Economic Growth, Innovation and Productivity

Why Should I Care?

Our levels of employment and prosperity depend on the size of our economy. This is dictated by our rate of innovation. Inventing and producing new and creative goods and services is the key to increasing productivity and prosperity.

This Lecture Has 5 Parts

- What is Innovation?

- Creative Destruction

- The Innovation Cycle

- Innovation and Long-Run Economic Growth

- Productivity

What is Economic Growth?

Economic growth refers to an increase in our production activity, in the number of transactions in the economy, and hopefully, in an increase in the flow of material objects and assets held by regular people. Economic growth is generally associated to an increase in well-being, but that is not necessarily always the case. Most of our issues surrounding the idea of growth are tied with the issues in its measurement, which is usually real GDP.

An increase in real GDP may happen for two reasons: expansion and development. It is very hard to trace how much of the change in GDP is due to expansion, and how much of it is due to development.

First, GDP will grow as we are producing more of the old work, which are goods and services that are in production already. We call this economic expansion. Economic expansion is easy to illustrate using the production possibilities function, as the maximum boundaries expand to the right on the horizontal axis, and towards the top on the vertical axis, of the graph.

Second, we may be producing new work, which are new goods and services that are often worth more money than old products. We call this economic development. This activity requires much research and development to make sure that the product is well designed and suits the needs of the clients. Economic development increases the PPC as well, but keep in mind it does so by increasing the diversity of production. If you start with a 2-dimension graph, with two industries producing, you would need to imagine that growth is illustrated by adding a 3rd dimension. The new industry adds work, on to the previous industries, therefore adding a 3rd axis on the model. It's gets harder to imagine as the number of industries grows beyond 3 dimensions, but the idea remains.

Producing more chairs and apples may be a good thing, but there comes a time when we do have enough chairs to go around. And as humans, we have often been good at learning to improve, so we might be able to produce all these chairs with less labour. This is when it becomes important to invent new products which hold more value to consumers. Economic development is the key to creating better jobs.

How does development happen? There's a long answer to that. But in short it happens in many ways, through entrepreneurship, import-replacement, copying ideas from abroad, university laboratories, and industrial research. Creativity and a local economic ecosystem that encourages new ideas is also really important.

A major issue is to figure where do we get the resources to add new production? Part of the answer lies in reducing the production of old-work, or at least becoming more productive in old-work, which releases workers and inputs for the new work industry.

-

What is Innovation?

Economic development relies on innovation. This is a specific concept in economics that refers to the introduction to market of a new product or production process. Here are some definitions:

Invention:

the creation and design of a new object

Innovation:

the introduction to market of a new product or production process. This includes significant improvements in technical specifications, components and materials, incorporated software, user friendliness or other functional characteristics.

Product innovation:

the introduction of a new product in the economy

Process innovation:

the introduction a new production process in the economy

Radical innovation:

an innovation which is radically different from existing products or processes

Incremental innovation:

an innovation which is not radically different from existing products or processes

R & D:

“scientific research and product development” is creative work undertaken on a systematic basis in order to increase the stock of knowledge, including knowledge of man, culture and society, and the use of this stock of knowledge to devise new applications.

Intellectual Property:

creations of the mind for which property rights are recognized.

-

Creative Destruction

Innovation has been at the heart of economic growth since forever. Joseph Schumpeter is known for his theory of creative destruction. In opposition to Adam Smith, he did not believe that the accumulation of physical capital, international trade or division of labour, were the root causes of prosperity. Schumpeter argued that economies grow because of product and process innovations, a phenomenon which is linked to trade, but that is not dependent on it. He argued economies become wealthier by destroying obsolete industries and creating new ones.

Schumpeter

Inventions do change the world. One of the most important inventions of human activity has been hay, which has permitted the building of cities such as Paris, enabling people to bring horses into colder areas north of the Mediterranean.

Innovations have also thrived as ludic (fun) activities in their early manifestations. Economic and urban theorist Jane Jacobs argues that many innovations have first been developed as musical instruments, toys and games. One modern example of this is the development of video games as a major software application for computers. The video game industry is now a dominant sector of the economy.

