The Basics of Markets and Transactions

Why Should I Care?

Many economists believe the “free market” knows best. This opinion has great influence over the laws of the land, and the level of government intervention in everyday life. But what are markets exactly, and are they “free”?

This Lecture Has 5 Parts

- A simple transaction model

- Four characteristics of free markets

- Four kinds of free markets

- Principles

- Limitations

What are Free Markets?

Products can be distributed to consumers in many ways. People can grow, fish, and hunt their own food, and then give the excess away to friends and family. People can make their own clothes and gift or barter them. People can also be organized in communal economies, where smaller groups of decision-makers allocate production to each household, or bartering agreements allow for specialization and trade. For a lot of our economic activity, these non-monetized allocation mechanisms can be quite efficient.

Another possibility is that money is used in transactions. There are basically two kinds of monetized allocation mechanisms: public goods, and free markets. In the first case, governments can produce a good or service itself, and then decide who gets to consume it. In this case, the state usually commissions an arms-length organization such as a school board, or a parastatal corporation (i.e. Crown corporations in Canada). The corporations are run by committees who usually set quotas for output to be made available. This is the case of public goods like universal health care, and public-school education in Canada, for example. The committees are important as they allow for information feedback about quantities and the quality of services.

In the second case, free markets, private enterprise is free to enter and leave the marketplace, which is enabled by rule of law, private property and contract law. Other than basic safety regulations, there is little oversight over decisions of how much output to sell, and who buys it. Some organizations are large corporations, which are run by committee, but no matter the size of the producer, the most important feedback mechanism is price and business profit levels.

Now, let’s define markets. Markets are “places” where people can trade goods and services. Many times, these places are physical spaces where people can go, and expect to find booths, kiosks, and stores that offer products. Markets can be organized as a sporadic occurrence, such as a Saturday Farmer’s Market in the summer, or a continual presence such as a commercial street in the city, or a shopping mall. Markets can also be immaterial spaces, such as online transactional websites like eBay and Amazon. Trades can be accomplished with money, or through bartering. Usually in economics we use money in our models because it allows us to have a comparable measurement, the price per-unit, across different products, and for different lots of quantities.

Markets are considered to be a social institution as they have rules which can vary from one society to another. Whether or not it is OK to negotiate the price, for example, varies across continents. Some countries have banned markets at different times in history. Most countries restrict markets to certain sectors of the economy.

The freedom aspect relates to the ability for both sides of the transaction to walk away from the deal, if they don’t agree on price, or quantity. Freedom also allows people to enter a market without having to ask permission. For example, a seller might not like the fact that more and more sellers are competing with him. In a free market, there is nothing he can do about it.

Some markets have more freedom than others. Government regulation usually limits that freedom, and most of the time this is to protect consumers. For example, it is illegal to sell certain products, such as toxic chemicals, or illicit drugs, in Canada. There are also lots of regulations in the food industry, so that consumers don’t get sick.

-

A simple transaction model

Our simple model of a transaction is inspired by the work of French economist Leon Walras. His most famous work was interested in determining if markets were in equilibrium, and if there was a general equilibrium for all markets. The Law of Walras states that there is such an equilibrium, and this has been the basis for most research in micro-economics for the past century. This being said, we will try to understand markets before we discuss more philosophical questions like general equilibrium.

A market has basically two sides, a buyer on one side, and a seller on the other side. There are many types of markets, as we will discuss later.

The initial move to start the transaction is a social convention, which depends on culture. On some markets, the buyer must make the first move. This is called a bid price. Other times, the seller must start the process. This is the ask price.

Once a bid, or an ask, is presented, then you will see the negotiation take place. If the final bid does not equal the final ask, there will not be a transaction. If the final bid does equal the final ask, the transaction goes through at what is now called the market price.

A few definitions:

Bid price:

The price a buyer is willing to pay for a product.

Reservation price:

The highest price a buyer is willing to pay for a product.

Ask price:

The price a seller wants to receive for a product.

Cost-price:

The lowest price a seller is willing accept.

Market price:

The price that meets both the requirements of the bid and the ask price. The bid price must be equal to (or higher than) the ask price.

Let's look at the example of a house transaction, with one buyer and one seller. The first price being presented is usually the ask, and is listed on a real estate site, such as Realtors.ca. The buyer can match the ask, or offer a bid. Usually the bid would come in below the ask, since the buyer would like to maximize their transaction. If they agree to meet somewhere in between, there will be a transaction. The table below shows the different prices. In individual transactions, the market price is often kept secret, but may be published if both parties agree.

