The WNBA – Building a Sustainable Sports Business

Founded in 1996, the Women's National Basketball Association (WNBA) was launched in 1997 with support from the National Basketball Association (NBA). It was the first women's professional basketball league to receive significant financial and promotional backing from a major men's league. Initially perceived as a marketing extension of the NBA, the WNBA has grown into an organisation at a crossroads. While it is currently experiencing unprecedented attention, increased investment, and growing cultural relevance, it still faces challenges in monetisation, visibility, and long-term sustainability, especially as it navigates critical collective bargaining agreement (CBA) negotiations with its players for the 2026 season.

Some members of the media believe that the WNBA (https://www.wnba.com/) is at a critical juncture in its history. If the ongoing collective bargaining agreement (CBA) negotiations fail, or if a lockout or strike occurs, the league could face significant challenges that may threaten its future. Commissioner Cathy Engelbert and the league must address a variety of pressing issues shortly. Additionally, they need to navigate the implications of Caitlin Clark joining the league in 2024 and the passionate fan base that follows her. To date, many believe the league has failed when it comes to Caitlin Clark.

Key questions regarding the future of the WNBA include:

- What should be the WNBA’s top priority for achieving long-term sustainability: media rights, player salaries, expansion, or global growth?

- Should the WNBA maintain a close connection to the NBA, or pursue full financial and branding independence?

- How can the league manage tensions between emerging stars and established veterans to keep both long-time and new fans engaged?

- In what ways can the WNBA cultivate a fan base that remains active during its short season?

- What are the best strategies for capitalising on new media and digital trends to generate long-term revenue?

Additionally, the league faces important questions related to Caitlin Clark's entry into the league:

- How can the WNBA transform the attention generated by Caitlin Clark into sustained business growth?

- Should the WNBA centre its marketing efforts around Clark, or adopt a more balanced approach?

WNBA History

Below is a short video of the history produced by the WNBA.

The WNBA began with eight teams and has expanded to thirteen teams in the 2025 season, with plans to grow to fifteen teams by the 2026 season. Its current expansion plans aim to reach eighteen teams by 2030 under the leadership of Commissioner Cathy Engelbert. Over the years, the number of teams has fluctuated due to expansion and contraction, reaching a peak of sixteen teams in the early 2000s. Unlike other women’s leagues, the WNBA has survived for over two decades by aligning closely with the NBA, leveraging its infrastructure, media power, and financial support.

Team ownership in the WNBA is diverse, with both independent owners and owners of NBA teams. In some cities, the ownership of NBA and WNBA teams differs. There is also a notable discrepancy in arena capacities among the teams, ranging from a low of 3,200 fans for the Atlanta team to over 19,000 fans for teams in cities like New York and Minnesota. Additionally, four of the WNBA teams that play in NBA cities do so in arenas with capacities of 10,000 or fewer fans, with the Connecticut Sun also in an arena with a capacity of fewer than 10,000 fans.

https://youtu.be/2pUF7kfK8dA?si=PkVE80KC2sWFyzmP

Ownership and Expansion

The ownership structure of the WNBA is intriguing. NBA team owners control 42% of the league, WNBA owners hold another 42%, and an investment group owns 16%. This investment group contributed $75 million in 2022 and includes notable investors such as Nike, Michael Dell, Linda Henry, Dee Haslam, Condoleezza Rice, Micky Arison, and Laurene Powell Jobs, among others like Ted Leonsis, Herb Simon, and Joe Tsai. Leonsis (owner of the Washington Mystics and Wizards), Simon (owner of the Indiana Fever and Pacers), and Tsai (owner of the New York Liberty and Nets) each have three separate investments in the WNBA due to their roles as NBA owners, WNBA owners, and members of the investment group. The Phoenix Mercury and Minnesota Lynx are also owned by NBA owners in those cities. 1,3 2

The new ownership in Golden State, Cleveland, Detroit, and Philadelphia are all NBA owners in the same cities. This will mean that more NBA owners will have dual investments in the WNBA. The situation in Toronto is unique, as the primary owner of Kilmer Sports Ventures, Larry Tanenbaum, also owns 25% of Maple Sports and Entertainment, the parent company of the NBA's Toronto Raptors. Also of note is that the NBA's Los Angeles Lakers have recently been sold to one of the owners of the Los Angeles Sparks, and in Minnesota, there is new ownership of the Minnesota Lynx and Timberwolves. Additionally, the Connecticut Sun are reported to be for sale and will likely be relocated when sold.

