Google Flights - Strategic

HOW GOOGLE FLIGHTS IS SHAKING UP THE TRAVEL INDUSTRY

The internet is littered with the bodies of companies unable to adapt when Big Tech moved to offer a service for free.

Possibly the most famous example in tech history remains Microsoft’s decision in 1996 to give away its browser Internet Explorer bringing Netscape’s skyrocketing share price to an abrupt halt. The rest is history.

Although Google’s recent decision to stop charging for leads to airlines and OTAs in Google Flights might look insignificant in comparison, it is sending shockwaves across the travel industry.

To understand why, it is important to understand Google Flights’ weight in the airline distribution ecosystem.

The creation of a giant

Google planted the flag of its flight ambitions with the acquisition of ITA software back in 2010, the backbone of what would become Google Flights.

Since then, a slow but steady stream of product enhancements, combined with increasing search result visibility and a gradual integration into the rest of Google’s ecosystem (Gmail, Google Assistant etc.), has allowed the it to become a powerhouse in the airline distribution industry.

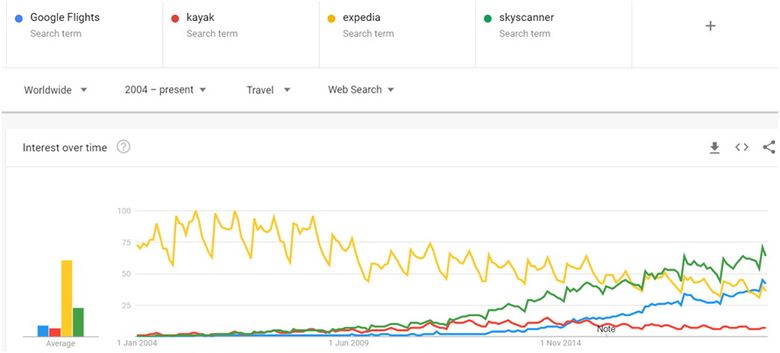

There exists no reliable industry data source to put a size to Google Flights, but comparing its worldwide brand searches in Google Trends vs. other global flight players illustrates a clear long term trend:

The chart of brand interest per region over the last 12 months shows Google Flights' dominance in the U.S. market vs. Skyscanner's stronghold in most of the other Western countries.

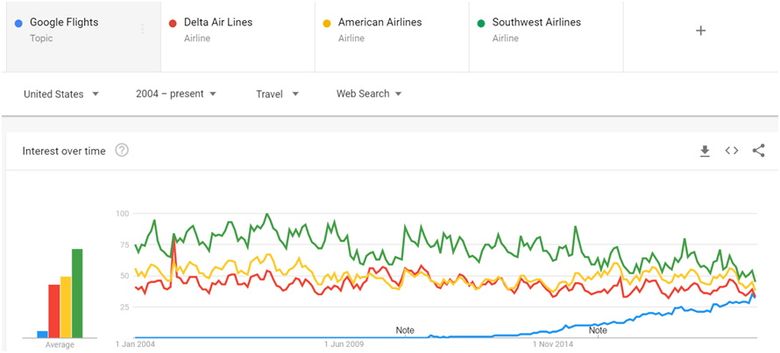

Comparing Google Flight with top airline brands in the US gives an order of magnitude of its unstoppable rise:

It’s important to note that Google Trends is a fairly accurate indicator of the consumer interest for a product or a brand, but not a reliable source for absolute traffic volumes

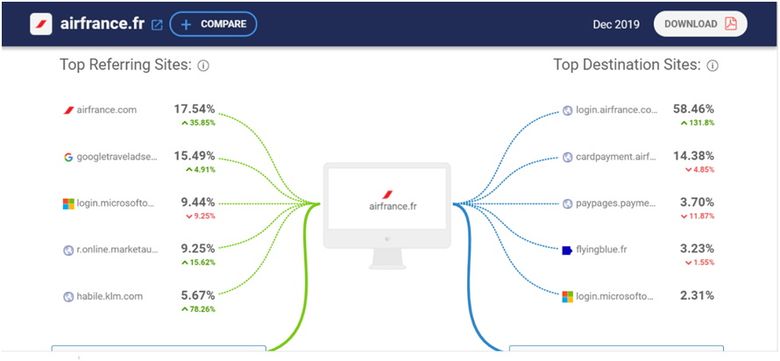

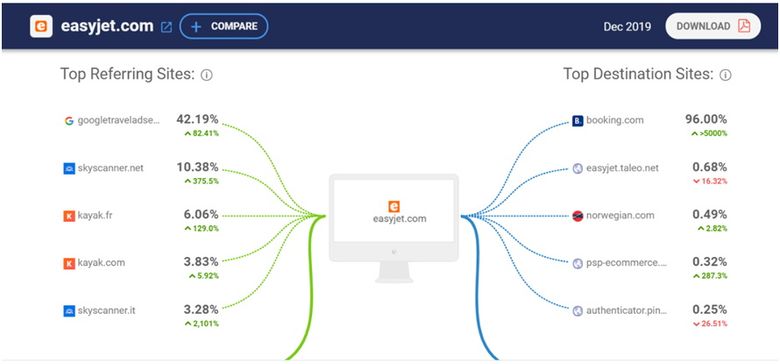

Knowing how much Google Flights represents in terms of upstream traffic for airlines tells us the story from another angle. Web analytics tool Similarweb identifies Google Flights referral traffic as “googleadservice” (separately from other Google traffic sources like Adwords and SEO categorized as “Search”, YouTube as “Social” and Google Display Network as “Display Advertising”), and ranks Flights as the top one or second referral site for many of top U.S. and European airline websites.