The reservation price on the buyer side represents the highest amount the buyer can afford to pay, or is willing to pay, for the house. Often times, the reservation is set by the pre-approved mortgage value determined by the buyer's financial institution. For wealthy buyers, the reservation price is set by their opportunity cost for capital.

The cost price on the seller side represents the lowest amount the seller needs to cover their costs. In the case of a house, the cost can be the price paid for the building of the house, including the building materials and labour. It can also represent the capital needs of the seller to rehouse themselves. Often times, sellers need money to buy another property, so that sets a low-bar for negotiations.

Mapping out a transaction for a house

| Cost |

1st Ask |

Market |

1st Bid | Reservation | |

| Buyer |

620,000$ |

600,000$ |

750,000$ |

||

| Seller |

450,000$ |

640,000$ |

620,000$ |

||

| Information |

Secret |

Public |

Secret |

Public |

Secret |

Low-Ball Bids

Some people love to bid really low. They might bid 100,000$ for a large house in the city. We call this a ‘low-ball’ bid. It might work, which would be great for the buyer. But usually, the seller will probably prefer to negotiate with someone else.

Low-ballers have a major problem: seller’s have a cost-price. They can’t sell below their cost of operating or doing business. In most cases, the cost-price is the lowest price a seller is willing to accept, or the lowest ask.

If you want to low-ball, try finding out the cost-price, and then add 5 percent. The bid should be accepted. The problem is that cost-prices are not public information. Sellers usually do everything they can to keep that information private.

Another parameter is on the buyer’s side. He or she does not have unlimited funds (usually) to make a purchase. There is only so much money in your wallet. Since the seller will benefit from a higher sale price, the first bid coming in might not be high enough to seal the deal. The buyer’s maximum purchasing power is called the reservation price. Buyers are also pretty keen on keeping their reservation a secret. Have you ever opened your wallet in from the of the salesman to show them how much money you really have to make the transaction? You would basically give away your highest bid at the very beginning of the negotiation process.

More definitions

Broker:

Someone who matches buyers and sellers.

Arbiter:

Someone who decides which of several options will prevail.

Asymmetry of information:

One of the parties holds more information than the other party, about the other party’s reservation price, or cost price.

Dealing with Retailers

When you walk into a store, the items already have a sticker price. This is the ask. Social convention in Canada discourages negotiating these prices. Compared to other parts of the world, Canadians are known to be very polite and shy when it comes to ‘bargaining.’ This is especially true in large stores where the staff is not able to change prices.

It is usually easier to negotiate prices in smaller stores, or when you purchase an expensive item, like furniture, an automobile, or a house. If you do start to negotiate, consider what happens if the seller takes your bid as an insult...

Dealing with Other Buyers

In a very hot market, you might be scared a matching bid will not be enough money to seal the deal. Sellers don’t always know how hot the market is, so they will entertain several bids, if they think they can get more money. Knowing this, some buyers will bid well above the ask, to be sure that they obtain the product. If the bid is greater than the ask price, the transaction usually goes through, to the greater benefit of the seller.

When People Don't Budge

If the final bid is lower than the ask price, and the seller does not negotiate on the price, there is no transaction. Both parties must walk away. In this case there is no transaction. Usually, this is because the bid was too close to the cost price, or the seller thinks they can find another buyer.

When Buying is a Bet on the Future

A client walks into a specialty footwear store to purchase a limited edition pair of sneakers, such as the Nike Supreme Dunk. The store is stocked with 1 pair, and its the right size. There is a lineup outside of 100 people, waiting for the same shoes.

Photo credit: https://www.pexels.com/photo/black-white-and-red-nike-sneaker-12891493/

Given the price parameters below, what would be a predictable outcome?

| Cost |

1st Ask |

1st Bid | Reservation | |

| Buyer |

250$ |

400$ |

||

| Seller |

50$ |

300$ |

You can graph the parameters this way. There's only one pair of shoes, so the dots line up vertically. On the graph, the buyer's values are in blue, and the seller's values are in red.

Our model does not predict the final price, but it does strike out many possibilities. First, the market price has to be above the cost-price of 50$, and below the reservation of 400$. However, the parties don't know these figures, which are kept secret from the other side. Second, the bid is higher than the ask, with a difference of 50$. If these figures don't change, there is no transaction. Third, let's assume the seller has more power in this trade than the buyer. This is because there are 100 people lining up outside to buy the shoes. The bid at 250$ is not a good idea.

The storekeeper will probably refuse it and ask the next person to enter the store. In the end, the buyer is probably going to pay at least 300$ for the shoes. If there wasn't a lineup outside, bidding at 250$ might work!