-

The Innovation Cycle

In history, innovations have tended to come in bunches. Examples abound: the Detroit automobile industry of the 1910’s and 1920’s, the Berlin electricity industry of the 1840’s, the California computer industry of the 1990’s and 2000’s.

Innovations tend to be the result of productive investment. This term refers to the focus on a return on investment, but also on the idea that the investment makes the system more productive. Buying a house is considered an investment, but not a productive one, because larger houses do not make for better workers. However, spending on machinery and software is a productive investment because it allows workers to produce more, in the same amount of time.

These kinds of investments are risky, but they are meant to improve the efficiency of the economic system. Many right-wing economists, such as those of the Austrian School of Thought, argue that bureaucracies are not best suited to pick productive investments. Of course there are many examples of productive public investments, such as the mega-dams built by Hydro-Québec.

Kondratiev

Using economic theory, we can model the Innovation Cycle to explain how this process works. This cycle is influenced by Schumpeter’s Theory of Creative Destruction. If the innovations are radical and have a broad effect on the economy, this can influence the macroeconomic cycle over several decades. This is called the Kondratiev Wave, after Russian economist Nikolai Kondratiev. He argued that long waves of innovation generate the long-term growth in prosperity typical of capitalist Western Economies. Kondratiev was imprisoned by the USSR government for providing a theoretical demonstration that capitalism would surpass communism economically.

Model - Innovation Cycle

- Assumptions

- Inventions become successful innovations.

- Prices are sticky but markets clear.

- Barriers to entry are low.

- Hypotheses

- Innovation will generate new and increasing demand.

- High prices attract competition.

- Predictions

- Four “stages” arise in the Innovation Cycle: Novelty, Rivalry, Consolidation and Obsolescence.

- Each stage is characterized by a distinct market structure: Monopoly, Perfect Competition, Oligopoly, Monopoly.

Product Innovation Cycle

1 – Novelty

A radical innovation creates a new market and industry. Monopoly position enables high prices to pay for extensive R&D.

2 - Rivalry

Competition increases as others suppliers copy the product. Industry tends to co-locate. Prices fall with incremental innovation.

3 – Consolidation

Quantities produced are at all-time highs. Oligopoly forms as competitors buy each other out.

Focus is on process innovation and cutting costs: build larger plants with increased automation, and/or delocalize and transplant to low-cost locations.

4 - Obsolescence

As product becomes obsolescent, demand wanes until industry disappears.

-

Innovation and Economic Growth

Innovation creates well-paid jobs in new industries. But it also destroys jobs in obsolete industries. This refers to economic development, but why is the overall effect positive?

First, let’s examine the Novelty and Rivalry stages of the cycle. When a new product is introduced to market, a new industry is created. For example, the advent of computers in the past two decades has spurred the creation of millions of jobs in the computer industry. These stages of innovation will shift both the short-run AS curve, and the long-run AS curve, to the right. This is a supply-side analysis. The reason has to do with capacity. New industries are usually associated with massive investments in machinery, plants, robots and knowledge. These forms of physical and human capital grow the productive capacity of the economy.

