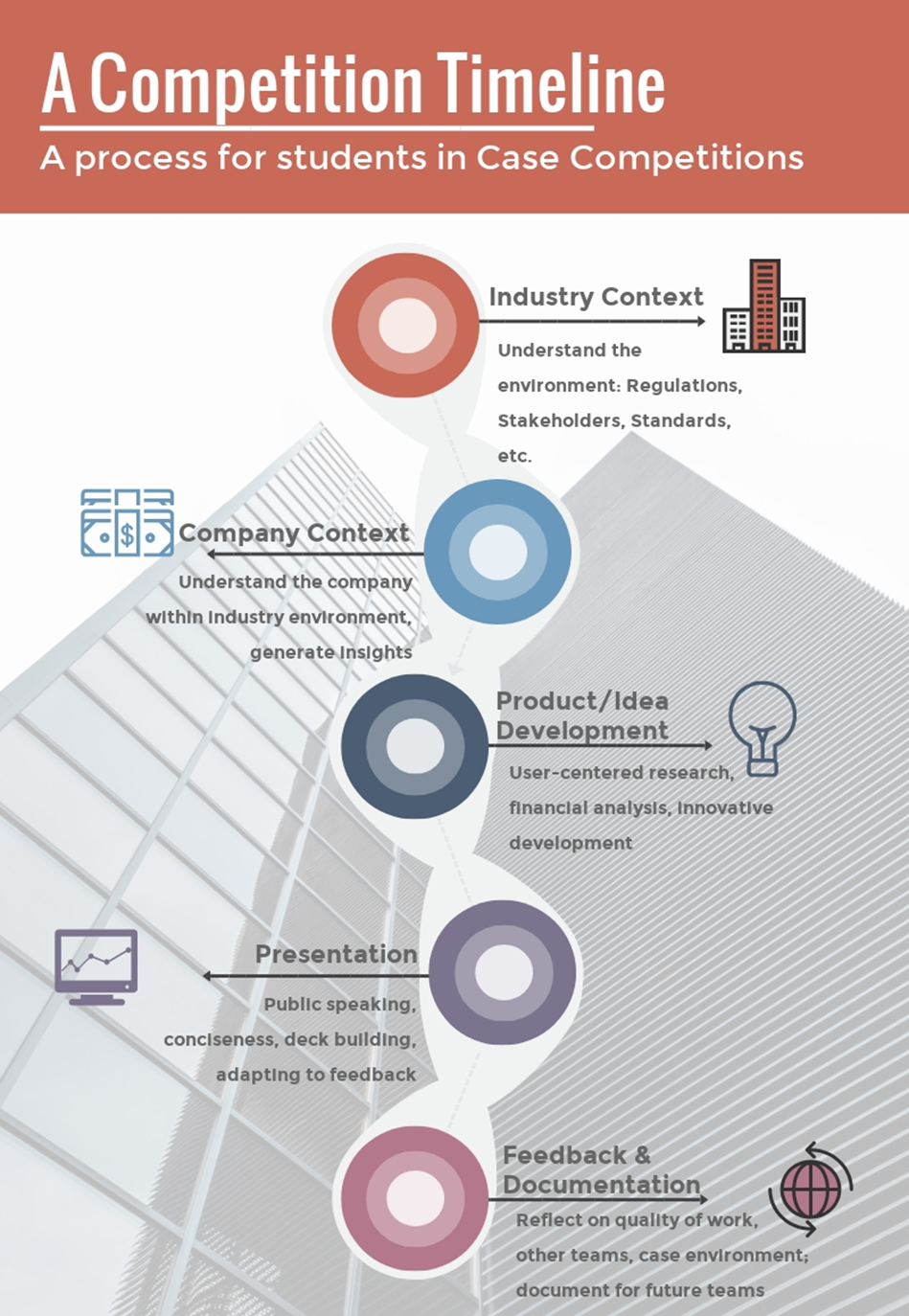

Case Solving Guide 2026

The first version of this guide was developed in 2019 for MGST 597.07 W19 by Shreya Khanna, Jennifer (Jiwoo) Jang, Graeme Climie, and Byron Holcek under the supervision of Cam Welsh

Company Context

Learning Objective: The goal is to identify the business the company operates in, understand the core needs of its products or services, and recognise the key stakeholders involved.

Internal Context: Where to Start

Begin by answering the following two questions:

- What business is the company in?

- How does the company generate revenue?

The answers to these questions may not be as straightforward as they seem. For instance, consider STARS Air Ambulance. When asked about their business, students might respond with terms like rescue, transportation, or medical emergencies. However, the true answer is "Saving Lives." When it comes to revenue generation, the company primarily relies on fundraising, with the understanding that one day, a potential donor might need their services.

Once you have clarity on these two questions, you can proceed to analyse what the company is doing in greater detail.