Expansion will not dilute the 42% ownership held by NBA owners, nor the 16% controlled by the 2022 investment consortium. However, the 42% owned by WNBA owners will be divided among 18 owners by 2030. According to Forbes, WNBA teams are worth 180% more than in 2023. The valuations range from $400 million in New York to $190 million in Atlanta. There are some estimates that the new Golden State franchise's valuation in its first season is $500 million. The average valuation is $272 million, which is 14.4x4 times the average revenue, which exceeds the valuation in all other major sports. The reasoning for this is that they reflect more on the potential of the league, given the belief it is reaching a tipping point based on what is known as the "Caitlin Clark Effect". 3

Challenges

Revenue and Profitability

The WNBA has historically struggled to generate significant revenue compared to men's leagues. For many years, it operated at a loss, but in recent years, it has started seeing growth in sponsorships and media deals. Reports indicate that the league has incurred annual losses in the range of $10 million, and this figure was projected to increase to between $40 and $50 million for the 2024 season.

Revenues for the WNBA are estimated to have increased from $100 million to $200 million in recent years. Continued growth is expected due to new broadcasting deals, significant increases in attendance, and additional sales from merchandise and arena concessions starting in 2024. In 2024, the highest revenue team is the Indiana Fever at an estimated $32 million, and the lowest revenue team is the Atlanta Dream at $11 million. The average revenue is approximately $19 million.5 3

Additional income will also be generated from expansion fees. The Golden State Valkaries began play in 2025 with a $50 million expansion fee. Teams in Toronto and Portland are scheduled to commence play in 2026, with expansion fees of $50 million and $75 million, respectively. The three new teams announced in June 2025 will each have an expansion fee of $250 million. These teams will be located in Cleveland (2028), Detroit (2029), and Philadelphia (2030). Other expansion bids came from the cities of St. Louis, Kansas City, Austin, Nashville, Houston, Miami, Denver, and Charlotte. 64

Media Coverage and Broadcasting

Media exposure for the WNBA has lagged behind that of men's leagues. Limited broadcasting slots and a lack of prime-time games have restricted its visibility. However, there is a positive change underway with recent broadcasting agreements with ESPN and Amazon Prime. In 2026, a new media deal sees the current media deal increase from approximately $60 million a year to approximately $200 million a year over 11 years with Disney (ABC and ESPN), NBC, and Amazon. It will also continue its Friday night double header on ION, which in the past has been reported to be worth $13 million a year. Terms of the new deal with ION to begin in 2026 have not been disclosed.2 5

In 2024, the network ratings of WNBA games (regular season and playoffs) averaged 394,000 viewers in games that did not feature the Indiana Fever and Caitlin Clark, the 2024 rookieRookie of the year.Year. Games featuring Clark averaged 1.14 million viewers. Many of the Clark games, along with playoff games and the all-starAll-Star game,Game, saw ratings that the league had not seen since it started in 1997. Many of the Clark games outperformed the NBA games on the NBA network, and the league saw million-viewer games that it had not seen in years. The 2025 season is seeing similar viewership trends. The top 13 WNBA broadcasts in 2024 featured Caitlin Clark, with over 1 million viewers.

