The WNBA's Future

Building a Sustainable Business Amidst a Revolution in Women's Sports

Cameron Welsh, Discover Your Mad Skills Toolkit

We're still a long way from matching the multibillion-dollar professional men's leagues that have dominated televised sports for a century in the United States. But last season (2024) was a turning point for the WNBA. Many ask when I knew it would be. I suspected it might be from the day we put tickets on sale for our April 15 draft; they sold out in minutes.

Cathy Engelbert, WNBA Commissioner 1

Founded in 1996, the Women's National Basketball Association (WNBA) was launched in 1997 with the support of the National Basketball Association (NBA). It was the first women's professional basketball league to receive significant financial and promotional backing from a major men's league. Initially perceived as a marketing extension of the NBA, the WNBA has grown into an organisation at a crossroads. While it is currently experiencing unprecedented attention, increased investment, and growing cultural relevance, it still faces challenges in monetisation, visibility, and long-term sustainability, especially as it navigates critical collective bargaining agreement (CBA) negotiations with its players for the 2026 season.

Some media members and the public believe that the WNBA is at a critical juncture in its history. If the ongoing CBA negotiations fail, or if a lockout or strike occurs, the league could face significant challenges that may threaten its future. Commissioner Cathy Engelbert and the league need to address several pressing issues soon. Furthermore, they must navigate the implications of Caitlin Clark joining the league in 2024, which saw her bring her passionate fan base to the league. In addition to Clark, the league has seen the intake of several high-profile college players in the 2024 and 2025 drafts, but none with Clark's profile and fan base.

Many feel the league has not effectively managed its approach to Caitlin Clark. The quote from Cathy at the top of this page serves as evidence of this sentiment, as Caitlin Clark broke records for jersey sales, attendance, and viewership during her last three years at Iowa, a school not known for its basketball program. She was featured in both the most-viewed and most-attended women's basketball games in history, with 18.9 million viewers tuning in for the National Collegiate Athletic Association (NCAA) 2024 finals between Iowa and South Carolina and an attendance of 55,646 for a 2023 exhibition game between Iowa and Duke held in the north end zone of Kinnick Stadium in Iowa City. The attendance in Iowa City nearly doubled the previous record of the 2002 NCAA Finals between Connecticut and Oklahoma at the Alamodome, which had 29,619 in attendance, reaching only 40.5% of its capacity.

Figure 1: Image of The Crossover at Kinnick (55,646 in attendance of a maximum capacity of 69,250)

Source: https://stories.uiowa.edu/crossover-at-kinnick-record-setting-crowd

WNBA Looking Forward

The WNBA faces several key strategic questions regarding its future, which its commissioner and senior management must address. For the league to achieve its growth objectives, it must become profitable. Some team owners have openly expressed frustration about the lack of return on investment over the past 28 years of operation. The important questions to consider include:

- Should the WNBA maintain a close connection to the NBA, or should it pursue full financial and branding independence?

- How can the league become profitable and reduce its reliance on the NBA to cover yearly losses?

- What should be the WNBA’s top priorities (media rights, player salaries, player management, expansion, and global growth) for achieving long-term sustainability?

- How can the league manage tensions between emerging stars and established veterans to keep both long-time and new fans engaged?

- How can the WNBA cultivate a fan base that remains active during its short season?

- With the increase in the number of teams, how should the league approach the season length and the need for more games?

- What are the best strategies for capitalising on new media and digital trends to generate long-term revenue?

Additionally, the league must consider important questions related to Caitlin Clark and the large fanbase she has brought with her entry into the league.

- How can the WNBA transform the attention generated by Caitlin Clark into sustained business growth?

- Should the WNBA centre its marketing efforts around Clark, or adopt a more balanced approach?

WNBA Looking Back

Over its 28 seasons, the WNBA has built a rich history of women's basketball. To commemorate this history, the WNBA produced a video for Women's History Month 2025.

Video 1: The History of the WNBA March 2025

Source: WNBA (https://www.youtube.com/watch?v=2pUF7kfK8dA)

The WNBA began with eight teams and has expanded to thirteen teams in the 2025 season, with plans to grow to fifteen teams by the 2026 season. Its current expansion plans aim to reach eighteen teams by 2030 under the leadership of Cathy Engelbert. Over the years, the number of teams has fluctuated due to expansion and contraction, reaching a peak of sixteen teams in the early 2000s. Unlike other women’s leagues, the WNBA has survived for over two decades by aligning closely with the NBA, leveraging its infrastructure, media power, and financial support.

The WNBA season runs from early May to mid-October, including the playoffs. When the league was established in 1997, it had 8 teams and a schedule of 28 games. This was expanded to 30 games, and then to 32 games in the following two years, coinciding with the league's growth to 10 and 12 teams. From 2003 to 2019, the yearly schedule featured 34 games each season.

In 2020 and 2021, COVID-19 disrupted the schedule. However, since 2022, the number of games has increased from 36 to 40, with a planned increase to 44 games in the 2025 season. Additionally, the 2025 season will introduce an expanded playoff format.

However, the potential for further expansion is limited. Increasing the number of games could create conflicts with media rights, as both the NBA and, particularly, the National Football League (NFL) dominate the fall broadcast schedule. The NFL has transitioned from a schedule of Sunday and Monday night games to include Thursday night and some Saturday games later in the season, once the NCAA schedule moves to bowl games. Friday and Saturday are largely occupied by NCAA football during the fall. In the spring, NCAA March Madness influences the broadcast schedule until the first weekend in April. Importantly, the tournament affects the readiness of the current season's draft class. Rookies who participate in the women's version of March Madness and, in particular, the Final Four, enter the league with minimal rest.

Team ownership in the WNBA is diverse, with both independent owners and owners of NBA teams. In some cities, the ownership of NBA and WNBA teams differs. There is also a notable discrepancy in arena capacities among the teams, ranging from a low of 3,200 fans for the Atlanta team to over 19,000 fans for teams in cities like New York and Minnesota. Additionally, four of the WNBA teams that play in NBA cities do so in arenas with capacities of 10,000 or fewer fans, with the Connecticut Sun also in an arena with a capacity of fewer than 10,000 fans.

Title IX and Women's Sports

President Richard Nixon signed Title IX into law in 1972. Title IX prohibits schools and educational institutions that receive federal funding from discriminating against students, employees, or participants based on their sex. This includes sports, requiring schools to have women’s sports teams and to fund them at the same level as men’s sports. The law ensures that women and girls have equal opportunities in sports, covering aspects such as participation, financial aid, and overall program benefits.

Despite its significance, issues remain regarding the equitable application of Title IX, particularly at the college level, where football often stands out as a primary concern. Since the implementation of Title IX, women’s professional sports in the U.S. have expanded, giving rise to leagues such as the WNBA, National Women's Soccer League (NWSL), and Professional Women's Hockey League (PWHL) and several other disbanded leagues over the past 50 years. Some, including journalist Christine Brennan, argue that without Title IX, these leagues might not exist, and the WNBA may not have received the financial support it has from the NBA to remain viable. 2

Recently, discussions have emerged in the media regarding how the WNBA will address the inclusion of transgender players. Previously, Layshia Clarendon was the only openly transgender player to play in the league, having been born female and identifying as non-binary. Due to Donald Trump's successful legal actions concerning Title IX, recent changes by the NCAA will render NCAA transgender players ineligible for the draft, affecting U.S. college athletes. Additionally, regulations adopted by other professional leagues worldwide may also prevent transgender players from being draft-eligible. Furthermore, the new Olympic president's decision to exclude transgender athletes from women’s competitions is likely to influence how sports governing bodies around the globe will handle transgender participation in the future.

Ownership and Expansion

The ownership structure of the WNBA is intriguing. NBA team owners control 42% of the league, WNBA owners hold another 42%, and an investment group owns 16%. This investment group contributed $75 million in 2022 and includes notable investors such as Nike, Michael Dell, Linda Henry, Dee Haslam, Condoleezza Rice, Micky Arison, and Laurene Powell Jobs, among others like Ted Leonsis, Herb Simon, and Joe Tsai. Leonsis (owner of the Washington Mystics and Wizards), Simon (owner of the Indiana Fever and Pacers), and Tsai (owner of the New York Liberty and Nets) each have three separate investments in the WNBA due to their roles as NBA owners, WNBA owners, and members of the investment group. The NBA owners also own the Phoenix Mercury and the Minnesota Lynx in those cities. 3, 4

The new ownership in Golden State, Cleveland, Detroit, and Philadelphia are all NBA owners in the same cities. This will mean that more NBA owners will have dual investments in the WNBA. The situation in Toronto is unique, as the primary owner of Kilmer Sports Ventures, Larry Tanenbaum, also owns 25% of Maple Sports and Entertainment, the parent company of the NBA's Toronto Raptors. The NBA's Los Angeles Lakers have recently been sold to one of the owners of the Los Angeles Sparks. In Minnesota, there is new ownership of the Minnesota Lynx and Timberwolves. Additionally, the Connecticut Sun are reported to be for sale and will likely be relocated when sold.

Expansion will not dilute the 42% ownership held by NBA owners, nor the 16% controlled by the 2022 investment consortium. However, the 42% owned by WNBA owners will be divided among 18 owners by 2030. According to Forbes, WNBA teams are worth 180% more than in 2023. The valuations range from $400 million in New York to $190 million in Atlanta. There are some estimates that the new Golden State franchise's valuation in its first season is $500 million. The average valuation is $272 million, which is 14.4 times the average revenue, which exceeds the valuation in all other major sports. The reasoning for this is that they reflect more on the potential of the league, given the belief it is reaching a tipping point based on what is known as the "Caitlin Clark Effect." 5

On August 2, 2025, the Boston Globe reported that the owners of the Connecticut Sun had agreed to sell the team to a minority owner of the Boston Celtics for $325 million. The new owner plans to relocate the team to Boston for the 2027 season. This sale price is $125 million higher than Forbes' estimated value of the team during the 2025 pre-season. Both the sale and the relocation are subject to approval by the WNBA's Board of Governors.

Additionally, the new ownership intends to build a $100 million practice facility in Boston. However, it has been reported that Engelbert did not present the sales agreement to the board, and the exclusivity period expired on July 31. Mark Lasry has since made another offer to relocate the team to Hartford for over $300 million, which also includes plans for a practice facility. It should be noted that Mark Lasry is a prominent funder of Unrivaled 3-on-3 Basketball. Both offers have received support from the respective state governors and city mayors.

The WNBA is reportedly looking to negotiate with one of the rejected expansion city proponents, with Houston emerging as a leading candidate. There are also rumours of a potential relocation fee ranging from $100 million to $150 million. Based on past team sales and relocations in other U.S. leagues, there may be significant legal challenges to the WNBA's position. The idea of adding a relocation fee to one of the original sales offers appears consistent with trends observed in other U.S. leagues.