Additionally, try to gain insight into the company’s culture and operational approach. Reflect on how the company has functioned in the past and what values are essential to it. For example, TATA in India has a culture of acquiring iconic brands and allowing them to operate independently while providing financial support. Proposing a strategy that contradicts this culture would be challenging for TATA.

Next, it is crucial to understand the markets the company is serving. This is why we will examine the product and service categories the company is involved in. Understanding user needs at a deeper level and thinking creatively about how to address them is vital. Analysing a product or service and exploring the intricacies involved in its creation can further enhance your understanding.

Once you have a general idea of the products or services offered by the company, consider the following questions

- What is the underlying user need? (For example, the fundamental need of a car is to facilitate transportation from one place to another.

- What alternative solutions exist for fulfilling this need besides owning a product? (For example, car-sharing services.

- What is the service experience? (What are the benefits of not owning this product?)

- What systems need to be in place? Consider which partners you would need, what types of feedback or data would be important to gather, and whether this data could benefit others.

By tackling these questions, you can develop a clearer understanding of the company’s impact and opportunities in the market.

As part of this section, it may be helpful to develop a customer or product journey to understand how customers interact with the product and identify any potential issues in the company’s current strategy.

To gain insights into a company, it's essential to understand the main players who have invested in it, whether directly or indirectly. This understanding can inform various aspects, such as identifying the target market for the company and determining the structure needed if you were to start a similar company.

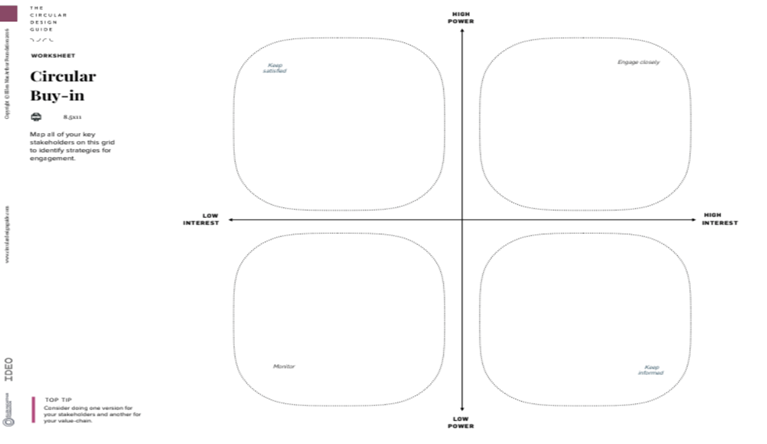

You should also develop strategies for involving stakeholders throughout the project, from co-creation to maintaining their engagement. A further discussion of stakeholders is included later in the document.

Use the provided template to map the stakeholders. Consider creating two separate maps: one for internal stakeholders (those involved in your project) and another for external stakeholders (those with whom you might need to partner for any potential business idea).

Figure 1: Stakeholder Map (Circular Design Example)

1. Take the stakeholders one by one and consider each of their perspectives using the following questions:

o What matters to them most?

o What keeps them up at night?

o How do they problem-solve?

o Who else do they have around them that might support your idea?

2. Building off these perspectives, develop a narrative/conversation starter for each person. Notably, they might be very different from one person to another. What matters to them the most?

3. Start the conversation using these questions if helpful:

o Can you think of ways to build on this?

o How could we work together?

o What else do you need to know?

o How might we show proof of concept quickly and at minimal cost to mitigate risk?

4. Start building the Business Model Canvas based on the company research (see Idea Development)

External Environment: Company Context

(Adapted from Dr Scott Radford, Associate Professor of Marketing – Haskayne School of Business)

Learning Objective: Companies do not operate in isolation. To fully understand the context in which a company functions, your team should analyse the surrounding environment, objectives, strategies, and activities. This examination will help identify problem areas and opportunities, allowing you to recommend a plan of action aimed at improving the company's performance.

Macro Environment Factors

|

Demographic |

o Major demographic developments and trends pose opportunities or threats to this company? o What actions have companies taken in response to these developments and trends? |

|

Economic |

o What major developments in income, price, savings, and credit will affect the company? o What actions has the company been taking in response to these trends? |

|

Environmental |

o What is the outlook for the cost and availability of natural resources and energy needed by the company? o What concerns have been expressed about the company’s role in pollution and conservation, and what steps has the company taken? |

|

Technological |

o What major changes are occurring in product and process technology? o What is the company’s position in these technologies? o What major generic substitutes might replace this product |

|

Political |

o What changes in laws and regulations might affect strategy and tactics? o What is happening in the areas of - pollution control - equal employment opportunity - globalisation, product safety - advertising - price control o Are there major current events that affect the company? Who are the major players? |

|

Cultural |

o What is the public’s attitude toward business and the company’s products? o What changes in customer lifestyles and values might affect the company? |