-

Four conditions of free markets

There cannot be a free market transaction, if one of the following conditions is not met:

- There is at least one buyer

- There is at least one seller

- There is a product

- Both parties are free to agree on price and quantity

The fourth condition is also called 'mutual agreement' and relates to freedom. One could say there could be a market exchange, even under coercion (force). A criminal could force you to buy their product at the price of their choosing. However, this market is not “free”, and many would view it as immoral. Free markets imply that both parties are free to agree, and free to disagree, to the transaction. Later we will discuss perfectly competitive markets, which are based on the idea that entry into the market is also free.

Another example of a coercive market would be when buyers are not forced to consume, but when both prices and quantities are set by the supplier. This is called a monopoly, and in many cases, these are run by the State. For example, university education in Canada is essentially a State-run market, where provincial officials set quotas for quantities of students per school, and also set the “total cost” which is the average expenditure per student. The government also sets parameters for the level of fees that colleges can charge to students, who are free to choose one school or another. This is not a “free” market, but it is still quite moral.

-

Four kinds of free markets

Depending on the type of product, markets do not operate the same way. There are four types of free markets:

One-to-one:

One buyer and one seller. Private negotiation. Terms are usually subject to a contract. Often each agent will hire a professional broker if their knowledge of the market is perceived to be lower than the other agent’s. Each transaction has different prices. In the case of large contracts, the buyer will use the public tender process to attract several producers and force them to compete on price and quality for the business. In a public tender, the suppliers have access to technical documents with the technical specifications required. Sometimes the documents are public, sometimes they are kept private and are protected by confidentiality agreements. In French: ‘contrat de gré à gré’ and 'appel d'offres'.

One-to-all:

Many buyers, and one seller, but lots of product. No negotiation. The price is set by the seller hoping it fits customer’s terms for value, quantity, and quality. Sellers adapt their price if sales are insufficient. Most retail stores do this. In French: commerce au détail.

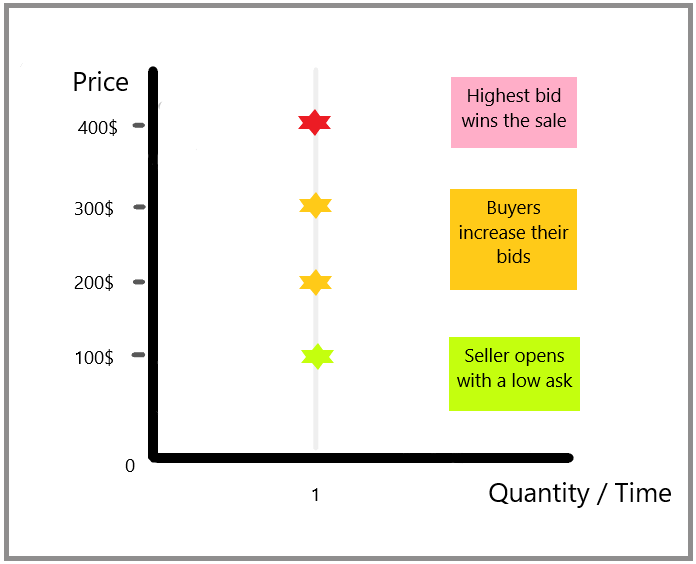

Auction:

One unit of product, which is unique and rare. One seller, but many buyers. The auctioneer takes bids, and the highest bid wins the prize. eBay is an online auction website. Bids can be secret, or public. Final price can be secret, or public. Auctions are used notoriously to market rare art, collector's items, and rare talents such as professional sports players and artists. In French: ‘enchère’.

In this graph, the seller starts the process with an ask of 100$ (in red). The first bid comes in at 500$, then 600$ and finally 650$ (in blue).

Open-market:

Many buyers and many sellers. Many units of same product. An arbiter takes the buyers’ bids and the asking prices. The arbiter settles the difference, and sets the price to which everyone is constrained. Buyers and sellers don’t know who they transact with.

No matter the kind of transaction, a producer must cover his costs of production, including raw materials, machines, labour, and services (energy, lighting, electricity, etc.). However, many products are sold at a higher price than “cost-price”. This is usually due to the strong level of demand for that product. More on this later.

-

Principles

Positive:

Transactions occur only when both parties agree.

Normative:

Regulators should intervene if consumer surplus is too low, compared to the seller’s profit.

Regulators should ban auctions on markets that are public necessities.

-

Limitations

These four types of free markets have their limitations. Markets can be free, yet still yield imperfect results, either by controlling information such as industry-wide inventory levels, quality, available alternatives, or by controlling the stock itself.

The best possible market outcome would:

- Maximize the quantity of product consumed

- Minimize the cost for consumers

- Give no advantage to either the seller or the buyer.