Challenges

Revenue and Profitability

The WNBA has historically struggled to generate significant revenue compared to men's leagues. For all of its years, it operated at a loss, but in recent years, it has seen growth in sponsorships and media deals. Reports indicate that the league has incurred annual losses in the range of $10 million, and this figure was projected to increase to between $40 and $50 million for the 2024 season.

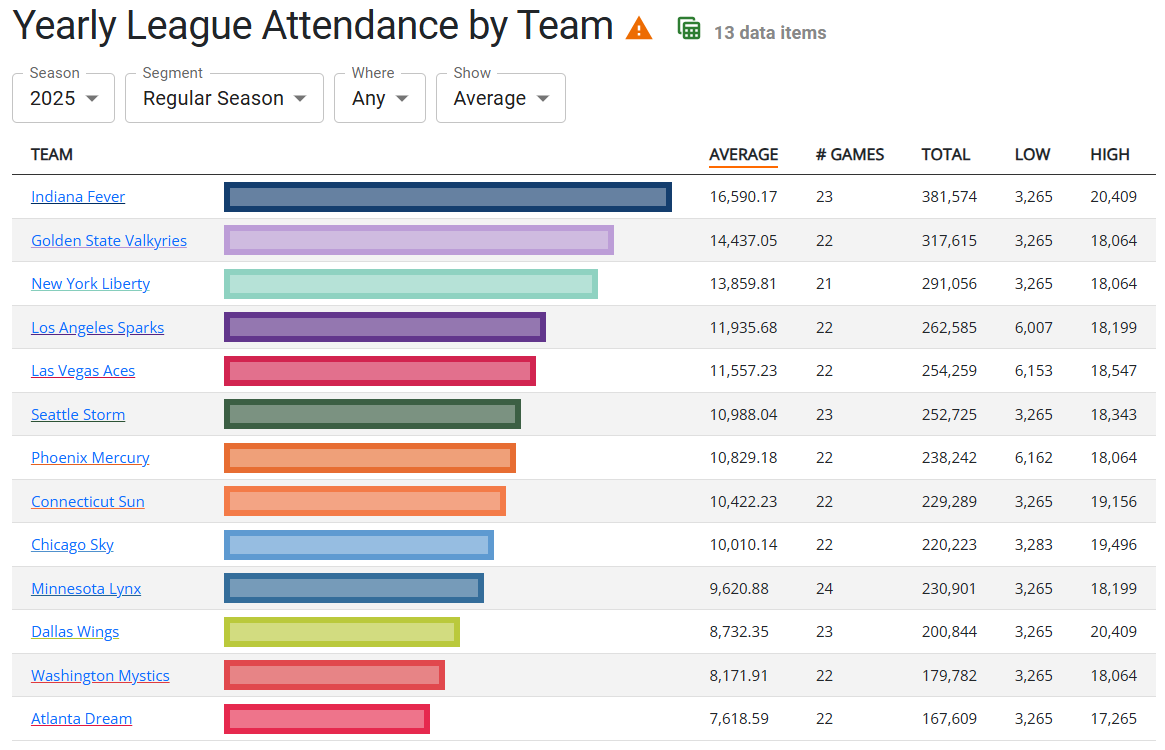

Revenues for the WNBA have reportedly increased from $100 million to $200+ million in recent years. Continued growth is anticipated due to new broadcasting deals in 2026, significant increases in attendance, and increased sales from merchandise and arena concessions that began in 2024 and are expected to continue in 2025 (see Exhibit 3). In 2024, the team with the highest revenue is the Indiana Fever, estimated at $32 million, while the Atlanta Dream has the lowest revenue at $11 million. The average revenue across teams was approximately $19 million. 6 This average would translate into an estimated revenue of $228 million for the 2024 season. It isn't easy to get the actual revenue and profit numbers, as the WNBA's financials are reported to be mixed with the NBA's financials.

Additional income is also generated from expansion fees. The Golden State Valkyries began play in 2025 with an expansion fee of $50 million. Teams in Toronto and Portland are set to play their inaugural seasons in 2026, with expansion fees of $50 million and $75 million, respectively. Additionally, the three new teams announced in June 2025 will each have an expansion fee of $250 million. It is believed that a significant portion of these expansion fees is being returned to NBA owners to help recover the substantial costs incurred in supporting the league over the past 28 years, as well as to provide some returns to other investors. The actual split of the new fews for the teams beyond the 2026 teams may be included in the new CBA. These new teams will be located in Cleveland (2028), Detroit (2029), and Philadelphia (2030). Other cities that submitted expansion bids include St. Louis, Kansas City, Austin, Nashville, Houston, Miami, Denver, and Charlotte. 7

Media Coverage and Broadcasting

The media exposure for the WNBA has historically lagged behind that of men's leagues. Limited broadcasting slots and a scarcity of prime-time games have hindered its visibility. However, there are positive changes on the horizon with a new media rights agreement set to take effect as part of the 2026 NBA media rights deal.

Starting in 2026, the annual value of the WNBA's media deal increases significantly from approximately $60 million to around $200 million over 11 years, with major networks including Disney (ABC and ESPN), NBCUniversal, and Amazon Prime. Additionally, the league will maintain its Friday night doubleheader on ION, which has previously been valued at about $13 million per year. The specific terms of the new deal with ION, which is set to commence in 2026, have not yet been disclosed. 8 According to Sportico, the total of the new media deals will be approximately $260 million a year. 9

In 2024, it was reported that the average network ratings for WNBA regular-season games reached 394,000 viewers for games that did not feature the Indiana Fever and Caitlin Clark, the 2024 Rookie of the Year. However, according to Sports Media Watch, regular-season and playoff games featuring the Fever and Clark averaged 1.18 million viewers across all networks, and 1.59 million if excluding NBA TV, which is available in fewer than 40 million homes. 10 Many of these games, along with playoff games and the All-Star Game, achieved ratings that the league had not seen since 1997.

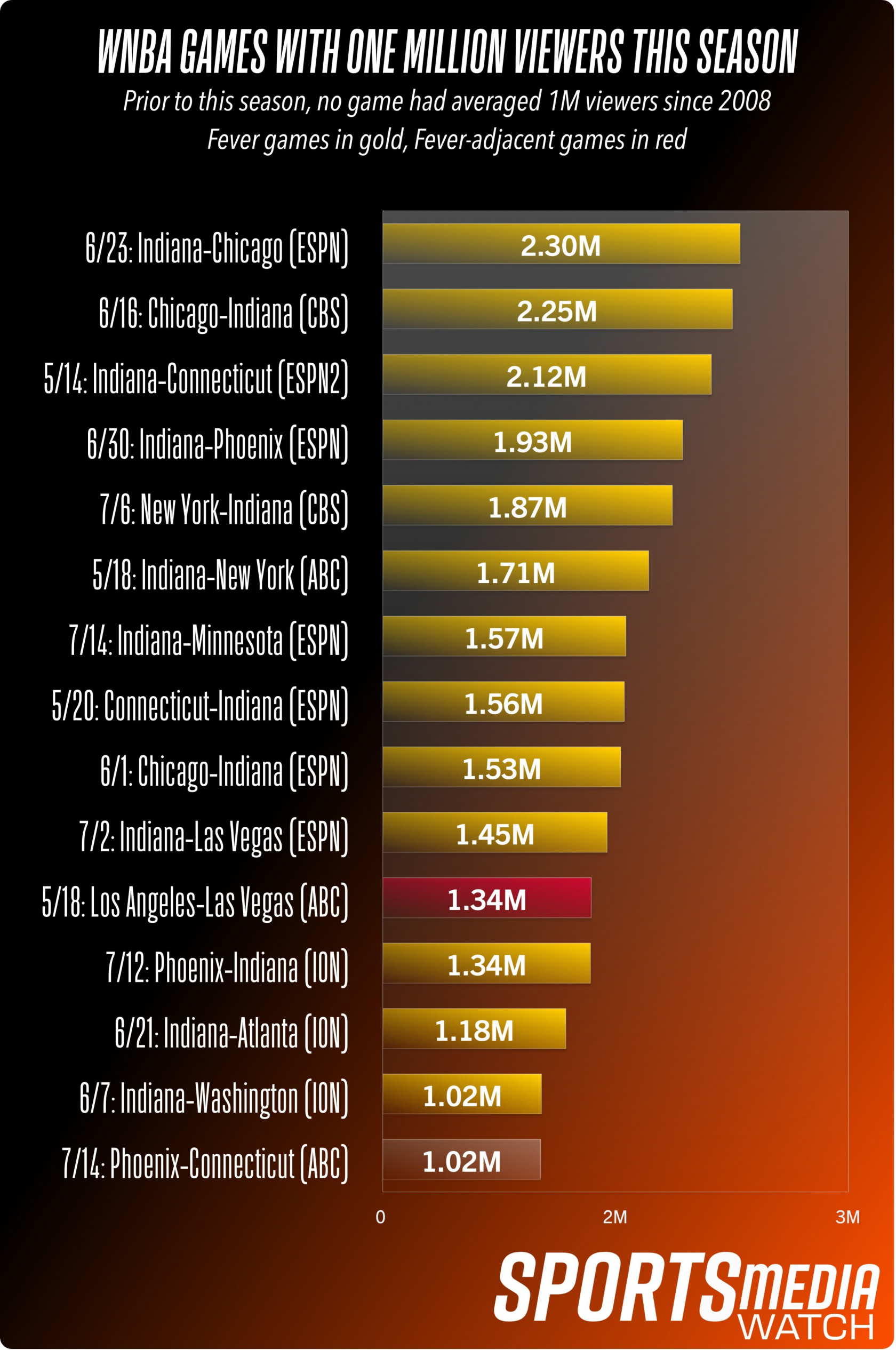

The 2024 season marked the first occurrence of one million viewer games since Candace Parker joined the league in 2008. There were a total of 23 games that reached the million-viewer mark, including playoff games in 2024. 11 Notably, several of Clark's games outperformed NBA games on NBA TV.

The 2025 season is witnessing similar viewership trends. Thirteen of the top fourteen WNBA regular-season broadcasts in 2024 featured Caitlin Clark, each attracting over one million viewers. The only exception, ranked 14th, was a game aired before one of the Fever games (see Figure 9).

The highest-rated 2024 game was the All-Star Game. It attracted 3.44 million viewers, where the U.S. Olympic team played the WNBA All-Stars. Caitlin Clark and Angel Reese were members of the All-Stars team. Viewership in 2025 fell to 2.2 million, likely due to Clark being sidelined with an injury and the traditional game format.

