Applications in Monetary Policy (Keynesian Cross)

Why Should I Care?

Since monetary policy is inherently inflationary, at least potentially, it's important to use a modelling simulation that can predict both the outcome of output, but also inflation (or deflation) generated by the new policy.

This lecture has 3 parts

- Keynesian Transmission Mechanism

- Expansionary Policy

- Contractionary Policy

What are Applications in Monetary Policy?

How does the central bank eliminate a recessionary or inflationary gap?

By changing the Policy Rate, the central bank can have an impact on GDP. It will do this by changing the money supply to change Investment Spending. That, in turn, will affect Aggregate Demand, which is part of the process to determine GDP.

-

Keynesian Transmission Mechanism

This set of domino effects is called the Keynesian Transmission Mechanism. Note that Keynesians are interested in maintaining a healthy output level as a means to ensure full-employment on the labour market. In Canada, the central bank is not mandated to do this, only to manage the rate of inflation and keep it around 2 percent. If the rate of inflation is below 1 percent, you can expect the BoC to increase money supply, and usually this is the case in a recession, that low inflation, or even deflation, is accompanied by high unemployment rates. However, in the case of stagflation, when there is price inflation and a drop in output, the BoC is expected to follow its inflation targets as a priority over any other issues.

Here is the mechanism in detail:

1. Central bank modifies policy rate to signal later changes to Money Supply (MS).

-

- The central bank changes its policy rate

- Decrease: Expansionary

- Increase: Contractionary

- Commercial banks follow suit and change their retail interest rates

- Creditors modify their demand for loans

- Lower rates increases demand for loans

- Higher rates reduces demand for loans

- The central bank changes its policy rate

2. New demand for loans means new level of Investment (I).

-

- Lower rates increase investments

- Higher rates decrease investments

3. New investment levels will directly affect Aggregate Expenditure (AE) and the level of employment.

-

- More Investment grows AE

- Less Investment shrinks AE

END RESULT:

Hopefully, the economy returns to the long-run equilibrium of full-employment. Where Y = Yf