In stark contrast, Google Flights is missing as an important referral site among most OTAs, since it was deliberately excluding them from its core result pages (with some rare exception such as Kiwi.com, thanks to its virtual interlining).

Winds of change

Lately, Google has started to open its flight search result page to OTAs outside the U.S.

The change only seems to apply on certain airlines only but some random searches on a Spanish IP show a significant number of OTAs mixed with airline website results:

It is impossible to estimate the share of Google Flights' searches impacted by this change and the degree of traffic funneled to OTAs, but it shows that Google is reviewing its original “airline only” comparison principle.

By doing so, the tech giant is further going head-to-head with the rest of flight metasearch competitors that have historically made THEIR living from OTA referral fees.

Metasearch having its Kodak moment

The rise Google Flights during the last decade has reshaped the competitive landscape of the flight metasearch business.

Now, the decision to offer its flight referrals for free to both airlines and OTAs is likely to trigger a bloodbath among metasearch players with high depency on flight revenue.

Global leaders Skyscanner and Kayak, being part of travel giants Trip.com Group and Booking Holdings respectively, might be able to pivot fast enough.

Skyscanner is moving full steam ahead into a transactional business, becoming effectively another OTA.

Kayak is working in integrating other group services like the loyalty program “Genius” and restaurant reservation platform Opentable to extend its value proposition in line with the so-called “connected trip” vision of the wider Booking Holdings family.

Smaller regional metasearch players are unlikely to benefit from such competitive moats and might eventually fade into obscurity.

OTA price wars

Online travel agencies outside the U.S. look in the immediate future as the clear winners of these changes. Tapping into the highly qualified flight traffic from Google Flights for free, might spark a new price war putting at risk the desired fare integrity from airlines.