On All-Star Friday Night 2025, which included the 3-Point Contest and the Skills Challenge, viewership averaged 1.31 million, nearly double that of 2024. The 3-Point Contest featured Sabrina Ionescu, who holds the record for the highest score in the contest with 37 points, surpassing both male and female players. In 2024, she also challenged Steph Curry in the NBA's 3-Point Contest, where Curry emerged victorious with a score of 29 to 26.

ESPN's broadcast numbers, which include ABC, are illustrated in Figure 2. In the media rights deal that expires at the end of 2025, ESPN platforms, along with CBS, have access to the largest WNBA audiences. Other broadcast platforms, such as ION and NBA TV, have smaller audience reaches. Additionally, Amazon Prime, another broadcast partner, does not publicly release viewership numbers. Games broadcast regionally are available live on the WNBA's League Pass platform, and rebroadcasts of all games can also be accessed on that platform.

Figure 2: WNBA Viewership Across ESPN Platforms

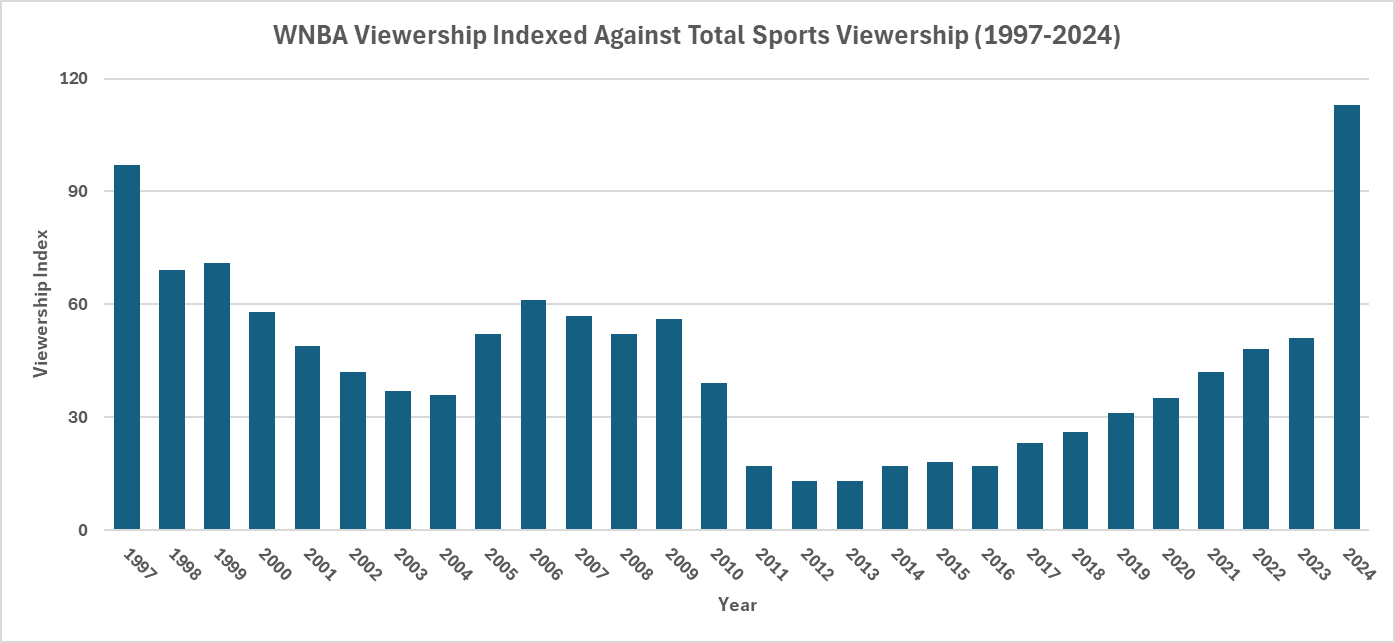

Below are the Nielsen Ratings for the league indexed against all sports. The important aspect is the trend of the ratings over the years. (See Figure 2 and Figure 4)

Figure 3: WNBA Viewership Indexed Against Total Sports Viewership (1997 to 2025)

Source: https://amsgrowthpartner.com/wnba-2025-will-the-ws-keep-coming/ - Nielsen National TV View, P18+. WNBA ratings by season indexed against All Sports ratings for the full year.

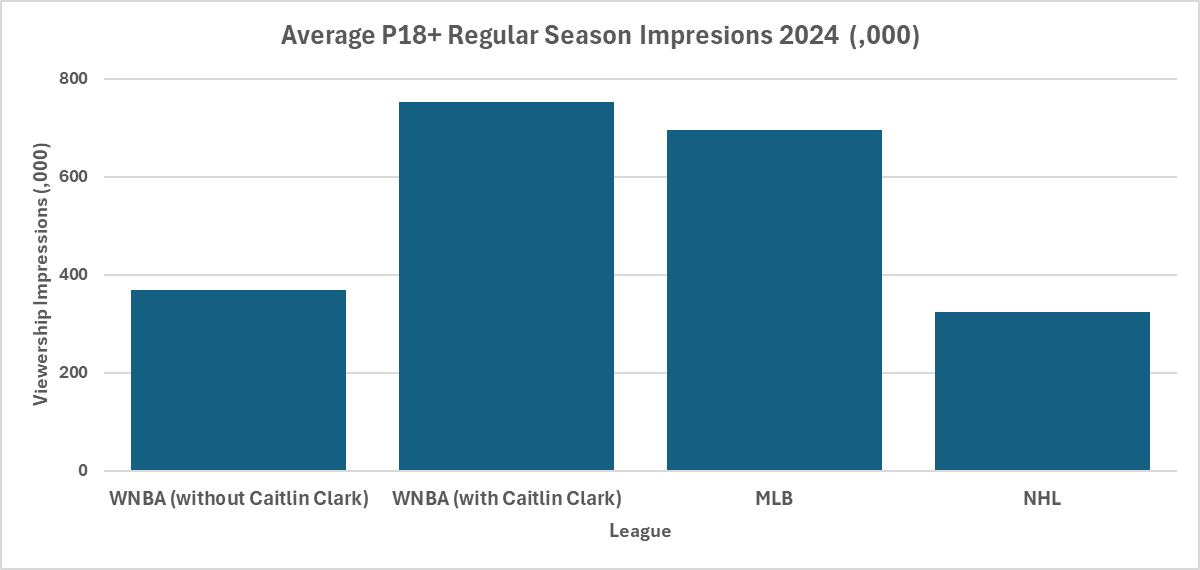

In addition to the historic ratings levels, the average number of per-broadcast impressions for the WNBA is compared to Major League Baseball (MLB) and the National Hockey League (NHL), with and without Caitlin Clark. These ratings included all broadcasters that have media rights deals for the WNBA. In 2025, the Indiana Fever developed a streaming package to stream about half of their games in an expanded regional area across Indiana, Iowa and other neighbouring states. Other teams seem to be considering similar broadcasting packages.

Figure 4: Average P18+ Regular Season Impressions 2024 in thousands

Source: https://amsgrowthpartner.com/wnba-2025-will-the-ws-keep-coming/ - Nielsen National TV View P18+. Average of all regular-season games for each sport in 2024.

2025 Viewership

According to Front Office Sports, viewership for the WNBA is up halfway through the 2025 season. The league is averaging 794,000 viewers across 56 games in 2025 on all national networks, according to Nielsen data, representing a 21% increase over 2024. This rise in raw viewership is largely driven by games featuring the Indiana Fever, which have attracted an average of 1.26 million viewers across 19 contests. This figure is only 7% higher than the 32 Fever games that aired last year, likely due to the absence of Caitlin Clark in some high-profile matchups.

While non-Fever games are drawing significantly fewer viewers, there has been notable growth compared to the entire 2024 season. Here are the key statistics:

- Total WNBA games: 794,000 viewers, up 21%

- Fever games: 1.26 million viewers, up 7%

- Non-Fever games: 549,000 viewers, up 37%

The non-Fever viewership calculation is based on 37 games this year, compared to 66 games for the entirety of last season. It's also worth noting that nearly every Fever game is nationally broadcast, typically airing on the league's biggest networks, including CBS, ABC, and ESPN. 12

Pay Equity and Player Compensation

WNBA players have been advocating for improved salaries and working conditions. The 2020 CBA marked a significant step forward, offering higher pay, maternity benefits, and better travel accommodations. This agreement was set to last until 2027; however, the Women's National Basketball Players Association (WNBPA) has decided to revisit it early and is currently renegotiating terms for the 2026 season. A major concern remains that players' salaries are still significantly lower than those of their NBA counterparts. In fact, during the term of the agreement, the players' revenue share decreased from 11.1% to 9.3% due to a surge in league revenues. 13

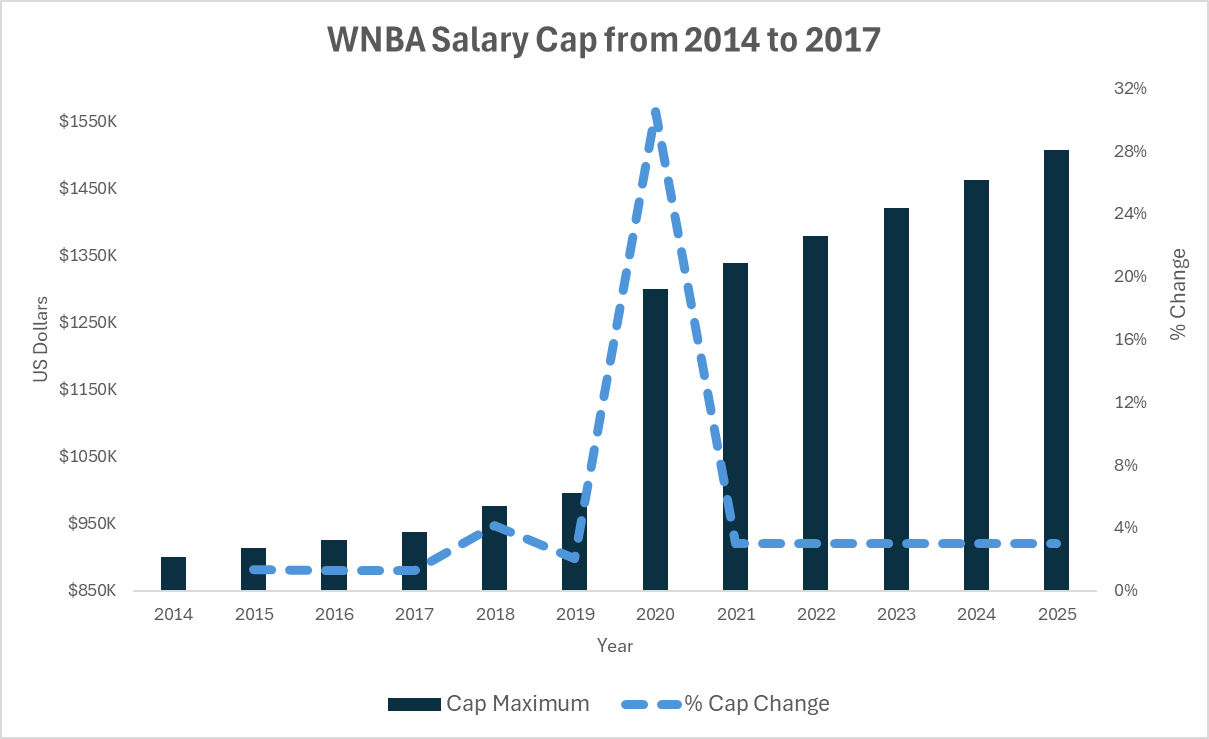

Since 2014, the salary cap for teams has increased from $901,000 to $1,507,100 in 2025. Before 2020, there were yearly increases of 1.3% in the cap. (See Figure 5) The new CBA in 2020 raised the salary cap from $996,000 to $1,300,000. Since then, the cap has increased by 3% each year. The 2020 CBA also introduced free agency and trade deadlines to the league. 14