Microenvironment Factors

|

Markets |

o What is happening to market size, growth, geographical distribution, and profits? What are the major market segments |

|

Customers and Consumers |

o What are the customers’ needs and buying processes? o How do customers and prospects rate the company and its competitors on reputation, product quality, salesforce, and price? o How do different customer segments make their buying decisions? o Are the customers and consumers different groups? o How do you satisfy both the customer and the consumer? o How do consumers influence buying decisions? |

|

Competitors |

o Who are the major competitors? What are their objectives, strategies, strengths, weaknesses, sizes, and market shares? o What trends will affect future competition and substitutes for the company’s products? |

|

Distribution and Dealers |

o What are the main trade channels for bringing products to customers? o What are the efficiency levels and growth potentials of the different trade channels |

|

Suppliers |

o What is the outlook for the availability of key resources used in production? o What trends are occurring among suppliers? |

|

Facilitators |

o What is the cost and availability outlook for transportation |

|

Publics |

o Which publics represent opportunities or problems for the company? o What steps has the company taken to deal effectively with each public? |

Idea Development and Stakeholder Understanding

Learning Objective: To be able to understand the users of the product/idea/strategy, and to go through the product/idea/strategy development cycle in a flexible, adaptive way while considering your stakeholders' wishes.

Idea Development

With product ideas and even strategies, user-centric research is necessary to gain empathy and understanding of your target demographic. It can also help to identify the range of people that sit on your value chain. Use the following steps as an interview guide:

- Define the individuals in your value chain.

- Create your questions. Questions should be directed towards identifying their needs and pain points.

- Set a time to meet with the individuals in their environment.

- Record your interview.

In the context of a case competition, the answers to the above points need to be found in the case or in the outside research you undertake.

Discuss the key ideas and inputs that you gathered from the speakers. Using these insights, the next process is to brainstorm ideas. Use the following template, and brainstorm:

|

Name of Idea |

|

Photo or Visual (if applicable) |

|

What is it / How does it work? |

|

Desired Impact |

|

Who is it for? |

Figure 2: Idea Generation Template

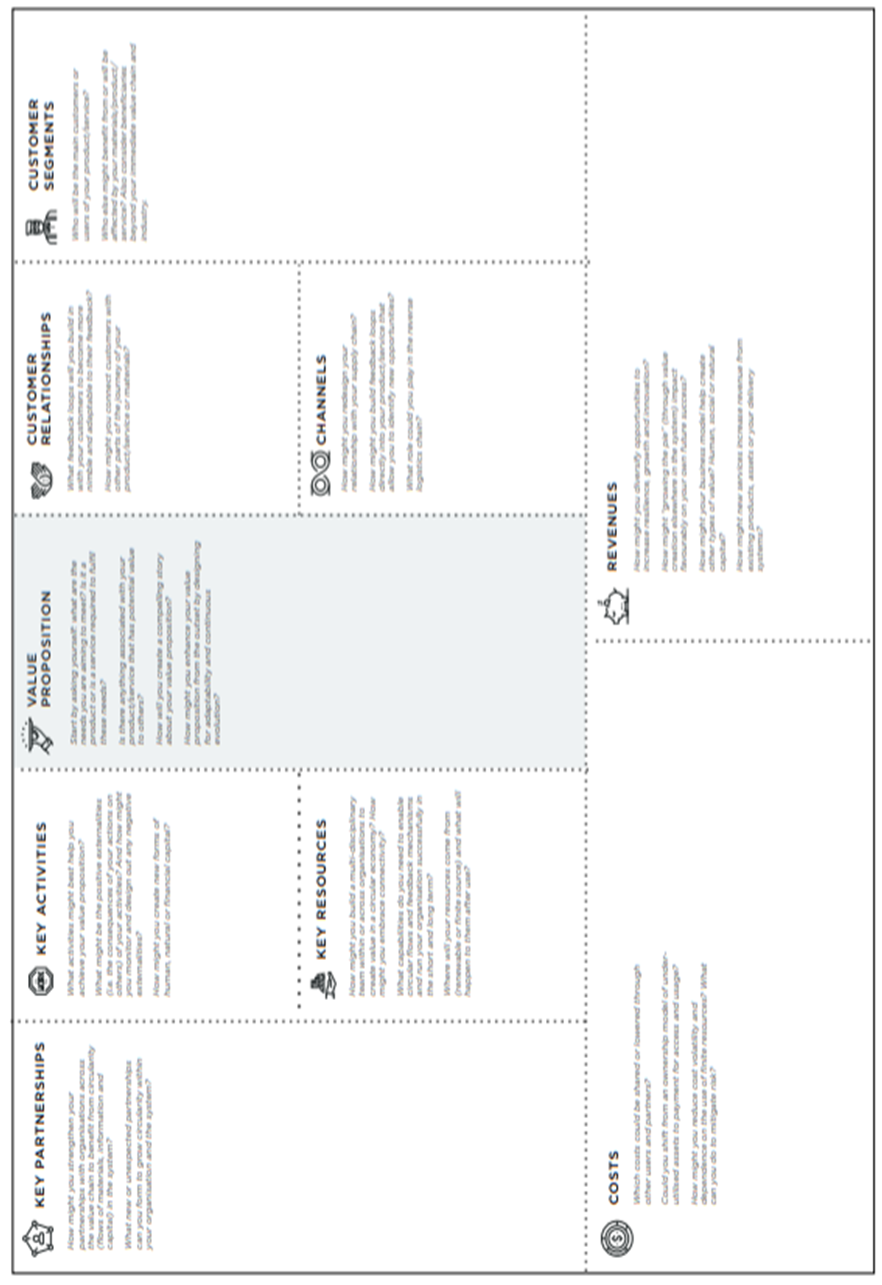

After brainstorming your ideas, select the one that alleviates the pain points most efficiently. Is it a feasible business model or solution?

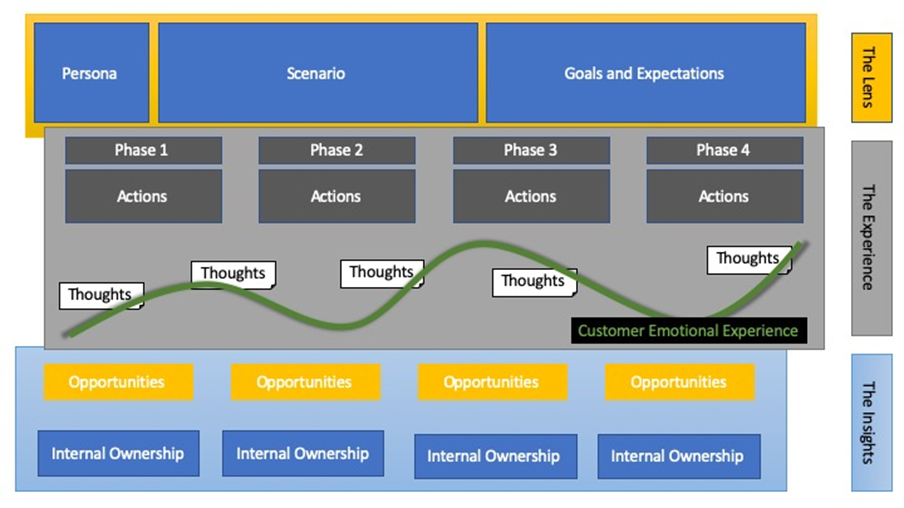

Begin developing a Business Model Canvas. The Business Model Canvas helps structure discussions, is fast and highly flexible, and is easy and intuitive to use. Additionally, consider the Customer Journey (see illustration), which illustrates that you may need micro-strategies that can be product- or service-based, or geographically based.

|

Figure 3: Business Model Canvas |

Figure 4 Customer Journey

Understanding Stakeholders

Gaining a better understanding of stakeholders involved with your process can create vastly superior knowledge and outcomes through the fundamental understanding of what matters to these different individuals. Stakeholder-centred research helps your team gain empathy for the people who will be impacted. This will help your team develop a better understanding of the demands of many stakeholders and refine your recommendation accordingly to benefit all parties and truly separate yourselves from other teams.

Steps associated with stakeholder-centred research are as follows:

- Start by defining all the different individuals who would sit as key stakeholders for your project. Who might be individuals who may benefit the most from your recommendation?

- Next, develop a set of questions that your team would be interested in knowing from these individuals. The ability to ask questions that look to understand their needs and what they experience will be useful in further creating empathy towards your stakeholders.

- If time permits, it could be wise to shortlist certain individuals who fall under your team’s identified stakeholders to set up an interview with these individuals and fully understand their perspectives. For example, if your team is working on a live case, it would be best to put yourselves in their shoes and answer the questions you have developed on what you would be interested in, given your position as a stakeholder.

- Once your team has the answers to your stakeholder questions, it would be best to quickly debrief on what each member had “heard” and take the main points to enhance your team’s recommendation.

Items needed to understand stakeholders

o Empathy: The effort to understand people, their needs, why they do things a certain way and what is meaningful to them.

o Observation: Observing what people do and how they interact with their environment gives you clues about how they feel. Actions speak louder than words; therefore, through observation, a stronger sense of stakeholders can be established.

o In-depth conversation: Useful when interviewing someone or discussing with your team. IT will highlight the key reasons why there may be different perspectives and allow your team to develop a more holistic view of your stakeholders.

Stakeholders to consider when working on a case

For-profit Companies

o Users: Key things to consider here are the product or service quality, privacy, and security.

o Society: Ensuring the company is acting in a manner that society would support. Items to consider are the company’s practices, whether they are ethical, environmentally friendly, or is the company is transparent with its information. These are things that many people would want a company to abide by.

o Debtholders: Is the company able to effectively pay back its debt? All debtholders care about is being paid back. If the company is riskier, that could impact its credit rating and deteriorate its balance sheet.

o Government: Is the company following regulations and benefitting society? Is it contributing to the greater good of the economy?