-

Expansionary Policy

Monetary Policy: EXPANSIONARY

Objective: CREATE JOBS

Means: THE KEY INTEREST RATE IS REDUCED

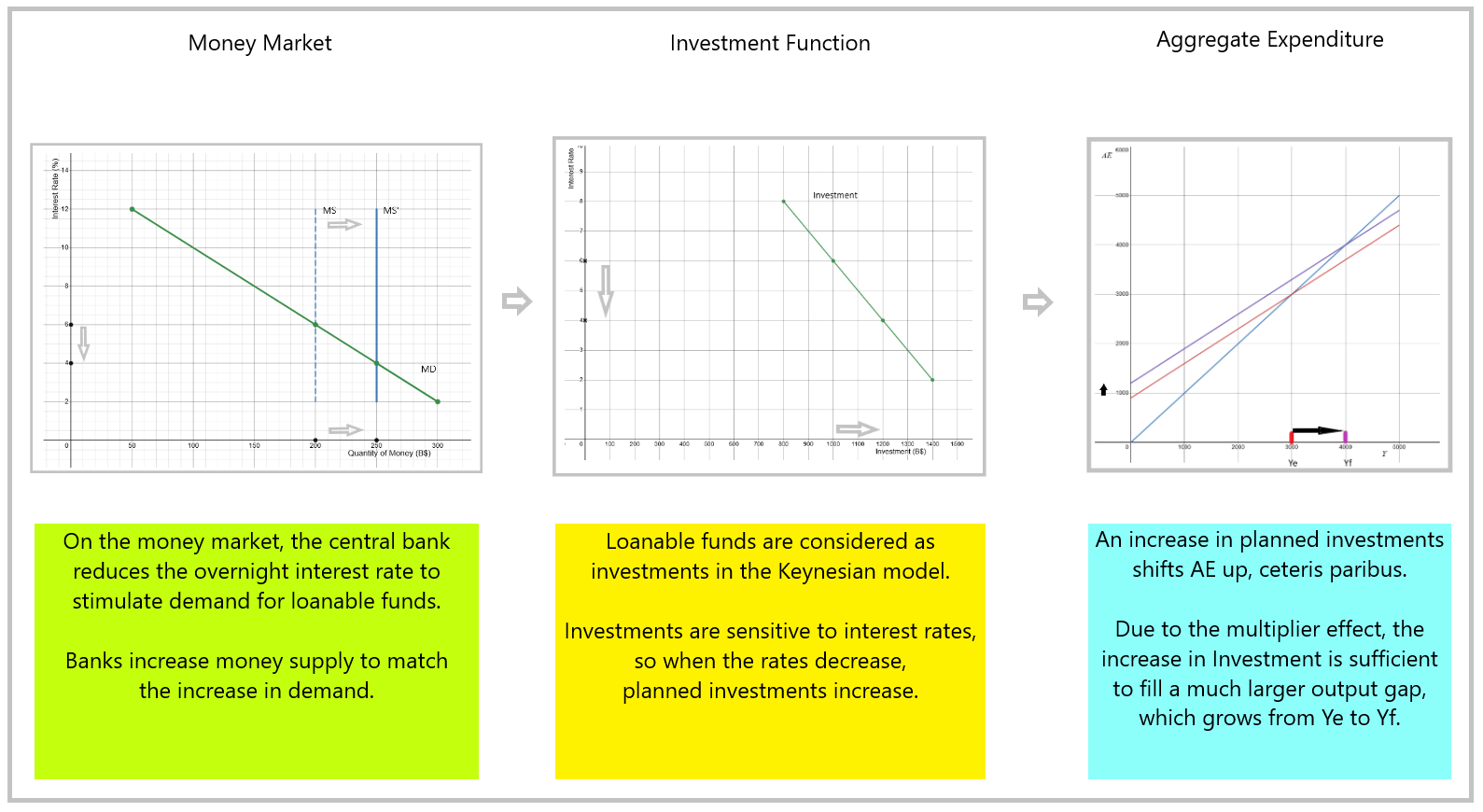

Graph - Expansionary Policy Transmission to Investment

The graph above shows that a lower interest rate will increase Quantity demanded for loanable funds, which are considered investments by Statistics Canada. Investments include buying homes, building factories and purchasing machines such as computers and robots.

As you remember from the Keynesian Cross model, AE is composed of four variables, which are C + I + G + NetX. If we assume all variables to remain constant, except for Investment (I), then an increase in Investments will generate an increase in AE. You can then shift the AE curve up, and use the model to predict output and inflation results. The model predicts an increase in real GDP.

As you can see on the graph, monetary policy can be analyzed the same way as fiscal policy, if you adhere to the Keynesian view that a creation of money will bring more investment, which will create real output, and not just higher prices. A keen observer will note that governments are usually prone to act in terms of fiscal policy, so it's important that central banks don't over-do it, in terms of policy. Ironically, it is also important that central banks remain independent from parliaments and elected officials, to avoid using new money to help win elections.

-

Contractionary Policy

Monetary Policy: RESTRICTIVE

Objective: STOP INFLATION

Means: THE KEY INTEREST RATE IS INCREASED

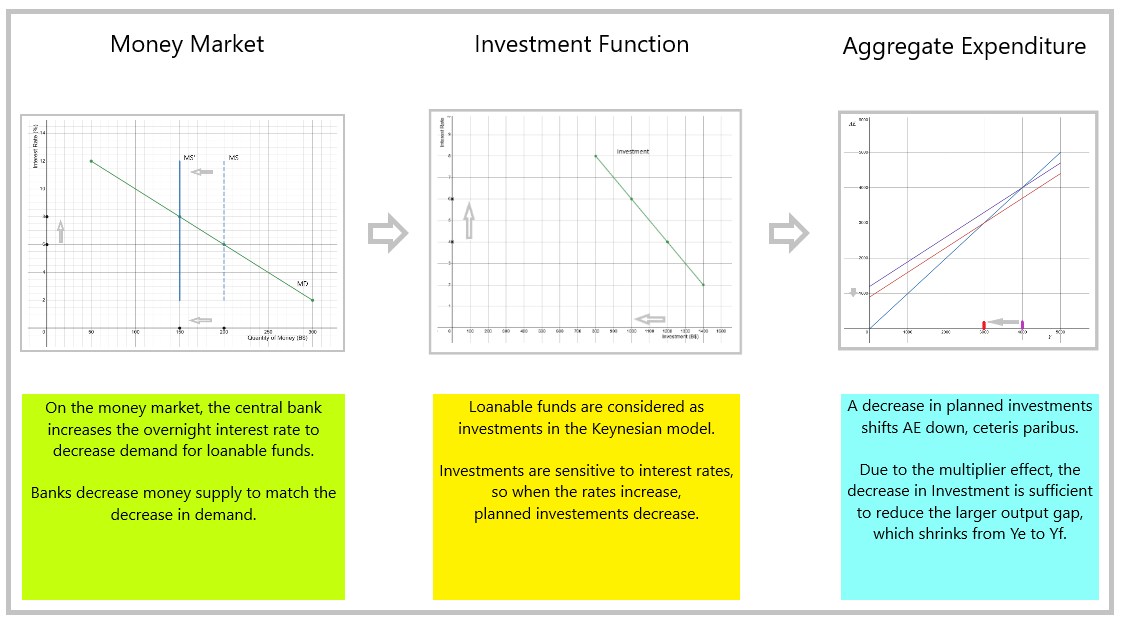

Graph - Restrictive Policy Transmission to Investment

The graph above shows that a higher interest rate (6 from 4 percent) will decrease Quantity demanded for loanable funds, which are considered investments by Statistics Canada. Investments include buying homes, building factories and purchasing machines such as computers and robots.

As you remember from the AD-AS model, AD is composed of four variables, which are C + I + G + NetX. If we assume all variables to remain fixed, except for Investment (I), then a decrease in Investments will generate a decrease in AE. You can then shift the AE curve down, and use the model to predict lower output.

References and Further Reading

Ireland, P. N. (2005). The Monetary Transmission Mechanism. National Bureau of Economic Research, Working Papers. No. 06‐1. https://www.bostonfed.org/-/media/Documents/Workingpapers/PDF/wp0601.pdf