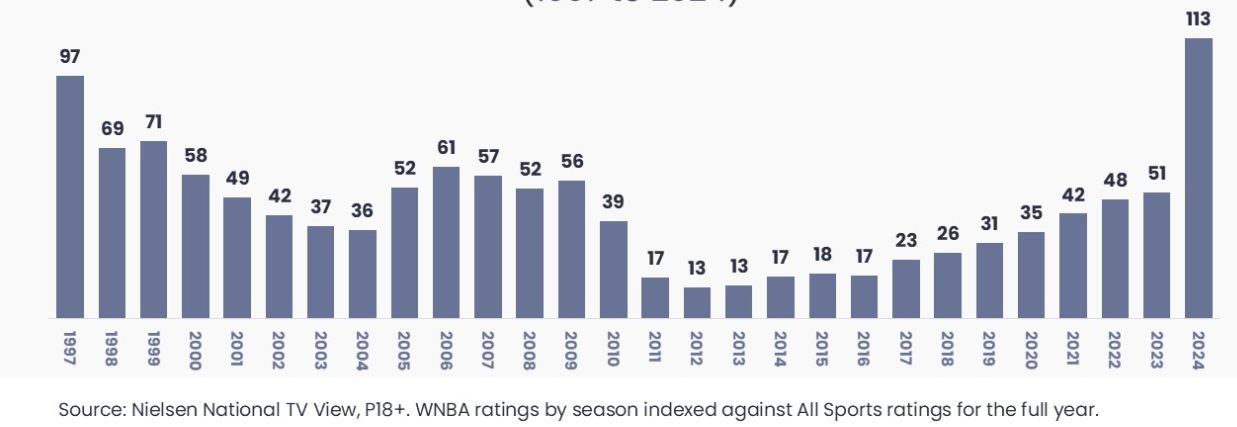

Below are the Nielsen Ratings over the history of the league indexed against all sports. The important aspect is the trend of the ratings over the years

Figure 1: WNBA Viewership Indexed Against Total Sports Viewership (1997 to 2025)

Source: https://amsgrowthpartner.com/wnba-2025-will-the-ws-keep-coming/

In addition to the historic ratings levels, the average number of per-broadcast impressions for the WNBA is compared to MLB and the NHL and with and without Caitlin Clark. These ratings included all broadcasters that have media rights deals for the WNBA.

Figure 2: Average P18+ Regular Season Impressions 2024 in thousands

Source: https://amsgrowthpartner.com/wnba-2025-will-the-ws-keep-coming/

Pay Equity and Player Compensation

WNBA players have advocatedbeen advocating for betterimproved salaries and working conditions. The 2020 Collective Bargaining Agreement (CBA) was a significant step forward, providing increasedhigher pay, maternity benefits, and upgradedbetter travel accommodations. This agreement extends through 2027,2027; buthowever, the WNBA Players Association (WNBPA) has optedchosen to revisit the contract early and is currently renegotiating terms for the 2026 season. A major concern remains that players' salaries continue to be significantly lower than those of their NBA counterparts. In fact, during the term of the agreement, the players' revenue share decreased from 11.1% to 9.3% due to a surge in league revenues.4 6

Since 2014, the salary cap for teams has increased from $901,000 to $1,507,100 in 2025. Before 2020, there were yearly increases of 1.3% in the cap. The new CBA in 2020 raised the salary cap from $996,000 to $1,300,000. Since then, the cap has increased by 3% each year. The 2020 CBA also introduced free agency and trade deadlines to the league. 7

Nneka Ogwumike, the president of the WNBPA, expressed the union's motivations for opting out of the current CBA: "Opting out isn't just about bigger paychecks—it's about claiming our rightful share of the business we've built, improving working conditions, and securing a future where the success we create benefits today's players and generations to come." 8

Key issues include salaries, the salary cap and its structure, and working conditions for players, as well as the priorities of the owners. To address these challenges, players may need to prioritise the WNBA over other commitments. Currently, the average salary in the WNBA for the 2025 season is $102,249, which runs from early May, including training camp, to mid-October, including the playoffs. Many players opt to play overseas during the offseason for significantly higher salaries. Those who remain in the U.S. often participate in Athletes Unlimited (https://auprosports.com/) or the new Unrivaled 3-on-3 (https://www.unrivaled.basketball/) leagues. Unrivaled launched in January 2025 and offers much higher average salaries than the WNBA.

Sponsorships, Marketing and Brand Building

The WNBA has, since its beginning, had numerous sponsors for a variety of services and products. A list of those sponsors is in Exhibit 1. In addition, individual teams have sponsors and jersey sponsors. Jersey sponsors are listed in Exhibit 2 for the 2025 season.

Building the individual brands of players, such as Caitlin Clark, A’ja Wilson, and Breanna Stewart, is crucial for increasing the league's popularity. Additionally, social justice activism has become a defining aspect of the WNBA's brand identity.