Non-profit Companies

o Donors: People who donate to not-for-profits generally believe in its mission. Donors will be most interested in whether their money is being used appropriately in accomplishing the mission of the non-profit.

o Users: As non-profits work towards bettering a certain aspect of life for certain people, as a general overview, users will be interested in how the non-profit is accomplishing its goals and the impact that they are making

o Staff: Generally, people who may be very passionate about the mission; however, to accomplish the mandate of the non-profit, appropriate compensation must be distributed.

o Government: Is the non-profit working ethically and within regulations and law to fulfil their goals?

o Corporations: How will partnering with said non-profit align with company values and image? Note that large corporations can deploy large amounts of funding.

Developing a Product or Service

o Suppliers: Developing strong relations with suppliers is crucial. Being able to develop an effective distribution and supply chain will make suppliers more willing to engage with your team. Additionally, meeting payment requirements is another significant way of establishing good relations with suppliers.

o Buyers: Can be different from users. May hold less information than a user purchasing a product or service. Will be looking for something, perhaps attention-grabbing.

o Users: Hold certain expectations of products, such as being sourced responsibly, high quality, and safe.

o Investors: The main concern is the product or service capable of producing strong returns for themselves.

Building Financials

Learning Objectives: The purpose of this section is to give students an understanding of key business numbers, the ability to conduct risk analysis and judgment, and interpret these numbers to make important decisions for the case. This section will be broken down into knowing the most important financial metrics associated with taking on a new initiative, how to interpret these key metrics, the ability to benchmark these metrics relative to competitors, and communicating the quantitative analysis effectively towards the audience.

Key Ratios: The key ratios and metrics used to analyse the success of initiatives are as follows: Net Present Value (NPV), Return on Investment (ROI), Internal Rate of Return (IRR), Payback Period, Break-Even, and Profitability Index (PI). A Discounted Cash Flow (DCF) will be covered in this section. It is essentially a more complicated NPV calculation, but it could prove to be an effective measure of value in certain situations. Also, note that NPV can be difficult to do in less mature companies, and that is where a tool like ROI might be more appropriate.

Net Present Value (NPV)

Essentially, the NPV is the difference between the present value of cash inflows and the present value of cash outflows over time. It is important to realise the difference between profitability and NPV, as profit is concerned with the end of the income statement; however, NPV concerns itself with cash. A company can be profitable but still generate a negative NPV and vice versa; this will be covered more extensively in the DCF section.

NPV formula:

Where,

n = Number of time periods (years)

t = Time period (year)

i = Discount Rate

Rt = net cash inflow – cash outflow during a single time period t

Overall, the equation can be simplified to,

NPV = (Today’s value of the expected cash flows) – (Today’s value of invested cash)

The higher the NPV, the better the project is in undertaking; it is also considered the most important metric to follow when making financial analyses. It is better to use a mix of various financial analyses.

To note, the discount rate is the rate you must use to convert the future value of cash flows back to the present time. Appropriate discount rates can be determined by using comparable companies, or, to simplify it, by just using an industry standard of roughly 10%. However, as risk increases, so should the discount rate, as it also measures the return that could be earned in alternative investments. See the chart below for some additional guidelines for discount rates.

|

Business Characteristics |

Risk Premium (Discount Rate) |

|

Established Business Strong trade position, well-financed, management depth, stable earnings history, predictable future |

6 – 10 % |

|

Established Business In a More Competitive Environment Strong trade position, well-financed, management depth, stable earnings history, less predictable future due to competitive environment |

11 – 15 % |

|

Business in a Very Competitive Environment Low barriers to entry in the industry, little management depth, risky future, even if past performance is good |

16 – 20% |

|

Small Business / Highly Cyclical Business Depends on the special skills of one or two people or large businesses that are highly cyclical |

21 – 25% |

Figure 5 Risk Premiums for Different Business Characteristics

Return on Investment (ROI)

Essentially, ROI is a performance measure used to evaluate the efficiency of an investment or compare the efficiency of several different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.

ROI formula:

ROI = (Current Value of Investment – Cost of Investment) / (Cost of Investment)

To break down the formula, ROI is essentially the received benefit (return) of an investment divided by the cost of the investment. The result is generally expressed as a percentage.

If the ROI is net positive, it is probably a worthwhile investment; however, if alternatives exist with a higher ROI, the metric is a good way to eliminate or select the best option.

Internal Rate of Return (IRR)

Essentially, IRR is a discount rate that makes the NPV of an investment equal to zero. Generally, the higher the IRR of a project, the more desirable it is to be undertaken. It is uniform for investments of varying types, and as such, IRR can be used to rank multiple options on a relatively even basis.