Figure 5: WNBA Salary Caps 2014 to 2025

Data Source: https://www.spotrac.com/wnba/cba

Nneka Ogwumike, the president of the WNBPA, expressed the union's motivations for opting out of the current CBA: "Opting out isn't just about bigger paychecks—it's about claiming our rightful share of the business we've built, improving working conditions, and securing a future where the success we create benefits today's players and generations to come." 15

During the 2025 All-Star Game, the WNBA and the WNBPA held discussions regarding the CBA. The reports on the outcome of these discussions have been mixed in terms of progress. At the game, players wore t-shirts during warm-ups that featured the slogan "Pay Us What You Owe Us." This gesture has received varied reactions from the media and fans. While there is consensus that players deserve higher pay given the apparent growth of the league, the specific amount remains a topic of debate.

Key issues include salaries, the salary cap and its structure, working conditions for players, as well as the prioritisation of the WNBA when players play elsewhere in the off-season. To address these challenges, players may need to prioritise the WNBA over other commitments. Currently, the average salary in the WNBA for the 2025 season is $102,249, which runs from early May, including training camp, to mid-October, including the playoffs. Many players opt to play overseas during the offseason for significantly higher salaries. Those who remain in the U.S. often participate in Athletes Unlimited (https://auprosports.com/) or the new Unrivaled 3-on-3 (https://www.unrivaled.basketball/) leagues. Unrivaled launched in January 2025 and offers higher average salaries than the WNBA.

Sponsorships, Marketing and Brand Building

The WNBA has had numerous sponsors providing a variety of services and products since its inception. Exhibit 1 contains a complete list of these sponsors. Additionally, individual teams have separate sponsors, including those featured on their jerseys, which are detailed in Exhibit 2 for the 2025 season. The league continues to attract new sponsorships, as evidenced by initiatives like the in-season Commissioner's Cup tournament. This tournament is sponsored by Coinbase. All participating players receive $5,000 in cryptocurrency. The winning team members share a total prize of $500,000, and significant funds are also allocated to charities supported by the teams during the tournament (see Figure 6).

At the 2025 All-Star Game, Aflac and the WNBPA sponsorship provided $60,000 in prize money for the winner of the 3-point contest and $55,000 for the winner of the skills challenge. This is in addition to the guaranteed $2,575 specified in the CBA. Additionally, Starry served as the title sponsor of the 3-point contest, representing another brand within the PepsiCo portfolio that is not listed in Exhibit 1.

Figure 6: Commissioner's Cup Prize Money

There is a growing emphasis on pregame fashion runways, attracting support from outside traditional athletic sponsors, including partnerships with cosmetic companies like Sephora, which sponsored the upstart Unrivaled Basketball and is an official sponsor of the new franchises in Golden State and Toronto.

Moreover, the league is making efforts to build the individual brands of star players such as Caitlin Clark, A'ja Wilson, Paige Bueckers, and Breanna Stewart. This is crucial for increasing the league's popularity, similar to what happens in MLB, NFL, and NBA. Caitlin Clark has been likened to sports legends like Michael Jordan, Larry Bird, Magic Johnson, and Tiger Woods for her role in introducing the sport to new audiences, particularly casual sports fans. The challenge for the WNBA is to leverage its other stars to build upon Clark's momentum. Cathy Engelberg has acknowledged that the league was unprepared for Clark's impact. Christine Brennan, a respected sports journalist known for her support of women's sports, critiques the league in her new book, "On Her Game: Caitlin Clark and the Revolution in Women's Sports", for not adequately preparing players and teams for the changes Clark brings.

More Questions Posed by the Commissioner

In a recent article in the Harvard Business Review, Cathy Engelbert examined the history of the WNBA and looked ahead to its strategic future. She posed several questions that highlight important issues for the league, some of which overlap with the questions posed earlier in the case. These questions include:

- How can we expand to reach a global fan base?

- Which marketing investments will have the greatest impact?

- How can we continue to leverage data to gain insights into what fans want to experience, whether in the arena, on their devices, or during broadcasts?

- How can we utilise social media to deepen our relationship with fans and foster more cohesive communities among the league, its fans, and the players?

- How can we effectively share players' stories and enhance their experiences within the league?

- What can we learn from tech and consumer brands that successfully engage customers and keep them involved, thereby deepening their engagement? 17

Caitlin Clark and the "Caitlin Clark Effect"

They cannot have f____ed up this Caitlin Clark thing up any worse if they tried.

Charles Barkley, Naismith Basketball Hall of Fame member on narratives surrounding Caitlin Clark 18

Below is a WNBA ad featuring Caitlin Clark promoting the first game that will feature Clark and Paige Bueckers, the 2024 and 2025 number one draft choices.

Video 2: WNBA Promo for Indiana Fever v Dallas Wings, July 13, 2024

Source: WNBA (https://www.youtube.com/watch?v=dYnJS7hAgXc)

The Iowa Hawkeye Phenom

Caitlin Clark, the former star of the University of Iowa and the No. 1 overall pick in the 2024 WNBA draft for the Indiana Fever, is widely recognised as a transformative figure in women’s basketball. Noted for her exceptional shooting range, charisma, and competitive spirit, she became a household name during her record-breaking college career.

During her college career, Clark set the all-time scoring record for both male and female Division I players, helped her Iowa Hawkeyes reach consecutive Final Four finals, and set viewership records in the Women’s Tournament that exceeded those of the Men's Tournament. Notably, the final game in 2024 featuring Iowa and South Carolina attracted 18.9 million viewers, with a peak viewership of 24 million, showcasing the most-viewed women's college basketball game ever and placing it just behind a handful of men’s games. She also features in three of the top-most-viewed women's college basketball games and the two most-viewed national championship games.

Entry into the WNBA

Clark's entry into the WNBA in 2024 has sparked a significant surge in media attention, ticket sales, and commercial interest in the league. It all began with the 2024 WNBA Draft, which featured Clark and drew a record 2.4 million viewers, the highest ever recorded. This marked a 4.2-fold increase over the previous high set in 2004 and was double the viewership of the 2025 draft featuring Paige Bueckers.