Caitlin Clark and the "Caitlin Clark EffectEffect"

College and- theAn Iowa HawkeyesHawkeye

Caitlin Clark, the former star of the University of Iowa and the No. 1 overall pick in the 2024 WNBA draft for the Indiana Fever, is widely recognised as a transformative figure in women’s basketball. Noted for her exceptional shooting range, charisma, and competitive spirit, she became a household name during her record-breaking college career. Her entry into the WNBA in 2024 has generated a significant increase in media attention, ticket sales, and commercial interest in the league.

During her college career, Clark set the all-time scoring record for both male and female Division I players, helped her Iowa Hawkeyes reach consecutive Final Four finals, and set viewership records in the Women’s Tournament that exceeded those of the Men's Tournament. Notably, the finals in 2024 attracted 18.9 million viewers, with a peak viewership of 24 million, showcasing the most-viewed women's college basketball game ever and placing it just behind a handful of men’s games. She also features in three of the top-most-viewed women's college basketball games and the two most-viewed national championship games.

WNBA Entry

EntryClark's entry into the WNBA in 2024 has generated a significant increase in media attention, ticket sales, and commercial interest in the WNBA

TheIt all started with the 2024 WNBA entry draftdraft, featuring Clark and a recorded 2.4 million viewers—the highest ever—marking a 4.2-fold increase over the previous high in 2004 and double the viewership of the 2025 draft.draft featuring Paige Beuckers. Her debut WNBA game attracted over 2.1 million viewers on ESPN2, making it the most-watched WNBA game since 2001. The Indiana Fever witnessed a 319% increase in home attendance, and during road games, their matches sold out opposition arenas, with some teams, like those in Atlanta and Washington, needing to move games to larger venues. In 2025, several teams with smaller arenas shifted games featuring the Fever, and some even arranged premium packages that required purchasing additional tickets to gain access to Fever games. The Fever experienced an astounding 1,193% increase in jersey sales, leading to an audit of their merchandise store in 2025. Additionally, draft beer sales at Gainbridge Fieldhouse, the Fever’s home arena, surged by 750%. In total, the Fever set 10 viewership records in 38 televised games during 2024.

Merchandise and the Secondary Market

Clark's influence extended to the secondary market, where her games caused ticket prices to spike by 5 to 10 times. Conversely, when she missed some games due to injury in 2025, ticket prices on the secondary market fell drastically. During that period, overall television viewership for the league dropped by 55%.

Wilson Sports sold out limited edition Caitlin Clark basketballs multiple times in less than 30 minutes in 2024. In 2025, 13,000 pairs of her Nike player edition shoes sold out reportedly in under a minute on SNKRS and are being resold for 2 to 3 times their original $190 price on the secondary market. According to Fanatics, her jersey is the second most popular jersey among both NBA and WNBA players, ranking only behind Stephan Currie. Special edition jerseys like her all-star jersey sold out in minutes. Her autographed sports cards continue to set record prices and consistently outperform all other WNBA players significantly.

On the Court

On the court, Clark shattered 64 WNBA records, and her performance in the 2024 season is unmatched in the league's history when her full stat line, leaving out turnovers, is searched in the Across The Timeline database. She became the first rookie to achieve a triple-double, accomplishing this feat twice in her rookie season. Additionally, she helped the Fever qualify for the playoffs for the first time since 2016. 2025 continues to see her establish WNBA records even though she has missed a significant number of games due to injury.

Sponsorship & Endorsements

Caitlin Clark broughthas significantly elevated the WNBA's profile by bringing high-profile sponsors likesuch as Nike, Gatorade, and State Farm into the WNBAconversation, dialogue as she broughtalongside her NILName, Image, and Likeness (NIL) sponsorship dealsdeals. withWhile her to the WNBA. Otherother players have broughtsecured NIL deals to the league and have high-profile sponsors and endorsements, but Clark broughthas signed high-value contractscontracts. withUpon her. As she enteredentering the league, she signedinked an 8-yearyear, $28 million Nikedeal deal,with Nike, which is reportedly significantlyfar more valuable than any contract previously held by other playerplayers in the leagueleague. ever. SheClark is reportedprojected to earn over $11.1 million aannually, year, of whichwith less than $80,000 iscoming from her WNBA salary, according to Sportico. This impressive income places her 10th on the listglobal globallyearning and welllist, ahead of anyall other WNBA playerplayers, and she is the only team athlete in the top 15. InternetIn searchescontrast, ofnet worth estimates for other top WNBA stars findtypically netrange worth estimates in thefrom $2 to $5 millionmillion.