IRR formula:

Where,

Ct = net cash inflow during period t

Co = total initial investment costs

r = discount rate

t = the number of time periods

IRR cannot be analysed by hand; luckily, there is a built-in Excel function that can efficiently calculate the IRR of a project.

Generally, the higher the IRR, the better and more appealing the project is to undertake.

Payback Period

Essentially, the payback period is the length of time required to recover the cost of an investment. It is an important determinant of whether to undertake the position or project, as longer payback periods are typically not desirable for investment positions. Also, to note, Payback does not consider the time value of money (TVM) (money today is worth more than money tomorrow).

Payback Period formula:

Payback period = (Initial Investment)/(Net Annual Cash Inflow)

This is a simple calculation that determines the number of years it takes to recover the fund invested without considering the TMV. It is usually used in a supplementary to other more prominent metrics such as NPV and IRR.

Generally, the shorter the payback period is, the better.

Break-Even

Essentially, entails the calculation and examination of the margin of safety for an entity based on the revenues collected and associated costs. Using a sensitivity of prices, a company will use the break-even analysis to determine the level of sales necessary to recover fixed costs.

Break-Even formula:

(Fixed Costs)/(Price – Variable Costs) = Break-Even point (In Units)

This calculation will allow you to develop a sensitivity surrounding profit margin and effectively allow you to understand and show the audience how much demand is needed to recover fixed costs.

The fewer the units needed to break even, the better.

Profitability Index (PI)

Essentially, the PI is an index that attempts to identify the relationship between the costs and benefits of a proposed project.

PI formula:

A profitability index of 1.0 is logically the lowest acceptable measure on the index, as any value lower than 1.0 would indicate that the project’s PV is less than the initial investment. Essentially, the higher the PI, the more attractive the project is to undertake.

The higher the PI, the better.

Discounted Cash Flow (DCF)

A DCF is a common but complicated financial model. This section will highlight the DCF briefly. Many assumptions must be incorporated into this analysis; it is highly recommended to avoid using a DCF in financial calculations unless members are familiar with the model and a more holistic financial view is needed.

The commonly used DCF is unlevered. This model does not account for any debt in terms of interest payments and provides you with the EV (Enterprise Value) of a firm. If used to calculate the implied share price for a public company, Net Debt (Total Debt – Cash) is subtracted from EV, and this gives you Equity Value. The Equity Value is then divided by total dilutive shares (All common shares plus any convertible securities) to arrive at the implied share price.

The beginning of a DCF is essentially a company’s income statement without accounting for interest payments. Revenue less any associated predictable costs to arrive at EBIT (Earnings Before Interest and Taxes). From EBIT, you will apply the corporate tax rate accordingly and arrive at Net Income.

Once arriving at Net Income, you must begin to add back and deduct other uses of cash. As DD&A (Depreciation, Depletion, and Amortisation) is included in the income statement as a deduction because it is a tax savings, it must be added back in whole as the next item on the DCF.

The next step is determining the change in Net Working Capital (NWC). The change in NWC is the difference between Current Assets (Excluding Cash) – Current Liabilities for one time period over the previous (generally end of year). If the change in NWC is positive, then it is a deduction on the DCF and vice versa if it is negative. This may seem counterintuitive; however, if you think about it, as current assets increase more than current liabilities, there is a greater usage of cash, thus meaning a deduction on the DCF model. A strong company will generally have a positive change in NWC as it uses more cash to improve and grow the business.

The next step is determining the Capital Expenditures (CAPEX) for a company on an annual basis. CAPEX is always a deduction on the DCF model as it is a major usage of cash for companies. A strong and growing company will have to increase CAPEX, and the best way to determine this if a company has growing revenues is by making CAPEX a certain percentage of revenues annually.

After completing these steps, you will have effectively arrived at your Free Cash Flow (FCF) for a period of time. Next, you must apply an appropriate discount rate (Weighted Average Cost of Capital (WACC)) to discount the FCF back to present value. Computing the WACC can be troublesome, so it is recommended to use an industry average of 10% for simplicity.

The last step in the DCF model is determining the terminal value. The terminal value is obtained using the final period’s FCF value in a perpetuity equation. The terminal growth rate is a major assumption that can greatly impact the EV and implied share price, so it must be accurate. A general rule of thumb is that mature and “value” companies will grow at roughly 3% in perpetuity (the average rise in the US’s GDP). However, for smaller companies with strong growth potential, a terminal growth rate higher than 3% is more appropriate. The equation is as follows: (FCFn)/(WACC-Terminal Growth Rate). This value must be discounted to present value accordingly as well.

With the discounted cash flows of each year determined and the discounted terminal value, you will then be able to sum them all together to arrive at your terminal value.