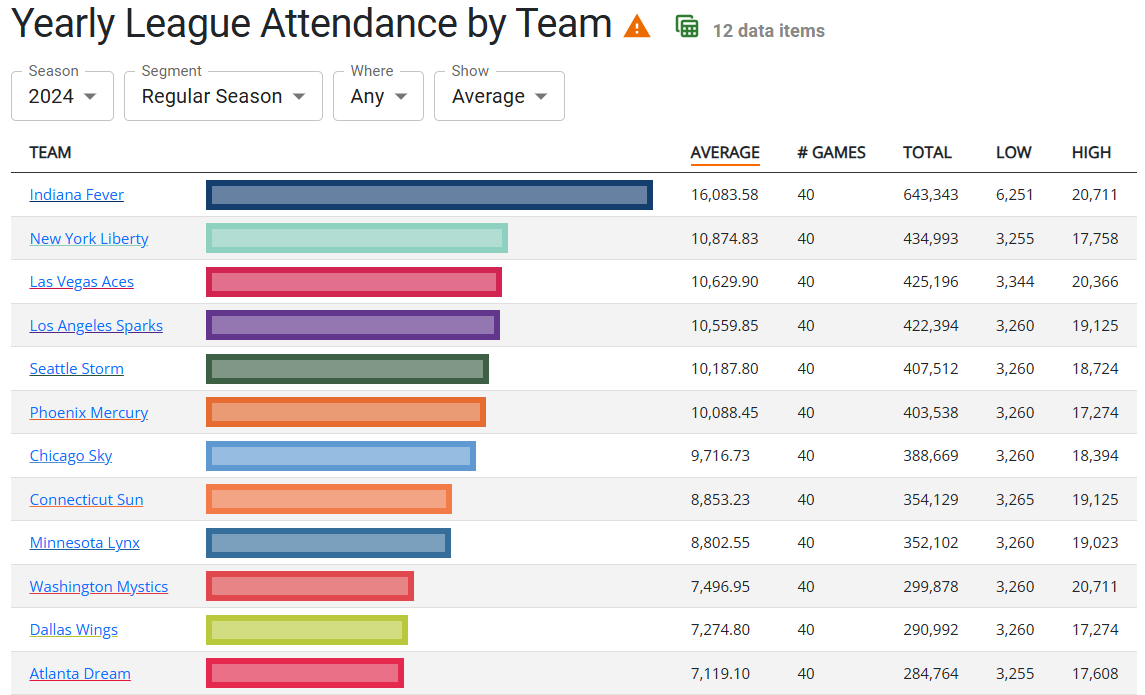

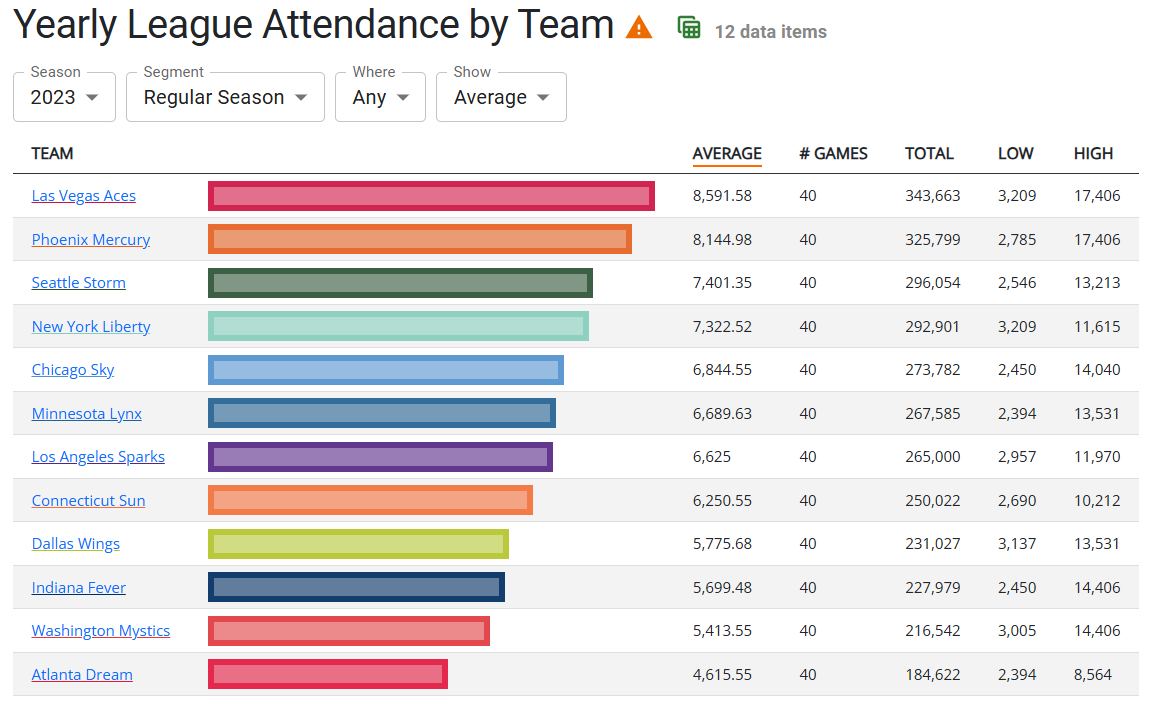

Her debut in the WNBA attracted over 2.1 million viewers on ESPN2, making it the most-watched WNBA game since 2001. The Indiana Fever experienced a remarkable 319% increase in home attendance. During road games, their matches sold out opposing arenas, with some teams, such as those in Atlanta and Washington, needing to move games to larger venues.

In 2025, several teams with smaller arenas adjusted their schedules to accommodate games featuring the Fever and even offered premium packages that required purchasing additional tickets to access Fever games. The Fever saw an astounding 1,193% increase in jersey sales, prompting an audit of their merchandise store in 2025. Additionally, draft beer sales at Gainbridge Fieldhouse, the Fever’s home arena, surged by 750%. In total, the Fever set 10 viewership records across 38 televised games during 2024. 19

Merchandise and the Secondary Market

Clark's influence extended to the secondary market, where her games caused ticket prices to spike by 5 to 10 times. Conversely, when she missed some games due to injury in 2025, ticket prices on the secondary market fell drastically. During that period, overall television viewership for the league dropped by 55% and Fever viewership fell by 50%.

Wilson Sports sold out its limited-edition Caitlin Clark basketballs multiple times in under 30 minutes in 2024. In 2025, 13,000 pairs of her Nike player edition shoes reportedly sold out in under a minute on the SNKRS app and are being resold for two to three times their original price of $190 on the secondary market. According to Fanatics, her jersey is the second most popular among both NBA and WNBA players, ranking only behind Steph Curry. Special edition items, such as her All-Star jersey, sold out in minutes. Additionally, her autographed sports cards continue to break record prices and consistently outperform all other WNBA players significantly.

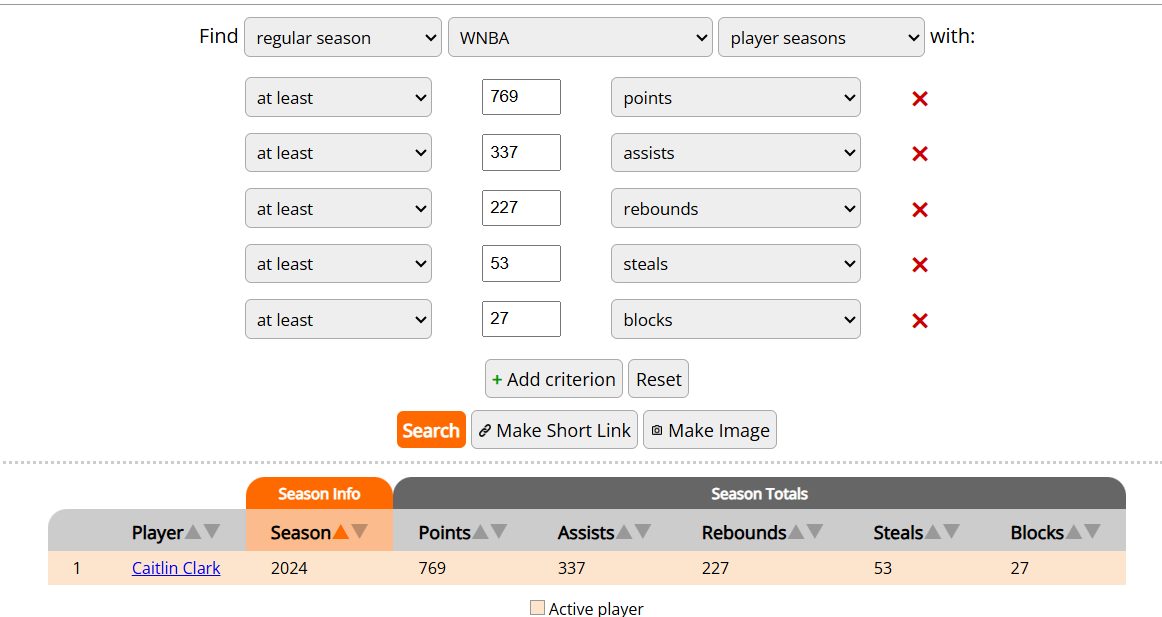

On the Court

On the court, Clark set 62 WNBA records (see Figure 7). Her performance in the 2024 season is unparalleled in the league's history when considering her full stats, excluding turnovers, as detailed in the Across The Timeline database (see Figure 8). By the end of the 2024 season, only 153 players in the league's history had matched her rookie stat line over their entire careers. As of July 20, 2025, that number has decreased to 112 players for her career WNBA stat line. Throughout the history of the WNBA, 1,134 players have participated in at least one game, according to Across The Timeline as of July 20, 2025. Clark became the first rookie to achieve a triple-double, doing so twice during her rookie season. Additionally, she led the Fever to qualify for the playoffs for the first time since 2016. Despite missing a significant number of games due to injury in 2025, she continues to set new records in the WNBA, including the fastest player to reach 200 points and 100 assists in a season.

Figure 7: Caitlin Clark's Records 2024 Rookie Season

Source: https://www.reddit.com/r/wnba/comments/1flf1cz/every_caitlin_clark_recordmilestone_this_season/

Figure 8: Caitlin Clark's Rookie Stat Line Compared to All WNBA Players' Seasons

Sponsorship & Endorsements

Caitlin Clark has significantly elevated the WNBA's profile by bringing high-profile sponsors such as Nike, Gatorade, and State Farm into the conversation, alongside her Name, Image, and Likeness (NIL) sponsorship deals. While other players have secured NIL deals and endorsements, Clark has signed high-value contracts. Upon entering the league, she inked an 8-year, $28 million deal with Nike, which is reportedly far more valuable than any contract previously held by other players in the league. Clark is projected to earn over $11.1 million annually, with less than $80,000 coming from her WNBA salary, according to Sportico. This impressive income places her 10th on the global earning list, ahead of all other WNBA players, and she is the only team athlete in the top 15. In contrast, net worth estimates for other top WNBA stars typically range from $2 to $5 million.

There has been significant backlash from fans directed at Nike for not producing a signature shoe or clothing line for Caitlin Clark, as well as a lack of advertising featuring her. Other players, such as A'ja Wilson, Angel Reese, Sabrina Ionescu, Paige Bueckers, and JuJu Watkins, have received player edition or signature shoes from Nike and other sporting goods companies, including Adidas and Reebok. This criticism comes amid a disappointing performance from Nike's stock. Rumours suggest that a Clark signature shoe and clothing line will be launched around Christmas 2025, with a second player edition shoe expected to be released in October 2025.

In addition, Clark has several commercials for her sponsors, Wilson, State Farm, and Gatorade. She has deals with the companies listed below either as a WNBA player or through her collegiate Name, Image, Likeness (NIL) deals. In some cases, her NIL deals followed her to the WNBA. It is not clear if some of the deals at the bottom of the list (below Hyvee) continued beyond her college career.

- Nike: A major endorsement deal that includes a signature shoe and logo.

- Gatorade: A partnership with the sports drink brand.

- State Farm: An endorsement deal with the insurance company.

- Wilson: A multi-year deal that includes a signature collection of basketballs.

- Panini: A partnership with the trading card company.

- Xfinity: A deal with the telecommunications company.

- Gainbridge: A partnership with the financial services company and naming partner of the Fever Arena.

- Lilly: A partnership with the pharmaceutical company and Fever Jersey sponsor.

- HyVee: A partnership that includes a custom cereal brand, "Caitlin's Crunch Time".

- Buick: An automobile manufacturer. NIL 2023 deal.

- H&R Block: An income tax service company. NIL 2022 deal.

- Bose: Speaker and headphones manufacturing company. NIL 2024 deal.

- Shoot-A-Way: A Basketball shooting machine manufacturer. NIL 2023 deal.

- Goldman Sachs: An investment firm. NIL 2023 deal.

Based on the incoming players and the NIL deals now available to them in the NCAA, there has been a trend of increased player and league sponsorship valuation. This valuation is expected to rise. Trends like increased attendance, interest in franchises, and television ratings also influence this trend in valuation.

Demographics & Market Expansion

It’s important to recognize that there is this rival and there are other rivals, but Caitlin Clark is illuminating the sport. She particularly is the one who’s driving in a new kind of demographic that is reaching new kinds of people from the traditional WNBA fan base that is causing this growth rate and also accelerating interest in corporate sponsorships.

Ryan Brewer, Associate Professor fo Finance, Indiana University Columbus 20

With the drafting of Caitlin Clark and the emergence of the 2024 and 2025 draft classes, the WNBA has seen an influx of younger, more diverse fans. This shift is particularly evident in increased attendance and participation in autograph events before and after games, with a significant number of young girls and families attending games. Furthermore, there appears to be an increase in family attendance. For example, the Indiana Fever reported a 300% increase in attendance in 2024, while draft beer sales in the arena skyrocketed by 750%. This suggests a changing demographic among the new fans and supports the observation that more families, particularly dads taking their daughters to games, are becoming involved.