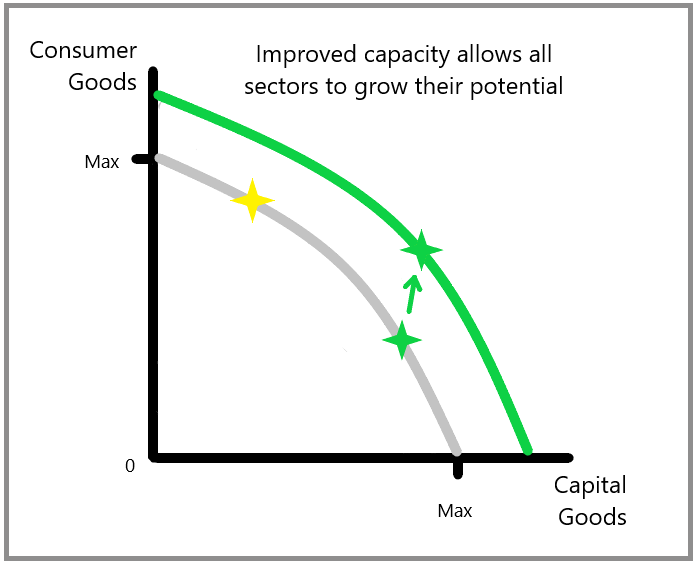

Using PPF to illustrate growth

We can consider the Production Possibility Frontier model to discuss capacity. The first step is to transition the economy towards the production of capital goods, such as machines, equipment, tools, computer hardware and software, as well as public infrastructure such as energy utilities, roads, ports and railways. This will reduce the comfort and convenience of the general population, but will allow all of the industrial sectors to increase production later.

The second step is to take advantage of the increased production possibility in both sectors. In the end, an increase in consumer goods can be achieved, while keeping the economy focused on improving technology and capacity, for a continued long-run cycle of economic growth.

Graph - Investment in Capital Goods Improves Capacity Across the Whole Economy

This situation can be the result of a government policy to encourage capital stock formation and discourage consumer good production. It can also be the result of the introduction of new radical technologies. This is the case for many major shifts in technology, such as the advent of coal power, electrical power, or computers. If the graph is depicting the industries of making automobiles, and building homes, it could be argued that the advent of electricity would improve the productivity of both industries.

The main point that this theory is making is that developing economies can benefit from focusing their efforts on productive capacity first, and that the spoils of consumerism can follow later.

Using LR-AS to illustrate growth

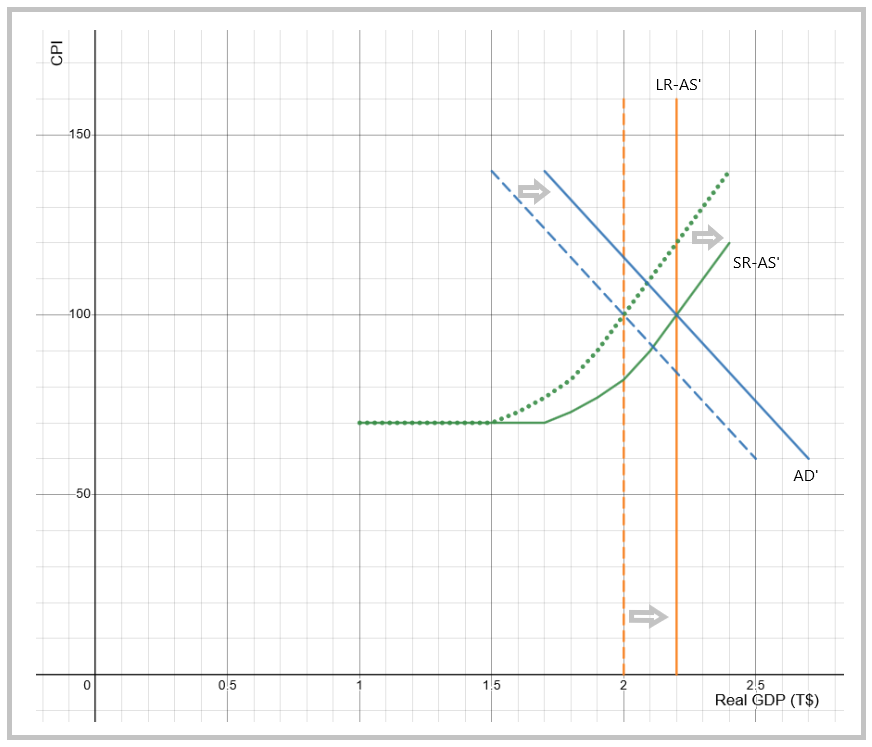

We can also use the AD-AS framework to discuss growth, using the long-run AS curve as the main driver. The graph below shows what happens when the long-run AS curve shifts right.