Key things to remember for a DCF are that the forecast period is recommended to be 5 years long, and credibility can be questioned as it is difficult to make accurate assumptions beyond a 5-year time horizon. Additionally, all assumptions for the model should be included in an appendix slide to walk your audience through your thought process of valuing a company. A sensitivity should also be included on EV or implied share price through the manipulation of terminal growth rate and WACC, as these items generally have the greatest impact on a DCF model.

Summary

Overall, these different valuation methods will generally work best for financials associated with case competitions. They are simple and help solidify your team’s arguments and solutions. It is always best to use a range of numbers; thus, running through a sensitivity on your outputs by changing your main inputs is essential. Having a sensitivity range allows for more credibility and can show your audience the value of your team’s solutions in best-case and worst-case scenarios. It is also easier to think of the value that a certain initiative brings as a separate project, essentially. Instead of thinking of the value that the project brings to the overall firm, the ability to quantify it separately can make it much simpler and easier to determine the true value and benefits of your solution.

Benchmarking

Benchmarking improves performance by identifying and applying best-demonstrated practices to operations and sales. Managers will utilise benchmarking to compare the performance of their products or processes externally with best-in-class companies and internally with other operating segments within the firm.

The objective of benchmarking is to find examples of superior performance and to understand the processes and practices driving that performance. Companies will then improve their own businesses by tailoring and incorporating these best practices into their operations. Companies will not imitate these practices but innovate them into their practices.

Benchmarking works by:

1. Selecting a product, service, or process to benchmark

2. Identify key performance metrics

3. Choose companies or internal areas to benchmark

4. Collect data on performance and practices

5. Analyse the data on performance and practices

6. Analyse the data and identify opportunities for improvement

7. Adapt and implement the best practices

Companies use benchmarking for:

- Improve performance: Identifying methods of operational efficiency and product design.

- Understand relative cost position: Reveals a company’s relative cost position and identifies opportunities for improvement.

- Gain strategic advantage: Helps focus on capabilities critical to building strategic advantage.

- Increase rate of organisational learning: Brings new ideas into the company and facilitates experience sharing.

-

Benchmarking can be a useful and powerful tool when conducting financial calculations and analyses. It can show the audience the benefits gained from the solution or idea your group has chosen to implement over other alternatives, and perhaps what other corporations are doing. Using the analyses described above, you will be able to quantify why your group chose to go the route you did. At the end of the day, any for-profit company has only one true duty, and that is to generate positive cash flows for shareholders.

How to Present Quantitative Analysis

Finances should be distributed throughout the presentation in key areas such as the implementation, alternatives, and recommendations. Through the implementation, finances should be able to demonstrate the sustainability and feasibility of your recommendation. Through alternatives, finances should be able to convey the superiority of your recommendation relative to others. Lastly, throughout the recommendation, finances will need to support your solution with a quantifiable benefit.

Presenting a range of numbers is a lot more credible than using exact values; it shows both optimistic and pessimistic scenarios of implementing your solution and being able to have an appealing pessimistic value can drive your recommendation to the audience. This can be done through a sensitivity analysis, which has been discussed above.

Additionally, it is important to determine a “walk-away” value. This essentially means that your group should come prepared with a value to abandon, whether it be a value that seems to be too good to be true (especially when dealing with investments) or a value of abandonment if your solution were to take a bad turn.

When presenting quantitative information, an important tool to convey to your audience is relative comparison. The relative comparison regarding your presentation is creating an image for your numbers presented that will allow the audience to understand the severity of your quantitative work. For example, if your group were to find that there are 100,000 tonnes of cardboard put into landfills a year and would like to use that fact in your presentation, your group could present it in the manner of “100,000 tonnes of cardboard are thrown away into landfills annually, which is roughly enough to fill X Olympic swimming pools”. This creates a greater understanding of the severity of the fact mentioned above in the audience’s minds and allows them to fully realise the severity of it more comprehensively.

Recommendation and Implementation

Learning Objectives: The purpose of this section is to give students an understanding of what is required to be in the recommendation and implementation of a case solution. This is why your audience has come to listen to you, and it is a significant portion of most case competition scorecards.

Recommendation

The recommendation is usually straightforward, as it is what the company should do. Numerous approaches can be taken, but the most important thing is that the recommendation is supported by the rest of the information you have delivered in your solution. Your audience needs to understand what the recommendation is and why it is the best recommendation.

Alternatives

You need to think about alternatives, but you may only present what you are doing, as you may not have time to do both. Alternatives need to be first and foremost MECE. They need to be mutually exclusive and comprehensively exhaustive. You also need to define the criteria you used to decide upon which alternative you are going to recommend. These criteria must be connected to the success factors for the solution and the values of the client company. When you do present an alternative, start with what you are doing and then present the alternative that you are not doing. Most often, in case competitions, it is best to present the negative side of what you are not doing to discredit those alternatives in the judges’ minds, especially when they are things other teams may present as solutions.