Another noteworthy trend is the growing crossover interest between NCAA, NBA, and WNBA fans. During the 2025 preseason, several teams played in the college arenas of their star players, such as Caitlin Clark at Iowa, Sabrina Ionescu at Oregon, and Angel Reese at LSU, which drew strong attendance. Caitlin Clark's game at Iowa was especially successful, selling out quickly with higher initial ticket prices and the highest average secondary ticket prices in WNBA history. This indicates a significant crossover of NBA and WNBA fans, particularly in Indiana with Pacers supporters and in Golden State among Warriors fans and players.

Additionally, there is a notable international audience following Clark's rise. Fan clubs have emerged, and some fans have travelled from far-flung locations to attend games in Indiana. For instance, a reporter highlighted that several fans travelled from Hong Kong to watch a game. During a post-game press conference, Clark was informed about her growing following in Hong Kong and invited to visit her Hong Kong Fan Club. Furthermore, YouTube features numerous videos showcasing her fans and fan clubs from around the globe.

An analysis by Ryan Brewer, an associate professor of finance at Indiana University Columbus, estimates that Clark will generate an economic impact of $1 billion on the WNBA in 2025. This projection is an increase from his estimate of $875 million for 2024. He calculated that Clark was responsible for 26.5% of all economic activity within the WNBA in 2024. 21

Other Star Players

The WNBA has been home to many outstanding women basketball players over the years, including legends like Maya Moore, Candace Parker, Lisa Leslie, and Sylvia Fowles. Today, prominent players include Breanna Stewart, Sabrina Ionescu, Angel Reese, A'ja Wilson, Napheesa Collier, and newcomers to the league in 2025: Paige Bueckers, Sonja Citron, and Kiki Iriafen. A notable distinction for Clark is her exceptional ability to attract attention and draw fans. No other player in the league seems to generate the same level of attendance and television viewership as Clark does.

Some players and fans are sceptical about the attendance figures, believing that the league and the players themselves are the main attractions. In 2024 and 2025, only games featuring Caitlin Clark seem to sell out, along with home games in 2025 that showcase the new expansion team, the Golden State Valkyries. The New York Liberty, the 2024 champions, ranked second in attendance that year. Along with the Valkyries and the Indiana Fever, they are one of only three teams to achieve an average attendance of 75% of capacity in large arenas (those with over 10,000 fans).

The attendance data for each team from the 2022 to 2025 seasons is contained in Exhibit 3. The Indiana Fever's attendance has decreased slightly through 23 games in 2025, largely due to Caitlin Clark missing several games because of lower-body injuries. The effect on 2024 viewership is illustrated in Figure 9. Up to All-Star Weekend in 2025, the only games attracting over 1 million viewers were those involving the Indiana Fever, regardless of Caitlin Clark's presence. Notably, a preseason game during her return to Iowa City drew a record 1.3 million viewers. In 2025, games that surpassed 2 million viewers all featured Clark.

Interestingly, in July 2025, ABC, a free-to-air broadcaster, aired an Angel Reese game on Saturday afternoon and a Caitlin Clark game on Sunday afternoon, but only released the viewership figures for the Sunday game, which attracted over 2 million viewers.

Figure 9: 2024 WNBA Games with 1 Million Viewers

Source: https://x.com/CClarkReport/status/1813298629110575109

Unrivaled Basketball

Breanna Stewart and Napheesa Collier co-founded Unrivaled 3-on-3 Basketball in 2023, with its inaugural season set to launch in January 2025. The league will feature six teams, each comprising six players. During its first season, all players are guaranteed a minimum payment of $200,000, in addition to equity ownership for the 10-week duration of the season. Although Collier and Stewart are the co-founders, the league has been funded through $35 million in seed and Series A funding.

The league's equity investments are primarily led by the Berman family, owners of CardWorks. The list of investors includes notable figures such as John Skipper, David Levy, Marc Lasry, Steph Curry, Giannis Antetokounmpo, Carmelo Anthony, Alex Morgan, Coco Gauff, Michael Phelps, Dawn Staley, and Geno Auriemma. Additionally, Warner Bros. Discovery, the owner of the league's media rights partner, TNT Sports, has also invested. TNT Sports has reportedly paid $100 million over six years for broadcasting rights and has agreed to air a second season in 2026. The emerging league has also secured financial sponsorships from various companies, including Sprite, BODYARMOR, Sephora, and State Farm. A complete list of sponsors can be found in Exhibit 4.

There were efforts to sign Caitlin Clark to a contract worth $1 million or more, along with a larger equity stake than what was offered to other players, in an attempt to boost viewership. However, she ultimately did not sign with the league. Despite this, the league successfully signed other high-profile players, including Angel Reese, Kate Martin, and Sabrina Ionescu. Reports indicated that Ionescu became the highest-paid player in 2024, earning double the average salary of her peers.

Additionally, Paige Bueckers and Flau'Jae Johnson signed NIL deals for the 2025 season, with Bueckers planning to play in 2026. Johnson will use her final year of NCAA eligibility to remain at LSU in 2025-26. Another notable player is Juju Watkins, who invested in the league instead of taking a NIL deal and is expected to be eligible to play in either 2028 or 2029, depending on the recovery from an ACL injury she sustained late in the 2024-25 NCAA season. For the 2026 season, Unrivaled has signed 14 NIL deals with NCAA players, and they are part of July 2025's The Future is Unrivaled Summit.

The 2025 television ratings were significantly lower than those of the WNBA, achieving an average viewership of 221,000 on TNT Sports and TruTV. The championship game attracted 364,000 viewers. In comparison, the WNBA's final game in 2024 drew an impressive 3.24 million viewers.

One notable aspect of Unrivaled is its mission to support better wages for players and reduce the need for them to go overseas during the off-season to earn more money playing basketball. These goals are admirable; however, there is a potential conflict of interest due to the ongoing CBA negotiations, as both founders are members of the WNBPA negotiating committee. This concern has sparked discussions on social media, with fans voicing their worries about potential conflicts and noting that such situations are not permitted in other professional leagues. During the 2025 All-Star Game Draft, Napheesa wore an Unrivaled t-shirt and promoted her league at least five times while selecting her WNBA All-Star team on ESPN, a competitor to Unrivaled's broadcast partner, TNT Sports, and an equity owner of the league.

The 2026 season of Unrivaled is set to proceed. TNT has agreed to continue supporting the league through its broadcasts in 2026. However, the network has proposed significant changes to the league's operations. These changes, which include taking the games on the road instead of playing all of them in a soundstage in Miami, would greatly alter the league's financial operations, which were said to be close to breaking even in 2025.

Controversies Around League Culture

Physical Play

The WNBA is known for its physical style of play, and recent discussions have centred on whether this level of physicality is appropriate, especially concerning star Caitlin Clark. Some argue that the increased physicality is a natural part of the league's growth, responding to the presence of talented players like Clark. However, others are concerned that the league may be pushing players too hard, which could lead to injuries.

During the 2024 season, Clark was the target of 17% of all flagrant fouls in the league. Notably, 80% of the flagrant fouls committed against her were by the Chicago Sky, a team coached by a former WNBA player recognised for her physical style of play. Some incidents raised concerns; at least one flagrant foul went uncalled during the game and was later re-evaluated by the league. Fans and some media commentators also criticised the officiating for other fouls that went unpunished. This prompted calls for improved officiating standards and better refereeing.

At the beginning of the 2025 season, the WNBA released a video (included below) highlighting the league's physicality as part of its promotional efforts for the upcoming season. However, some fans took offence at the advertisement, believing it conveyed the wrong message. They felt that the focus should have been on promoting the league's high-quality basketball instead.

Video 3: WNBA Promo for WNBA Season May 2025

Source: WNBA(https://www.youtube.com/watch?v=4zi64nhVjho)

In 2025, the issue escalated when a flagrant-1 foul against Clark was retroactively upgraded to a flagrant-2 by the league after the game. Fans expressed frustration that the player who committed the foul was allowed to continue playing, even though she would have been ejected had the foul been called correctly during the game.

Officiating

There’s a grab, there’s a hold, there’s another grab. I mean, all of those are fouls. Every single one of them, and then here – that’s a foul, that’s foul …

Rebecca Lobo, ESPN Basketball Analyst commentating on the Indian Fever v Dallas Wings on July 14, 2025 22

In addition to the physical aspects of the game, officiating in sports often faces heavy criticism for being inconsistent, showing favouritism, and lacking overall quality. This criticism comes not only from fans but also from long-term coaches, such as Cheryl Reeve, Sandy Brondello, and Stephanie White, as well as star players like Natasha Cloud, Kelsey Plum and Angel Reese. Beginning with the last two games of the 2024 WNBA Finals, these concerns have been voiced frequently.

On July 14, 2025, play-by-play analyst Rebecca Lobo criticised the officials for their failure to make adequate foul calls during a game. This criticism is notable because Rebecca is not only a respected analyst but also a former WNBA player and a member of both the Women's Basketball Hall of Fame and the Naismith Basketball Hall of Fame. As a former University of Connecticut player, she is part of the so-called "UConn Mafia," which some believe gives her influence in the league due to the success of the UConn women's program.

In a July 17, 2025, article on ESPN, the issue of officiating in the WNBA was examined from two perspectives. Monty McCutchen, the head of WNBA officiating, stated, "We own the stuff that we need to own. We're really good about that and trying to get better. It's an important piece of our culture to drive toward better performance, but there's always going to be noise about officiating that is inaccurate. We have to stay the course to what good training and good performance look like." 23

In contrast, Natasha Cloud, a guard for the New York Liberty, expressed her frustration: "I work my f---ing ass off all offseason for these 4½ months to try to win a championship, and if I feel like [refs are] having too much f---ing impact on the game, it shouldn't be. ... This is collaborative to make this thing go." 24

Brittney Sykes, a guard for the Washington Mystics, summarised the expectations of many players and fans: "For me, I just would want to have consistency on both sides of the ball." 25

From my perspective as a former official, I would argue that there is a substantial need for improvement in both consistency and the correct application of rules. Quality officiating is essential for maintaining the interest of casual fans in the league. In the video below, Rachael Demita, a former top NCAA player who has transitioned to basketball commentary, discusses the current state of officiating in the WNBA and how the league addresses these issues.

Video 4: Exposing The WNBA's Referee Problem... May 2025

Source: Racheal Annamarie Demita (https://www.youtube.com/watch?v=Ure8BAClPRo)

According to the WNBA, it takes accountability for its officials seriously by implementing referee accountability measures, which include evaluations conducted by an independent review team. Referees who do not perform consistently are ineligible for additional income opportunities, such as playoff assignments or other roles. The league has established a process that allows for referees to be placed on probation or demoted if they incorrectly apply the rules. Many fans on social media are calling for greater transparency in this system, as well as improved communication from league officials regarding efforts to enhance officiating, especially when inconsistencies are evident on the court.

Player and Fan Tensions

The way that the fans have surged, and especially behind Caitlin and Angel coming to this league — and also bringing the race aspect to a different level ... there's no place for that in our sport. We want our sport to be inclusive for race, gender…and really a place where people can be themselves.