There has been notable backlash from fans directed at Nike for not producing a Caitlin Clark signature shoe or clothing line, as well as a lack of advertising featuring her. Other players, such as A'ja Wilson, Angel Reese, Sabrina Ionescu, Paige Bueckers, and JuJu Watkins, have received player edition or signature shoes from Nike and other sporting goods companies like Adidas and Reebok. This situation arises amid disappointing performance from Nike's stock. Rumours indicate that a Clark signature shoe and clothing line will be launched around Christmas 2025, with a second player edition shoe slated for release in October 2025.

Brands are expanding activation efforts around Clark-led games and content.

League sponsorship valuation is projected to rise.

Demographics & Market Expansion

A wave of younger, more diverse fans is entering the WNBA market.

Increased crossover interest from the NCAA and NBA fan bases.

International basketball audiences are tracking Clark’s rise.

Exhibits

Exhibit 1 WNBA Sponsors (1997-2025)

-

Source: https://www.sportsbusinessjournal.com/sb-blogs/sbj-unpacks/2025/05/16/

Gatorade

Sports drinks, nutrition

1997

Nike*

Footwear & apparel

1997

Kia Motors

Automaker

Automaker

2008

American Express

Payment services

2010

Adidas

Footwear

Footwear

2011^

Anheuser-Busch (Michelob Ultra)

Beer

Beer

2012^^

State Farm

Property, auto, casualty insurance

2013

PepsiCo

Soft drinks, ready-to-drink tea and coffee, water, salty snacks

2015

Tissot

Timekeeper

Timekeeper

2015

Ticketmaster

Ticketing

Ticketing

2017

Under Armour

Footwear

Footwear

2017

NBA2K

Video game software

2018

New Era

Headwear

Headwear

2018

Puma

Footwear

Footwear

2018

YouTube TV

Streaming partner

2018

AT&T*

Wireless, telecom and technology services

2019

CarMax*

Auto retailer

2020

Deloitte*

Professional services

2020

DoorDash

On-demand delivery platform

2020

Glossier

Beauty

Beauty

2020

Moet Hennessy

Spirits and champagne

2020

Meta Quest

Virtual reality headsets

2020

Microsoft

Artificial intelligence, cloud, laptop/tablet, machine learning

2020

Coinbase

Cryptocurrency exchange platform

2021

Google*

Search trends andtrends, fan insights, mobile phone, fan phone, search engine, technology

2021

Wilson

Basketballs

Basketballs

2021

FanDuel

Sports betting, daily fantasy

2022

Getty

Photo licensing

2022

Peloton

Fitness

Fitness

2023

Mielle

Textured hair care

2023

Skims

Underwear

Underwear

2023

PlayStation

Entertainment console

2023

Bumble

Dating app

2024

Castrol

Motor oil

2024

Delta

Airline

Airline

2024

DraftKings

Sports betting, daily fantasy

2024

Jackson Family Wines (La Crema)

Wine

Wine

2024

New Balance

Footwear

Footwear

2024

Opill

Contraception

Contraception

2024

Reebok

Footwear

Footwear

2024

United Wholesale Mortgage

Mortgage

Mortgage

2024

Ally

Banking, debit cards

2025

BetMGM

Sports betting

2025#

Booking

.Booking.com

Accommodation, online accommodation booking service, online travel accommodations marketplace (excluding residential real estate)

2025

Coach

Handbags

Handbags

2025

Evernorth

Health services

2025

-

Source: https://www.sportsbusinessjournal.com/sb-blogs/sbj-unpacks/2025/05/16/

Gatorade

Sports drinks, nutrition

1997

Nike*

Footwear & apparel

1997

Kia Motors

AutomakerAutomaker

2008

American Express

Payment services

2010

Adidas

FootwearFootwear

2011^

Anheuser-Busch (Michelob Ultra)