SCQA - A Process to Arrive at a Solution

It is best to approach the issue in the case using a SCQA (situation, complication, question, and answer) approach. In this approach identify the situation making sure you are identifying the situation and not the symptoms that result from the situation Once this is accomplished you can focus on the complications which are the issues that are leading to the tensions and begin to ask the probing questions and propose your answers which must include a governing thought which can be broken down into key thoughts and the support for those key thoughts.

For example, the 2 figures below show the process for a response to how to do something and a response to why to do something. The figures below do not include the support portion of the processes in detail but would be the reasons that support the key line elements.

Figure 6: A SCQA Response to How

Figure 7 A SCQA Response to Why

Implementation

1. Business Operations:

a. Remember that your implementation should connect back to the answers you developed when you asked yourself, “What business is the company in?” and “How does the company make money?”

b. This question entails a deep understanding of the different operations of the business in your case study. Examples could be Sales, Management, Business Development, Marketing, Finance, Corporate Relations, Supply Chain, HR, etc.

c. For each business operation, develop what changes you would like to introduce, and create a list of 3-7 big ideas. This would be an introduction to your implementation piece.

d. Begin splitting up these ideas on a practical timeline and jotting them down. For example, if you are introducing a merger, it should not be included in the short-term implementation (the first year) plan; rather, you can begin including the groundwork leading up to a merger in that period.

2. Terms/Periods

a. A thorough implementation plan usually contains three time periods – short, middle, and long – with a brief cost analysis supporting the changes you are introducing.

b. A short-term implementation plan can include the first year divided into three quarters, or just the first three months of the year, depending on your content. The idea is to start introducing your big ideas and laying out the groundwork in this period. For example, to introduce a huge marketing program for the company, you would want to start performing market research in the first month, use the data to generate excitement towards the new product/service in the second month and push for national representation in the third month. This outline is practical and time sensitive.

c. A middle-term implementation plan can include years 2 to 5 or simply the second year, depending upon your proposal. The purpose is to start building the framework of your proposal in this period. For example, with the marketing program in place, we can push ticket sales in the first quarter of the second year, reach out for sponsorship in the second quarter and create personal experience packages as a marketing strategy in the final quarter. As you can see, we have expanded on the groundwork we set in our short-term implementation plan. This flow guarantees clarity and rationality.

d. Finally, a long-term implementation plan can include 3 to 5+ years. The purpose of this piece is to begin evaluations of the changes that were introduced. This will give the company an idea of whether the plan has worked or not, and if some additional steps can be taken to achieve the desired goal. This segment can also be used to mention any future opportunities/goals. For example, prepare for a major event, reevaluate customer needs and wants, and evaluate the rise in revenue/attendance, etc.

3. Spectrum Thinking

a. Think of the implementation plan and its three periods as a spectrum shifting from extremely detailed and quickly achievable to more summarised and long-term.

b. This spectrum must guide you in terms of laying out your plan for the company in a rational manner.

c. Must include the internal ownership of each of the steps and measures of success.

The following process can help you stay on track with the implementation plan rationally and clearly:

Figure 8 Measuring Success

Creating the Narrative

(Adapted from Global Retail Challenge)

Learning Objective: Learn the basics of telling great stories around your solution. What is an immersive and emotional story that makes people feel invested in your solution? The story you tell can be what makes or breaks your initiative. A compelling narrative about your product can create loyalty in customers and deepen investment from stakeholders.

Sometimes, the best story to tell isn't what you are doing, but just what you are doing that makes your solution a better experience.

Steps

1. Revisit your Solution (Brand) Promise. Think about the emotional qualities you want your solution (brand) to evoke for customers and stakeholders, along with the message you will use to make it resonate.

2. Empathise with internal audiences. Consider how your solution links to core business drivers such as:

a. Thinking beyond the product to develop new added value customer services (i.e. new models or ownership, personalisation or repair services)

b. Becoming more adaptive to customer needs

c. Becoming more collaborative as an organisational culture and less siloed

d. Capturing more value by closing the loop and re-using materials

e. Addressing risks in the business model around resource use

f. Activating your brand purpose

3. Create a storyboard that helps you think about the message you want to share with your audience. Try to answer the following questions, but feel free to play with the order. Does it start with a big, lofty challenge statement, or does it start with a small story of a person's life? That's up to you!

a. What's the challenge you are trying to solve?

b. What's your innovation? (keep this simple - don't try to over-explain)

c. Why is this important/relevant? (What's new or changing because of this?)

d. What insights brought you to this solution?

e. How will this change your customers' lives in some way?

f. What story or stories support this?

4. Think carefully about your use of words - what emotions are you trying to stimulate? Are you telling a story that others can buy into?

5. As you construct your story, try to be as specific as you can and use empathetic language.

6. Most importantly, pick a focus and create a 'through-line' to your story. Once you have the components in place, think about how you would tell this story to someone over drinks or to your grandmother. Is it relatable? Does it hold up outside of your industry and context?