Cathy Engelbert, WNBA Commissioner

There is absolutely no place in sport — or in life — for the vile hate, racist language, homophobic comments, and misogynistic attacks our players are facing on social media.

Terry Jackson, Executive Director WNBPA (Rebuff of the above quote) 26

There is significant tension between players and fans, particularly on social media and occasionally in the stands. This tension often extends beyond the typical rivalries found in sports, although at times it reflects the common disputes observed in other sports. Some commentators attribute this unrest to the league and its players not being adequately prepared for casual fans, who tend to bring more traditional rivalries into the mix. Additionally, there have been serious incidents involving stalkers, such as those related to Paige Bueckers while she was competing in the NCAA, and more recently with Caitlin Clark at the beginning of the 2025 season. Some WNBA veterans and media commentators, especially those at ESPN, have expressed concerns about the disproportionate attention Clark receives, igniting debates around race, respect, and equity, further exacerbating the tensions.

These issues have prompted various questions, particularly regarding the league's marketing strategy. One significant question is whether the league should focus its marketing efforts on one or two players or distribute the spotlight more evenly among various athletes. This discussion has also affected other promoters of women's basketball, such as Nike, which has faced backlash for promoting players like Bueckers, A'ja Wilson, and JuJu Watkins while seemingly overlooking Clark. During the COVID-19 pandemic, Nike developed a reputation for supporting athletes with social justice messages, like Colin Kaepernick, and has continued this trend with WNBA players. This period has seen considerable struggles for Nike's stock performance, and it will be interesting to see how Nike shareholders respond legally as the company starts promoting Caitlin Clark, who has already seen significant early success.

There are ongoing discussions about fairness in media coverage between veteran and rookie players, particularly regarding race and the treatment of legacy players. Media outlets have also addressed the lack of respect shown to the individuals who helped establish the league, although many former stars have praised players like Clark for their contributions to the game.

Player Activism

Activism is in our DNA

Nneka Ogwumike, WNBPA President and 14 year veteran 27

The league is recognised as a leader in player-driven activism. As it attempts to position itself as a mainstream sports entertainment entity, this activism could be seen as potentially problematic. Since the onset of COVID-19, when activism surged in both the WNBA, NBA and NFL, there has been a noticeable decline in NBA and NFL league-sponsored activism. There has also been social media backlash against players who continue to promote their activism in the NBA and NFL. This decline is reflected in the reduced visibility of promotional banners on courts, fields, and uniforms. The WNBA has experienced a similar trend to some extent; however, activism remains significant through player and team events and social media. Much of the activism also comes from personalities in the media who are associated with the league. It's challenging to determine whether activism is more media-based, league-based, or old-guard WNBA fan-based, given the noise on social media.

In the 2025 season, the WNBA launched the initiative "No Space for Hate." This multi-dimensional platform aims to combat hate and promote respect across all aspects of the league, from online interactions to in-arena behaviour. The initiative was developed by a Task Force that includes representatives from the league and its teams, with support from the WNBPA. The WNBA's comprehensive approach focuses on four key areas:

- Enhanced technological features to detect hateful comments online.

- Strengthened team, arena, and league security measures.

- Reinforcement of mental health resources.

- Alignment of core values against hate. 28

The question remains: How can the WNBA establish itself as the leading women's basketball league in the world while keeping its activism in check so that the league continues to appeal to casual fans? Engaging with casual fans is essential for scaling the league and achieving profitability.

A potential solution for the WNBA is to take inspiration from the NBA. Under Adam Silver's leadership, the NBA has successfully navigated the challenges of player activism in recent years. Players are eager to use their platforms to advocate for social issues, while the league works to maintain its popularity and attract a diverse audience, including viewers from countries with varying perspectives on these topics.

The WNBA could also consider looking at the NFL, which has implemented a policy in collaboration with players, clubs, owners, and the Players Coalition to effect positive change in their communities. The NFL focuses on supporting legislative initiatives in four priority areas: Education, Economic Advancement, Criminal Justice Reform, and Police & Community Relations. 29

Looking Towards The Future

Reflecting on the initial stages, there are several critical questions beyond the upcoming CBA negotiations. If these issues are not managed effectively, they could jeopardise the league's future, as a lockout or strike would be harmful. A poorly negotiated agreement could also alienate both players and owners, who are seeking a positive resolution after 28 years.

It has been reported in the media that the WNBA has just three more years to prove itself. The new media rights deal reportedly includes a review after three years, and if the performance metrics are not met, the media partners have the option to cancel the contract. This situation is reminiscent of the original United States Football League (USFL), which faced cancellation of its media rights contract and ultimately led to the demise of the league.

In recent years, the NBA has faced a decline in viewership, particularly on cable television. The new NBA contract, which also includes the WNBA, incorporates more streaming and free-to-air broadcast TV games. These formats have not experienced the same drop in viewership that cable has. Free-to-air broadcasts have even seen an increase in viewership.

Exhibit 5 includes Cathy Engelbert's state of the league address and the press conference from the 2025 All-Star Break on July 19. It covers topics such as CBA progress, expansion, and officiating.

Given the time pressure, several key questions need to be addressed:

- Should the WNBA maintain a close connection to the NBA, or pursue full financial and branding independence?

- How can the league become profitable and reduce its reliance on the NBA to cover annual losses?

- What should be the WNBA’s top priorities for achieving long-term sustainability? Considerations include media rights, player salaries, player management, expansion, and global growth.

- How can the league manage tensions between emerging stars and established veterans to keep both long-time and new fans engaged?

- What strategies can the WNBA implement to cultivate a fan base that remains active during its short season?

- With the increase in the number of teams, how should the league approach the season length and the need for more games?

- What are the best strategies for capitalising on new media and digital trends to generate long-term revenue?

Additionally, the league faces significant considerations regarding Caitlin Clark and other potential game-changing rookies entering through the upcoming drafts:

- How can the WNBA leverage the attention generated by Caitlin Clark to foster sustained business growth?

- Should the WNBA centre its marketing efforts around Clark, or adopt a more balanced approach?

Exhibits

Exhibit 1: WNBA Sponsors (1997-2025)

Source: https://www.sportsbusinessjournal.com/sb-blogs/sbj-unpacks/2025/05/16/

|

BRAND |

CATEGORY |

SINCE |

|

Gatorade |

Sports drinks, nutrition |

1997 |

|

Nike* |

Footwear & apparel |

1997 |

|

Kia Motors |

Automaker |

2008 |

|

American Express |

Payment services |

2010 |

|

Adidas |

Footwear |

2011^ |

|

Anheuser-Busch (Michelob Ultra) |

Beer |

2012^^ |

|

State Farm |

Property, auto, casualty insurance |

2013 |

|

PepsiCo |

Soft drinks, ready-to-drink tea and coffee, water, salty snacks |

2015 |

|

Tissot |

Timekeeper |

2015 |

|

Ticketmaster |

Ticketing |

2017 |

|

Under Armour |

Footwear |

2017 |

|

NBA2K |

Video game software |

2018 |

|

New Era |

Headwear |

2018 |

|

Puma |

Footwear |

2018 |

|

YouTube TV |

Streaming partner |

2018 |

|

AT&T* |

Wireless, telecom and technology services |

2019 |

|

CarMax* |

Auto retailer |

2020 |

|

Deloitte* |

Professional services |

2020 |

|

DoorDash |

On-demand delivery platform |

2020 |

|

Glossier |

Beauty |

2020 |

|

Moet Hennessy |

Spirits and champagne |

2020 |

|

Meta Quest |

Virtual reality headsets |

2020 |

|

Microsoft |

Artificial intelligence, cloud, laptop/tablet, machine learning |

2020 |

|

Coinbase |

Cryptocurrency exchange platform |

2021 |

|

Google* |

Search trends, fan insights, mobile phone, fan phone, search engine, technology |

2021 |

|

Wilson |

Basketballs |

2021 |

|

FanDuel |

Sports betting, daily fantasy |

2022 |

|

Getty |

Photo licensing |

2022 |

|

Peloton |

Fitness |

2023 |

|

Mielle |

Textured hair care |

2023 |

|

Skims |

Underwear |

2023 |

|

PlayStation |

Entertainment console |

2023 |

|

Bumble |

Dating app |

2024 |

|

Castrol |

Motor oil |

2024 |

|

Delta |

Airline |

2024 |

|

DraftKings |

Sports betting, daily fantasy |

2024 |

|

Jackson Family Wines (La Crema) |

Wine |

2024 |

|

New Balance |

Footwear |

2024 |

|

Opill |

Contraception |

2024 |

|

Reebok |

Footwear |

2024 |

|

United Wholesale Mortgage |

Mortgage |

2024 |

|

Ally |

Banking, debit cards |

2025 |

|

BetMGM |

Sports betting |

2025# |

|

Booking.com |

Accommodation, online accommodation booking service, online travel accommodations marketplace (excluding residential real estate) |

2025 |

|

Coach |

Handbags |

2025 |

|

Evernorth |

Health services |

2025 |

= Changemaker-level sponsor.

** = Official outfitter beginning in 2018.

^ = Footwear only beginning in 2018.

^^ = Bud Light was the official beer of the WNBA and all WNBA teams from 1997-2006.

#=Was a WNBA partner from 2018-21.

Exhibit 2: Team Jersey Sponsors 2025

Source: https://zoomph.com/blog/the-ultimate-guide-to-wnba-jersey-sponsors/

- Atlanta Dream: Cash App

- Chicago Sky: Magellan and UChicago Medicine.

- Connecticut Sun: Walgreens and Yale New Haven Health.

- Dallas Wings: Albert and Girls Empowered By Mavericks (GEM).

- Golden State Valkyries: Chase Freedom and Kaiser Permanente.

- Indiana Fever: Lilly and Salesforce.

- Las Vegas Aces: Ally and Ring.

- Los Angeles Sparks: Albert.

- Minnesota Lynx: Federated Insurance & Mayo Clinic.

- New York Liberty: Barclays & Liberty Mutual Insurance.

- Phoenix Mercury: Flipper’s World & Fry’s Food Stores.

- Seattle Storm: Symetra & Providence Swedish.

- Washington Mystics: CarMax.