Graph - LR-AS curve shifts right ondue to increased capacity

This graph can seem confusing, but it is packed with clever ideas. First, notice all three curves to the right. The first to shift would be the LR-AS, which is a reflection of an increase in production capacity. This would also affect SR-AS, which would shift right. The new on-potential equilibrium would sit at 2,2 T$ with CPI at 100, which is quite low.

Graph - LR-AS curve shifts right on increased capacity

This graph can seem confusing, but it is packed with clever ideas.

The short-run economy is not quite there yet. We've got a positive supply shock, but not reason yet for AD to shift. Our short-run equilibrium would be at Real GDP : 2.1 T$ and CPI : 90.

The problem now is that this equilibrium is still below potential. In layman's words, the cruelty of innovation is that it grows supply capacity faster than aggregate demand, so now we have unemployment to think about.

The good news is that AD should be able to follow suit. Economic development can be believed to act on both supply and demand aggregates. New products are added to overall production and help to grow consumption. Jobs are subsequently created. Also, the introduction of new products requires substantive amounts of spending on research and development of the product itself, and of the machines required to produce it. This grows investment.

Since consumption and investment are components of the AD function, all things being equal, AD should shift to the right on higher consumption and investment. If AD shifts sufficiently, the new equilibrium will be at 2.2 T$ and 100 CPI. Thus, pure economic development can be associated to non-inflationary growth. This is a remarkable outcome.

However, we should note that a substitution effect does take place. This means some people have stopped to buy obsolete products, in order to buy a new good. This puts a damper on added consumption. The decrease in jobs in traditional industries may lead to structural unemployment. Overall, innovation economists believe the effect is positive but it depends on many factors, such as the region and the demographic structure of society.

-

Productivity

Innovation makes us wealthier by helping us produce more, with fewer resources. This is the core element of economic expansion.

In economics, we believe that labour productivity is believedan important factor to behelp theworkers majorearn driver of realbetter wages. Employers are generally reticent to increase wages because this increases their costs. However, if workers can produce more in the same time frame, employers will be more likely to increase wages.

Labour productivity is a statistic that measures how much output (sales) is produced by one hour of labour.

PL = Output / hours worked

For example, if a company sells for 1 million dollars of chairs per month, and uses 20,000 hours of labour to produce those chairs, the productivity of labour is:

PL = 1,000,000 $ / 20,000 hours = 50 $ / hour

Productivity gains are often due to process innovation, where new robots, better tools, machines, or techniques help to produce more in the same amount of time. The consequences of process innovation are unclear and hard to predict. On one hand, it increases real wages. On the other hand, it creates technological unemployment.

Overall, this type of innovation is destructive rather than creative. But this is not a bad thing because we need to free some resources to create new industries. However, if jobs are not created in other industries, high unemployment may persist. Productivity gains are also due to product innovation, although the relationship is up to debate. Some believe that new technologies (I.E. Google, Microsoft and Apple) generate such high levels of sales, that revenues per worker are much higher than in older industries. These new jobs have a de facto higher level of productivity.

Wrap-Up

Innovation happens when a new product or process is sold on a market. This phenomenon is at the heart of economic growth. There is a long history of economic growth associated to technical progress, going back millennia.

The Innovation Cycle theory explains how innovations influence creation and destruction of industries, market structures and spending aggregates.

Product innovation increases consumption and investment. Process innovation increases productivity. Both can destroy and create jobs. Labour productivity measures output (revenues) divided by hours worked. Productivity explains real wages, and prosperity.

Cheat Sheet

Invention:

Creation and design of a new object

Innovation:

Introduction to market of a new product or production process.

Radical innovation:

An innovation which is radically different from existing products

Incremental innovation:

An innovation which is not radically different from existing products

Labour Productivity:

A measure of output divided by a unit of work.

References and Further Reading

Jacobs, J. (1969). Cities and the Wealth of Nations. Vintage.

Kondratiev, N. D., Daniels, G., & Snyder, J. M. (1984). The long wave cycle. Richardson & Snyder. Originally published in 1920.

Kondratiev, N. (1925). The Major Economic Cycles.

Schumpeter, A. (1942). Capitalism, Socialism and Democracy.