BeerBeer

2012^^

State Farm

Property, auto, casualty insurance

2013

PepsiCo

Soft drinks, ready-to-drink tea and coffee, water, salty snacks

2015

Tissot

TimekeeperTimekeeper

2015

Ticketmaster

TicketingTicketing

2017

Under Armour

FootwearFootwear

2017

NBA2K

Video game software

2018

New Era

HeadwearHeadwear

2018

Puma

FootwearFootwear

2018

YouTube TV

Streaming partner

2018

AT&T*

Wireless, telecom and technology services

2019

CarMax*

Auto retailer

2020

Deloitte*

Professional services

2020

DoorDash

On-demand delivery platform

2020

Glossier

BeautyBeauty

2020

Moet Hennessy

Spirits and champagne

2020

Meta Quest

Virtual reality headsets

2020

Microsoft

Artificial intelligence, cloud, laptop/tablet, machine learning

2020

Coinbase

Cryptocurrency exchange platform

2021

Google*

Search

trends andtrends, fan insights, mobile phone, fan phone, search engine, technology2021

Wilson

BasketballsBasketballs

2021

FanDuel

Sports betting, daily fantasy

2022

Getty

Photo licensing

2022

Peloton

FitnessFitness

2023

Mielle

Textured hair care

2023

Skims

UnderwearUnderwear

2023

PlayStation

Entertainment console

2023

Bumble

Dating app

2024

Castrol

Motor oil

2024

Delta

AirlineAirline

2024

DraftKings

Sports betting, daily fantasy

2024

Jackson Family Wines (La Crema)

WineWine

2024

New Balance

FootwearFootwear

2024

Opill

ContraceptionContraception

2024

Reebok

FootwearFootwear

2024

United Wholesale Mortgage

MortgageMortgage

2024

Ally

Banking, debit cards

2025

BetMGM

Sports betting

2025#

Booking.Booking.com

Accommodation, online accommodation booking service, online travel accommodations marketplace (excluding residential real estate)

2025

Coach

HandbagsHandbags

2025

Evernorth

Health services

2025

Exhibit 2: Team Jersey Sponsors 2025

Source: https://zoomph.com/blog/the-ultimate-guide-to-wnba-jersey-sponsors/

- Atlanta Dream: Cash App

- Chicago Sky: Magellan and UChicago Medicine.

- Connecticut Sun: Walgreens and Yale New Haven Health.

- Dallas Wings: Albert and Girls Empowered By Mavericks (GEM).

- Golden State Valkyries: Chase Freedom and Kaiser Permanente.

- Indiana Fever: Lilly and Salesforce.

- Las Vegas Aces: Ally and Ring.

- Los Angeles Sparks: Albert.

- Minnesota Lynx: Federated Insurance & Mayo Clinic.

- New York Liberty: Barclays & Liberty Mutual Insurance.

- Phoenix Mercury: Flipper’s World & Fry’s Food Stores.

-

Seattle Storm: Symetra & Providence Swedish.

-

Washington Mystics: CarMax.

End Notes

1.

- https://www.sportsbusinessjournal.com/Journal/Issues/2022/04/215/In-Depth/WNBA-owners/

2. https://www.espn.com/wnba/story/_/id/45508776/wnba-reaches-media-rights-deal-continue-airing-games-ion3.https://frontofficesports.com/wnba-expansion-north-philadelphia-detroit-cleveland/- https://www.forbes.com/sites/brettknight/2025/06/06/the-wnbas-most-valuable-teams-2025/

- https://www.cbssports.com/wnba/news/wnba-expansion-seven-lingering-questions-as-the-league-adds-teams-in-cleveland-detroit-and-philadelphia/

- https://www.espn.com/wnba/story/_/id/45508776/wnba-reaches-media-rights-deal-continue-airing-games-ion

- https://sherwood.news/business/wnba-mysterious-finances-salaries/

- https://www.spotrac.com/wnba/cba

- https://www.espn.com/wnba/story/_/id/41929722/wnba-opt-cba-collective-bargaining-agreement-wnbpa-players-union-2025-season

4. https://sherwood.news/business/wnba-mysterious-finances-salaries/

5.

6.