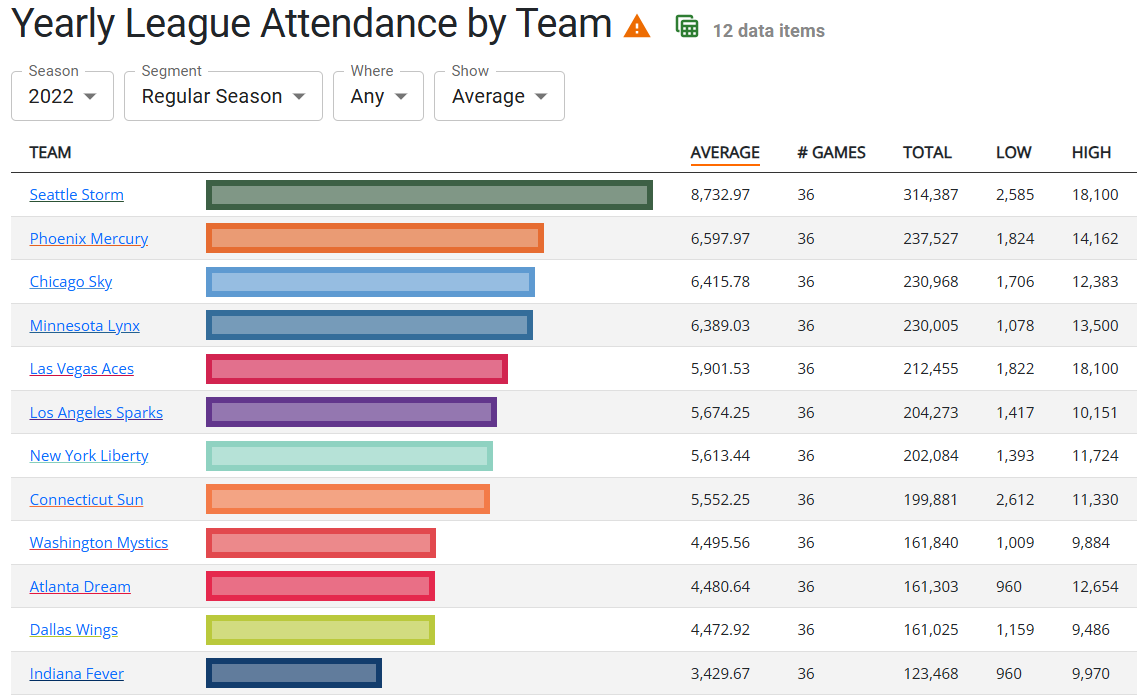

Exhibit 3: Attendance Figures 2022-2025

(2025 attendance as of July 20, 2025)

Source: https://www.acrossthetimeline.com/wnba/attendance.html#where=Any

Exhibit 4: 2025 Unrivaled 3-on-3 Basketball Corporate Sponsors

Source: https://en.wikipedia.org/wiki/Unrivaled_(basketball)

| Company | Joined | Role |

|---|---|---|

| Ally Financial | July 2024 | Founding Brand Partner and Jersey Sponsor |

| BODYARMOR | January 2025 | Official Sports Drink |

| IcyHot | January 2025 | Official Recovery Partner |

| Mediapro North America | November 2024 | Production and Hosting Partner |

| Miller Lite | December 2024 | Official Beer Partner |

| Morgan Stanley | January 2025 | Official Wealth and Asset Management Partner |

| Mount Sinai Medical Center | January 2025 | Official Medical Provider |

| Opill | January 2025 | Official Contracepives Partner |

| Samsung Galaxy | January 2025 | Official Technology and Presenting Partner |

| Sephora | January 2025 | Official Beauty Partner |

| Sprite | January 2025 | Presenting Partner of 2025 1v1 Tournament |

| State Farm | November 2024 |

Presenting Sponsor for 2025 Team Selection Show Home and Auto Insurance Partner |

| Therabody | January 2025 | Official Therapy and Massager Partner |

| Ticketmaster | December 2024 | Official Ticketing Partner |

| TNT Sports | October 2024 | Exclusive Media Rights Partner |

| Under Armour | December 2024 | Uniform Partner and Performance Outfitter |

| Vistaprint | January 2025 | Official Print and Design Partner |

| Wayfair | January 2025 |

Official Home Furnishing Partner Namesake of Unrivaled 2025 Arena |

| Wilson Sporting Goods | December 2024 | Official Ball Manufacturer |

Exhibit 5: Cathy Engelbert All-Star Break State of the League Press Conference

Source: Scott Agness | Fieldhouse Files (https://www.youtube.com/watch?v=XkWn0i_V33k)

End Notes

- Cathy Engelbert. (May-June 2025). The Commissioner of the WNBA on Transforming the League Ahead of a Breakout Season. Harvard Business Review. Harvard Business Publishing, Boston, USA. Sourced from https://hbr.org/2025/05/the-commissioner-of-the-wnba-on-transforming-the-league-ahead-of-a-breakout-season. July 18, 2024

-

Katie Couric. (July 8, 2025). The Caitlin Clark Effect: Christine Brennan on the Athlete Changing Everything. Sourced from https://www.youtube.com/watch?v=lj01ed-Qqx4. July 18, 2025.

- Derick Moss. (April 25, 2022). WNBA ownership snapshot. Sourced from https://www.sportsbusinessjournal.com/Journal/Issues/2022/04/25/In-Depth/WNBA-owners/. July 18, 2025.

- Annie Costabile. (July 2, 2025). WNBA Expansion Decisions Show League Prioritises North, NBA Ties. Sourced from https://frontofficesports.com/wnba-expansion-north-philadelphia-detroit-cleveland/. July 18, 2025.

- Brett Knight. (June 2, 2025). The WNBA’s Most Valuable Teams 2025. Sourced from https://www.forbes.com/sites/brettknight/2025/06/06/the-wnbas-most-valuable-teams-2025/. July 18, 2025.

- Brett Knight. (June 2, 2025). The WNBA’s Most Valuable Teams 2025. Sourced from https://www.forbes.com/sites/brettknight/2025/06/06/the-wnbas-most-valuable-teams-2025/. July 18, 2025.

-

Jack Maloney. (July 2, 2025). WNBA expansion: Seven lingering questions as the league adds teams in Cleveland, Detroit and Philadelphia. Sourced from https://www.cbssports.com/wnba/news/wnba-expansion-seven-lingering-questions-as-the-league-adds-teams-in-cleveland-detroit-and-philadelphia/. July 18, 2025.

-

Field Level Media. (June 13, 2025). WNBA reaches media rights deal to continue airing games on ION. Sourced from https://www.espn.com/wnba/story/_/id/45508776/wnba-reaches-media-rights-deal-continue-airing-games-ion. July 18, 2025.

- Eric Jackson. (July 17, 2025). Caitlin Clark’s Role Expands With Expected Presence at CBA Talks. Sourced from https://www.sportico.com/leagues/basketball/2025/caitlin-clark-wnba-cba-meeting-all-star-weekend-1234863066/. July 18, 2025.

-

Jon Lewis. (September 22, 2025). How Caitlin Clark raised the bar for the WNBA. Sourced from https://www.sportsmediawatch.com/2024/09/caitlin-clark-effect-wnba-rookie-season-recap/. July 21, 2025.

- Jon Lewis. (September 22, 2025). How Caitlin Clark raised the bar for the WNBA. Sourced from https://www.sportsmediawatch.com/2024/09/caitlin-clark-effect-wnba-rookie-season-recap/. July 21, 2025.

- Colin Salao. (July 30, 2025). WNBA Viewership Up Across All Networks Compared to 2024. https://frontofficesports.com/wnba-viewership-up-across-all-networks-compared-to-2024/ August 1. 2025.

- Tarpley Hitt. (September 25, 2024). The mysterious finances of the WNBA. Sourced from https://sherwood.news/business/wnba-mysterious-finances-salaries/. July 18, 2025.

- WNBA CBAs & Cap History (2025) Sourced from https://www.spotrac.com/wnba/cba. July 18, 2025.

- Christine Brennan. (July 8, 2025). On Her Game: Caitlin Clark and the Revolution in Women's Sports. Simon & Schuster. New York, USA.

- Cathy Engelbert. (May-June 2025). The Commissioner of the WNBA on Transforming the League Ahead of a Breakout Season. Harvard Business Review. Harvard Business Publishing, Boston, USA. Sourced from https://hbr.org/2025/05/the-commissioner-of-the-wnba-on-transforming-the-league-ahead-of-a-breakout-season. July 18, 2024

-

Indy Star | Indianapolis Star. (August 14, 2024). Caitlin Clark effect: Fever jersey sales up 1,000%, ticket sales 250%, TV records shattered. Sourced from https://sports.yahoo.com/caitlin-clark-effect-fever-jersey-183237353.html. July 21, 2025.

-

Ryan Gaydos. (July 14, 2025). WNBA legend needles refs for lack of foul calls on Caitlin Clark opponents. Sourced from https://www.foxnews.com/sports/wnba-legend-needles-refs-lack-foul-calls-caitlin-clark-opponents. July 18, 2025.

- Andrew Greif. (May 24, 2025). Caitlin Clark's impact on the WNBA could eclipse 'a billion dollars'. Sourced from https://www.nbcnews.com/sports/wnba/caitlin-clark-wnba-business-rcna208097. July 18, 2025.

- Andrew Greif. (May 24, 2025). Caitlin Clark's impact on the WNBA could eclipse 'a billion dollars'. Sourced from https://www.nbcnews.com/sports/wnba/caitlin-clark-wnba-business-rcna208097. July 18, 2025.

-

Maria Lawson. (July 17, 2025). WNBA officiating faces scrutiny heading into All-Star break. Sourced from https://www.espn.com/wnba/story/_/id/45740425/wnba-all-star-break-officiating-criticism. July 21, 2025.

- Maria Lawson. (July 17, 2025). WNBA officiating faces scrutiny heading into All-Star break. Sourced from https://www.espn.com/wnba/story/_/id/45740425/wnba-all-star-break-officiating-criticism. July 21, 2025.

- Maria Lawson. (July 17, 2025). WNBA officiating faces scrutiny heading into All-Star break. Sourced from https://www.espn.com/wnba/story/_/id/45740425/wnba-all-star-break-officiating-criticism. July 21, 2025.

-

Andrew Ricketts. (September 24, 2024). WNBA commissioner's quote exposes tensions behind league's rapid rise. Sourced from https://www.axios.com/2024/09/14/wnba-commissioner-caitlin-clark-angel-reese. July 18, 2025.

-

Lindsay Gibbs. (April 9, 2021). “It’s in Our DNA”: WNBA Players' Record of Activism. Sourced from https://globalsportmatters.com/culture/2021/04/09/its-in-our-dna-wnba-players-record-of-activism/. July 18, 2025.

-

WNBA Staff. (May 15, 2025). WNBA Unveils “No Space For Hate” Platform For Season-Long Community Impact. Sourced from https://www.wnba.com/news/wnba-unveils-no-space-for-hate-platform. July 18, 2025.

- NFL Football Operations. (2025). Social Justice. Source from https://operations.nfl.com/inside-football-ops/social-justice/social-justice/. July 21, 2025

No Comments