Either both the cost and reservation prices are held secret, or they are both made public.

The one-to-one market entails a risk of advantage, which is also called asymmetrical information. This means each side may doubt they hold enough information about the product, and the other party’s situation, to sufficiently guide them through the negotiation process. They may realize they don’t know enough about the market, and this may lead to a poor negotiation. Therefore, many people hire brokers to help them assess the correct value of a product. Unfortunately, brokers are expensive and may or may not work in the full interest of their client, depending on the type of remuneration that was agreed upon.

The one-to-all market also entails the risk of asymmetrical information, because most people do not always compare prices before they buy. Recent theory proposes that most stores can overprice slightly because they know people factor in the opportunity cost of “window shopping”, or comparing prices.

The auction is typical of situations where the supplier has complete control on the market because he owns a rare product. Buyers often complain they overpaid during an auction, getting emotionally wound up by the process, and by the risk of losing the auction. The seller gets the highest possible price. Auctions can also be unfair if one bidder is trying to increase the price without the true intention of actually purchasing the product. In the Canadian housing market, bids are kept secret to other bidders, which is frustrating because bidders will never now what the bids were. There is a tendency to overbid, to secure the transaction. This increases the cost of ownership, especially in sought-after housing markets.

The open-market can also lead to unfair trades if buyers and sellers don’t share all the information about the product. Also, truly open-markets are rare. Examples include computerized stock markets where a software arbiter sets prices in real-time by matching bids and asks. If a “bid” for a company stock comes in at $10.10, and the “ask” from a seller is $10.05, the transaction may go through at $10.07, depending on the pre-set parameters of the arbitrage software.

However, recent developments in computer brokerage have given an advantage to large institutional investors. Their computers can run many small transactions at every possible price. The computer can thus determine – in milliseconds – the reservation price of a buyer, and use that information to run a larger transaction at the reservation price. This is unfair to buyers who cannot do the same, to force sellers to reveal their bottom limit (Schmouker, 2009).

Green Policy

How you price pollution – if that’s the policy you choose – depends on the type of market.

In some cases, governments have created a ‘cap and trade’ system to market pollution. In this system, pollution is capped, and divided into equal amounts, which then become a permit. These permits are tradeable. A corporation with cleaner technology can buy permits from other “less clean” corporations. You might even see an auction occur when the permits become rare.

Climate Change Solution

In the case of a GHG carbon tax, you would imagine it works in more of an open market. Everyone pays the same prices, and the tax acts as a deterrent on the demand side.

Our simple Walrasian model points to different types of markets. This allows the economist to ponder the varying approaches one could take depending on the structure of industry.

Democracy Booster

It is important for consumers to know if they have power on a market. Democracy is not just about politics. It’s also about having your voice heard in the market economy. Of course, your voice won’t matter much if you are fighting others for product in a competitive auction.

Whether you are at the gas pump, or buying a flight ticket online, carbon taxes will affect you. It’s important we set up markets in a way that consumers always have options, always have the best information, so that they can have some power over the transaction.

Wrap-Up

Free markets are “places” where people can trade goods and services. Transactions occur when the bid price is equal to the ask price, and when the bid is below the reservation, and when the ask is above the cost-price.

Free markets need a buyer, a seller, a product, and freedom to agree on price and quantity. There are many types of markets such as one-to-one, one-to-all, auction, and open markets.

Free markets can lead to unfair transactions. Truly “open” markets are rare, and often limited to stock exchanges.

Cheat Sheet

Market price:

The price that meets both the requirements of the bid and the ask price. The final bid price must be equal to (or higher than) the final ask price.

Open-market:

Many buyers and many sellers. Many units of same product. An arbiter takes the buyers’ bids and the asking prices. The arbiter settles the difference, and sets the price to which everyone is constrained. Buyers and sellers don’t know who they transact with.

References and Further Reading

Salop, S. & Stiglitz, J. (1977). Bargains and Ripoffs: A Model of Monopolistically Competitive Price Dispersion. The Review of Economic Studies, Vol. 44, No. 3 (Oct., 1977), pp. 493-510. Stable URL: http://www.jstor.org/stable/2296903

Schmouker, O. (2009). Les ordinateurs prennent le contrôle des bourses. Les Affaires. Retrieved from http://www.lesaffaires.com/secteurs-d-activite/services-financiers/les-ordinateurs-prennent-le-controle-des-bourses/504621

Walras, L. (1976). Éléments d'économie politique pure ou théorie de la richesse sociale. Paris, Librairie générale de droit et de jurisprudence.

No Comments