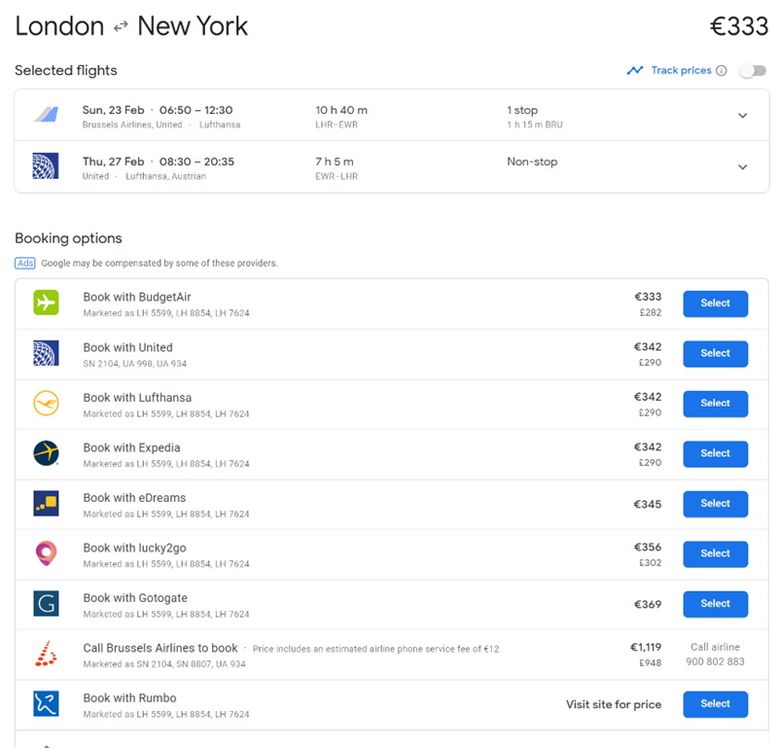

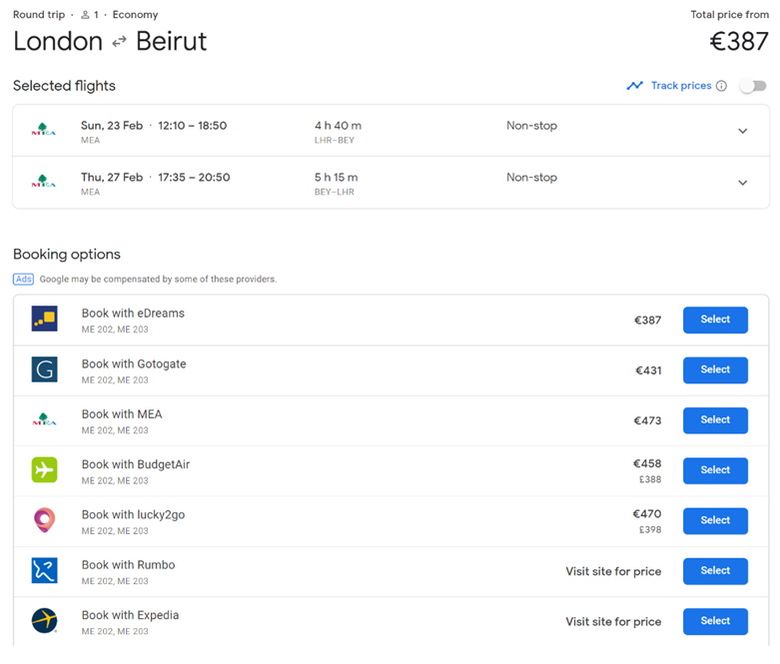

With, essentially, zero costs on Google Flight traffic, OTAs will be tempted to undercut airlines prices to rank above them and capture Google’s highly qualified traffic, betting on cross-sell opportunities and GDS incentives to keep a reasonable profitability.

Airlines will have a hard time to ensure fare integrity in a zero cost metasearch environment.

The big picture for Google

There are several of threads to untangle to understand the rationale of Google’s decision.

Google is facing intensifying scrutiny by antitrust authorities around the world, each with varying degrees of capacity to impose vast fines and even break up companies that have violated antitrust codes.

In March, Google will start its appeal in Brussels against three antitrust fines around shopping levied by European competition authorities.

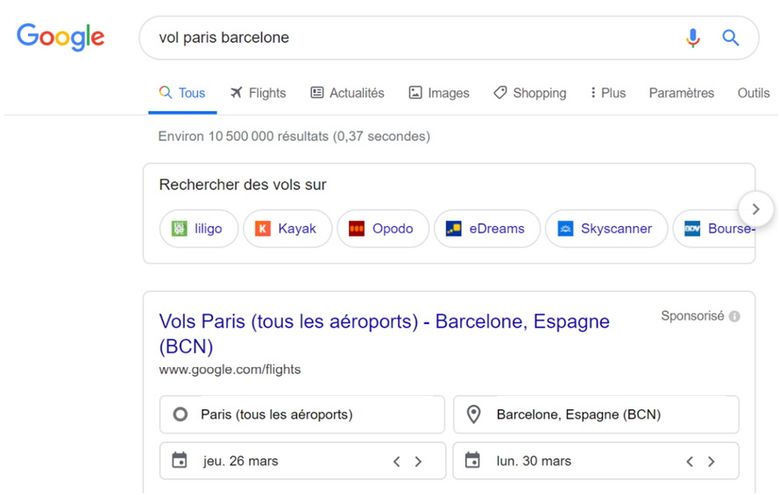

It might not be coincidental that Google decided to give away its referrals on flights now while testing at the same time cosmetic UX changes such as adding a small carousel of SEO links above its Google Flights module (screenshot with french IP):

Another potential regulatory slap might be brewing after 40 companies and trade bodies in the European Union and the U.S. have asked the E.U.'s Competition Commissioner Margrethe Vestager to investigate how Google is favoring its vacation rentals product in a “visually-rich OneBox," securing more user attention and clicks than any other competing services.

With this regulatory storm brewing around Google, being able to argue that its flights comparison service delivers the same free traffic than the organic search result represents a paradigm shift: placing its own Google Flight search box above the ads of commercial competitors can not been considered anticompetitive when it delivers free, or so called “organic”, traffic.

Why did Google decide to sacrifice its revenue on Flights?

It is impossible to pinpoint their travel revenue mix per product, but it seems fair to assume that Google Flights' revenue was nothing more than a drop in the ocean of the total travel revenue, since many airlines were lured into Google Flights from its creation by offering free leads, and the click share from OTAs was extremely small in the past.

Although Google’s decision can be considered a smart move, it begs the question that the search giant might find hard to explain to antitrust watchdogs: Why remove charges on flight comparison while not doing it on its hotel/vacation rental comparison service?

Conclusion

Google’s move of free referrals on its flight comparison service will have far-reaching consequences in the years to come.

It will be fascinating to see how the change will be backed into its legal battles with antitrust authorities, how it might impact the power balance between airline websites and OTAs in Google, and how it will cause the likely extinction of existing flight metasearch players as we know it.

But on a much larger scale, it might open Pandora's Box on a much larger piece of Google's revenue cake: Google Hotel Ads, according to industry sources, already represents 67% of the total worldwide hotel metasearch business.

The last few decades have shown that Big Tech moves can make or break things very fast.

Fasten your seatbelt to pass through some serious turbulence that Google Flights might just have triggered.

https://www.phocuswire.com/Google-Flights-impact-on-travel-industry

No Comments